Quick Value #199 - Atkore ($ATKR)

Building products co at <10x earnings and great balance sheet

Happy Holidays!

Enjoy this free edition of Quick Value and subscribe to the full newsletter if you haven’t already. Working on a yearend recap post and 10 stocks for 2024 (here’s the 2023 edition).

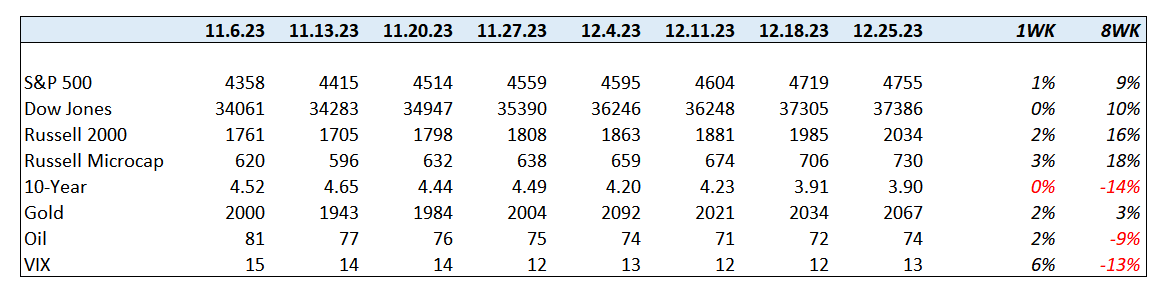

Market Performance

Quick Value

Atkore International ($ATKR)

My investment framework generally doesn’t consider stocks that are big market outperformers over a 5-year stretch (Atkore is +767%) but this one has an absolute favorite chart of mine… will get to that later…

What they do…

Atkore has a nice and simple business description in their 10-K — they make electrical, safety, and infrastructure products sold in both non-residential and residential construction markets:

We are a leading manufacturer of Electrical products primarily for the non-residential construction and renovation markets, as well as residential markets, and Safety & Infrastructure products for the construction and industrial markets. The Electrical segment manufactures high quality products used in the construction of electrical power systems including conduit, cable, and installation accessories. This segment serves contractors in partnership with the electrical wholesale channel. The Safety & Infrastructure segment designs and manufactures solutions including metal framing, mechanical pipe, perimeter security, and cable management for the protection and reliability of critical infrastructure. These solutions are marketed to contractors, original equipment manufacturers (“OEMs”), and end-users. We believe we hold #1 or #2 positions in the United States by net sales in the vast majority of our products. The quality of our products, strength of our brands, our scale and national presence provide what we believe to be a unique set of competitive advantages that position us for profitable growth.

These are small and unsexy products found in every building… they represent typically small portions of overall building costs.

There are 2 segments:

Electrical — majority of sales (68% FY23) and big margins (~38% FY23 EBITDA margins)… cash generator but “normalizing” a bit harder (see below)… at the 2016 IPO, Atkore estimated they operated in a $13bn sub-segment of the $78bn US electrical products market.

Safety & Infrastructure — perhaps the faster growing segment and more margin potential (12% FY23 EBITDA margins)… in 2016, they estimated the addressable market at $3.5bn.

Why it’s interesting…

1) Fundamentals vs. valuation

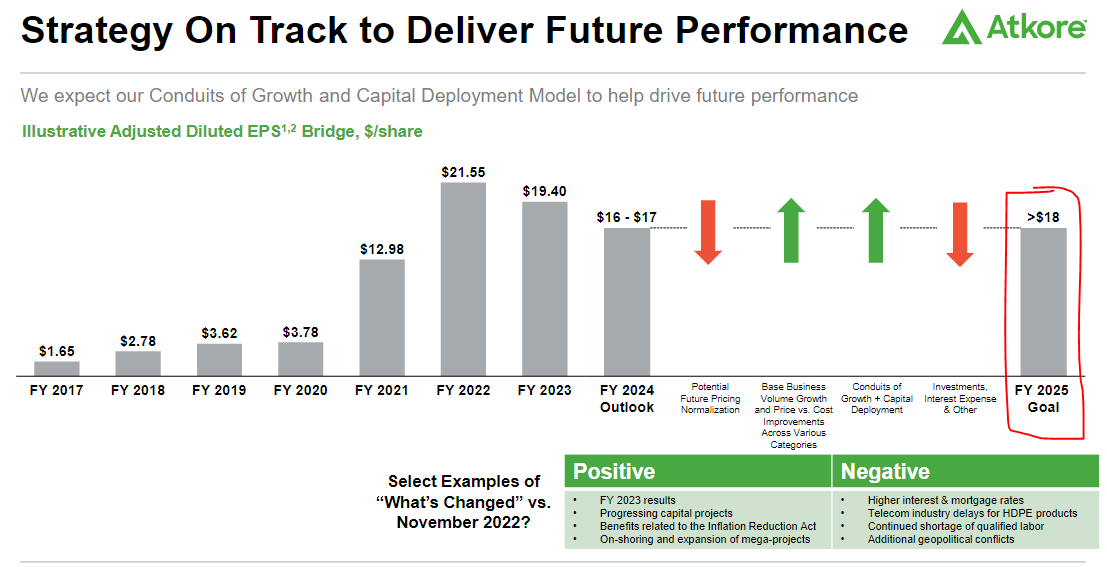

Atkore and the larger building products industry benefitted tremendously from the COVID pandemic… FY21-22 saw a nearly 3-6x improvement in EBITDA/EPS and 2x in sales. Those results are “normalizing” (i.e. declining) in FY23-24…

EPS is expected to fall 15% in FY24 ($16.50) before growing again in FY25. Management is confident they have line of sight to FY25 EPS of $18/share (or more) despite the industry/economic dynamics…

2) Passes the sniff test

I love a situation where fundamentals have improved, the outlook is good, yet valuation is flat-or-declining.

In this case, EPS has grown rapidly since 2017 with a solid outlook to 2025, yet the stock has seen multiple compression along the way and sits right around the long-term median.

To me, this chart says that investor expectations have dampened along with the rise in earnings. If the stock went from 10x earnings to 20x while earnings tripled, then I’d say expectations may be out of hand… No science here, just a reasonableness check when looking at a new idea.

3) Capital allocation

Operating cash flow was a cumulative $2.9bn from FY2016-2023.

Most of that went to buybacks (56%) with the vast majority of COVID-era earnings being returned to shareholders

Acquisitions are intermittent and typically small (i.e. <1x PY cash flow) — this bucket was another 25% of spend

Capex was a consistent ~2% of sales for many years but ramped to 6%+ recently for “technology investments” and it sounds like it’ll stay at that level ($200m) for FY24 too

Borrowings jumped in 2018 for a very large buyback from PE… since then, there hasn’t been any net new borrowings

On average, Atkore is converting ~80-90% of net income into FCF

FY24 highlights are: 1) another year of $200m capex; 2) a stepdown to $200m buybacks (3.3% of current market cap). With $16-17 EPS guidance, that could leave another $300m or so available to deploy!

Summing it up…

I have a hard time with these normalizing post-pandemic names where revenue and margins double overnight when compared to long-run averages. Atkore looks like they were smart about not taking their debt up with earnings and the “hangover” in FY23-25 looks tame compared to others.

Let’s do some quick math on a potential downside scenario…

Say revenue falls another 14-15% to $3bn and operating margins normalize to 20% (down from 25-30%) = $600m EBIT. Interest expense is running $35m per year and taxes at 25% = $424m net income. Call it 36m shares outstanding by end of 2024 and you have $11.75/share in earnings. With the stock at $162, that’s a reasonable 13.8x multiple for a low leverage, well-run business (and right inline with peer median multiples).

Here’s a look at a wide range of building products companies… Atkore is sitting near the bottom in valuation but has the best balance sheet.

This one is also interesting given Brad Jacobs’ recent announcement of rolling up building product distributors (customers for Atkore). I’m not sure how that could help or hurt this business.

Atkore looks like a really nice business and even with the run-up in stock price, it still trades at <10x normalized earnings. For patient investors looking out to FY25 and beyond this could be a nice “set it and forget it” name…

The best balance sheet Is encore for their cashthei are very similari but more focused