Quick Value #200 - Synchrony Financial ($SYF)

Private label credit card issuer at ~7x earnings; share count down 50% over past 8.5yrs

Welcome back from a brief holiday break!

Kicking off the first QV of 2024 (and 200th all-time QV) with a large cap financial. Synchrony was a 2015 spin-off and they’ve done a nice job of growing earnings and reducing shares outstanding (50% reduction since spun).

Subscribe to the full newsletter for upcoming portfolio review and next week’s premium Quick Value post.

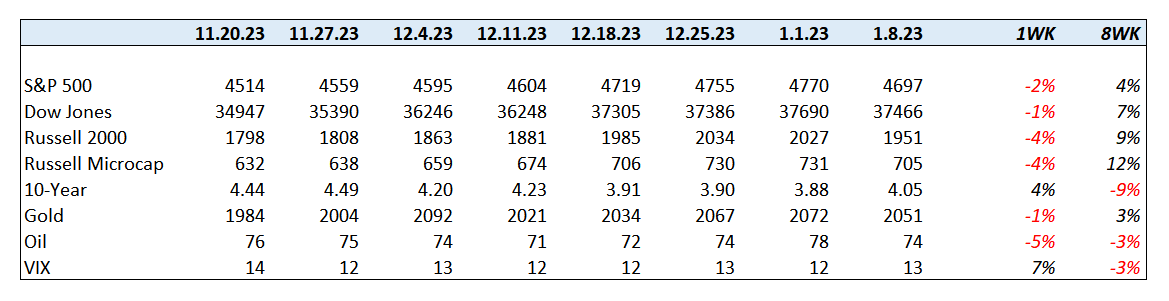

Market Performance

Quick Value

Synchrony Financial ($SYF)

What caught my eye recently was the announced sale of their Pets Best insurance business for a $750m after tax gain (following 3Q23 results). That works out to ~$1.80/share or ~5% of the market cap.

What they do…

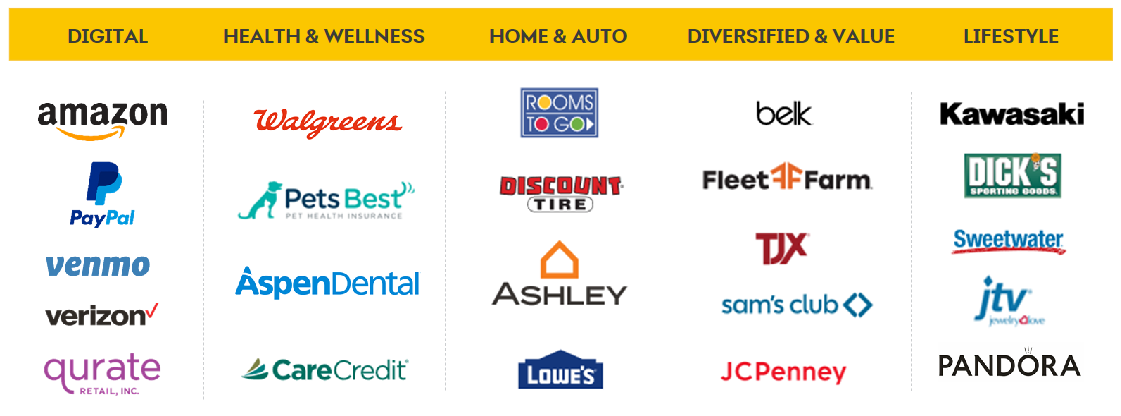

Synchrony is a private label credit card (PLCC) issuer, the largest in that industry (competitors include Citi, Capital One, and Bread Financial which was formerly Alliance Data). So when you sign up for that Lowe’s branded credit card, you’re really signing up with Synchrony.

These PLCCs are indeed banks, taking in deposits as the primary source of funding while extending credit via cards (and other consumer loans to a lesser extent) as opposed to mortgages or business loans.

The top 5 brands represented as of yearend 2022 were: Amazon, JCPenney, Lowe’s, PayPal, and Sam’s Club. These 5 make up >50% of revenue and receivables. Other brands that Synchrony partners with:

At the time of the spin-off, Synchrony had a ton of excess capital that they’ve slowly deployed into buybacks. Receivables and deposits have grown as the business expanded…

Why it’s interesting…

1) Excess capital and buyback machine

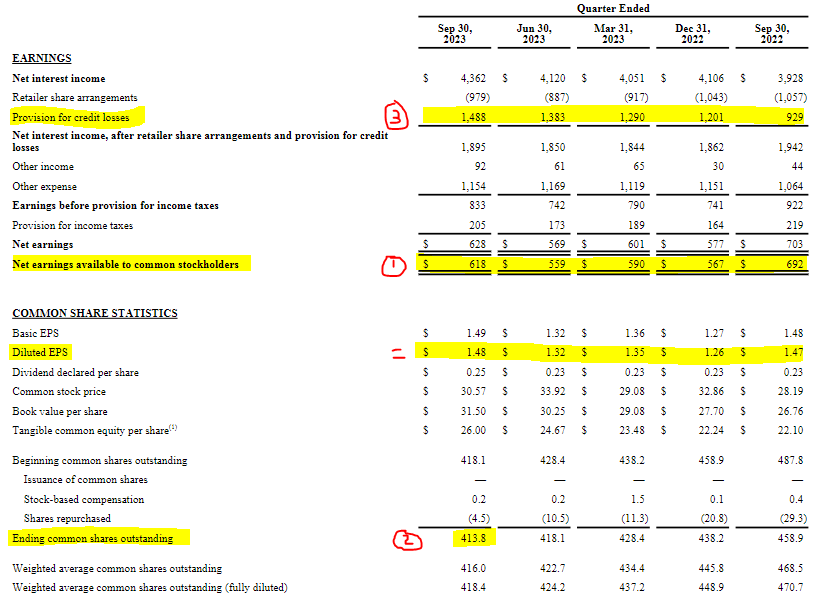

Synchrony is a steadily profitable business, and aside from a few small acquisitions, most of those profits have gone to share buybacks. As of 3Q23, the share count is ~415m or 50% lower than the 2015 spin-off start date (works out to a ~7% annual reduction).

Maybe “excess capital” isn’t the right word… but the $750m after tax gain is a nice boost to equity and should allow for additional buybacks. Management has a target capital ratio of 11% yet they’ve been sitting close to 12.5% for several quarters now. For a $100bn+ total asset business, that represents a decent amount of “excess” capital should they choose to deploy it (though regulatory reasons may not allow).

One caution on buybacks, I haven’t seen a good answer as to why the pace of buybacks has slowed so much over the past 5 quarters. It looks like they are repurchasing only enough to keep capital levels constant (i.e. balancing receivable growth and capital returns).

2) Cheap on normalized earnings

Analysts are estimating FY24 EPS at $5.36 right now. Good for a 7.3x P/E ratio. At first glance, those estimates look potentially low…

Here’s my math:

First, earnings have been declining YoY for the past 4 quarters but 4Q23 and all of FY24 should lap those declining periods… we’re already seeing earnings stabilize at or above the ~$560m quarterly mark. Simple math: $560m x 4 Q’s = $2.24bn divided by 414m shares = $5.41 EPS.

Next, share count continues to decline, albeit at a slower rate. Still, it’s reasonable to expect some level of share repurchases in 2024.

Last, provisions for loan losses are still growing YoY but should stabilize in FY24. Management highlighted a “normal” rate of net charge offs at ~5% of receivables and each quarter in FY23 has been at that level.

Trailing 12-month net earnings were $2.33bn. Assuming that’s a stable amount go-forward and using the current 414m share count gets us $5.63 in EPS. No consideration for receivables growth, additional buybacks, etc.

3) Inexpensive valuation

Below are pre-pandemic multiples for SYF, COF, and ALLY. Those stocks were trading at or above 10x earnings going into the pandemic. This isn’t a super clean comparison since the interest rate environment was much lower in 2014-2020.

What’s possibly more interesting to me is a) the discount to history; along with b) the potentially under-estimated FY24+ earnings levels for SYF.

Summing it up…

Shares of Synchrony are up nearly 34% over the past 3 months so maybe some of these comments are getting priced in…

Clearly this is a business heavily influenced by interest rates, consumer credit, and the pandemic aftershocks (stimulus, retail demand, etc.). But generally, retail purchase volume is a large part of GDP and should continue to grow. On top of that, other players have gotten weaker (Bread Financial) or are backing away from the space (Capital One).

At 9x earnings (long-term median multiple) of $6/share, SYF could trade for $54 which is still a decent premium from today’s level. Add in continued portfolio growth + share buybacks and perhaps this is a 10% earnings grower over the long-term.

This looks like a pretty reliable earnings grower and a “stay the course” capital allocation policy.