Quick Value #198 - Cheap Coal

Commodity producer at <3x EBITDA with net cash balance sheet

Getting my feet wet in the coal industry with today’s post… I’ve been flipping through names on my watchlist that seem to be left behind in the recent market rally. This is one of those ideas.

Today’s post is for premium subscribers and we’ll be back next week with a free edition of Quick Value. Cheers!

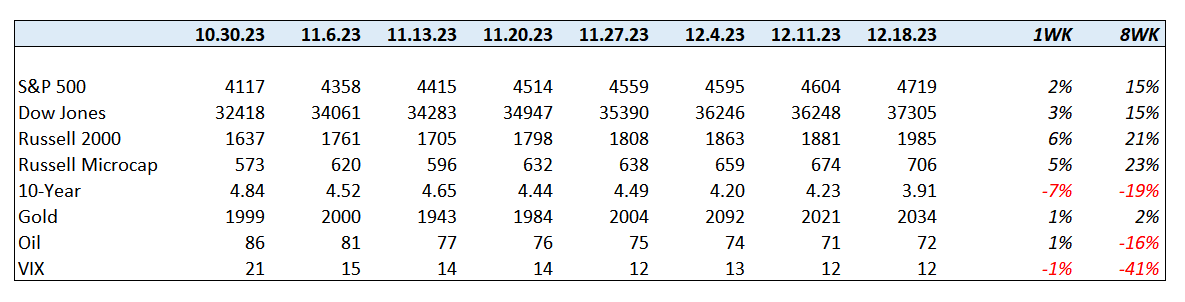

Market Performance

Quick Value

Peabody Energy (BTU)

I’ve seen a lot of discussion on Twitter/X the past few years around the post-reorg coal names… I never got around to taking a look and then shares rallied pretty hard from 2021-2022… most of the names have since flatlined while the market continues to rally so here’s a quick look at BTU (maybe the first in a series of reviews).

What they do…

Peabody is a thermal and metallurgical coal miner. The former is predominately mined for use in power generation (i.e. electricity) and the latter for making steel. They operate 17 mines in the US and Australia. Thermal coal was ~54% of 2022 EBITDA and met coal 46%.

The few bullet points you need to know about this business:

BTU emerged from bankruptcy in 2017 and swapped some debt for equity in 2021

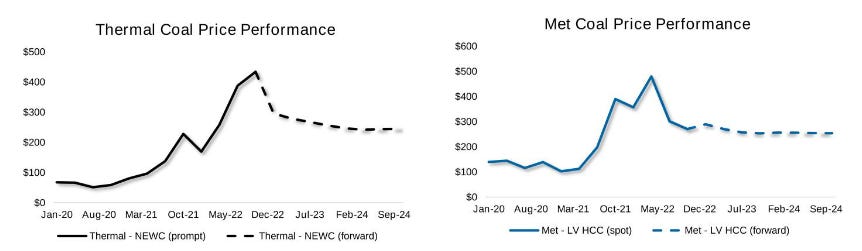

Coal prices rocketed higher in 2021-2022 which added tons of cash flow

Balance sheet flipped from net debt to big net cash position

Where’s the catalyst? Is it the outlook for future coal prices/volumes? Are investors less excited about thermal coal given its declining use in power generation?

Why it’s interesting…

1) Rapid cash generation

Post emergence, BTU has been able to rake in some cash (in part from cleaner balance sheet and part from better coal prices)…

A big portion of this cash went to repaying debt with a small convertible note ($320m) remaining

Buybacks were the next highest priority and took a back seat in 2020-2022 before resuming again in 2023

We’ve already established that debt balances are $1bn+ lower today than they were in 2018-2021 while cash on hand is close to 1/3 of the market cap. That leaves a lot of flexibility for future uses assuming you can get comfortability with the cyclicality of coal prices.

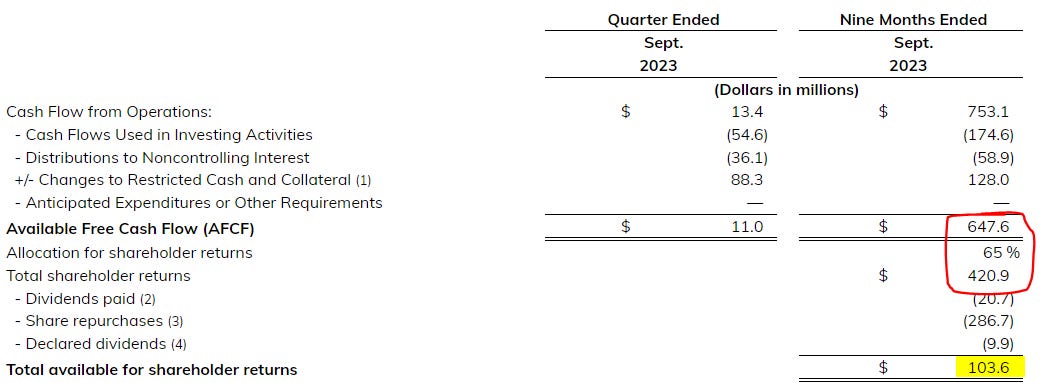

Management has a pretty straightforward approach of allocating 65% of free cash flow to shareholder returns and the calculation is included in each earnings release.

As of 3Q23 that left $104m remaining or ~3% of the current market cap.

2) Compelling valuation

BTU is one of the cheapest among coal producers at less than 3x forward EBITDA. Everyone has a similar net cash balance sheet and solid margins but the mix of thermal/met coal is a primary differentiator among the group.

Maybe that’s for good reason as the forward outlook is pretty murky… I’m guessing this is partly price related and partly volume related, but future EBITDA is expected to bottom at ~$760m (~3.3x EBITDA) in 20215 with zero credit for any cash generated prior to that.

There are 131m shares outstanding x $23/share = $3bn market cap. Net cash is $650m or so for an EV of roughly $2.4bn. There are some asset retirement obligations totaling $670m that I’ve excluded from that EV calculation.

If EBITDA falls to $760m in a few years that would price the stock at ~3.2x EBITDA with a healthy net cash balance sheet.

Summing it up…

Met coal prices are still elevated compared to years’ past while thermal prices are getting pretty close to 2019 levels. That looks like a recipe for continued cash generation but it’s hard for investors to get excited about a cheap but declining business (even if it’s really cheap on those declining figures). Important to note that tons sold are declining at a pretty good rate (from 186.7m in 2018 to 123.7m in 2022)…

It doesn’t sound as though they’ll ratchet up the cash returns to shareholders and that makes sense in a commodity business like this… protect the balance sheet while giving back any excess FCF.

I’m just a tourist in this space but the story seems pretty dependent on either: 1) aggressive increase in capital returns; or 2) better than expected commodity prices and/or volumes sold.

Would love to hear from those who have studied the space closely!

Worth redoing this one post Anglo deal?

Btu loves to overpromise et under deliver