Quick Value #202 - Advance Auto Parts ($AAP)

Double dose of mean reversion - earnings recovery & multiple expansion

Lots of new subscribers lately, once every few weeks I’ll plan to “reintroduce” the newsletter and what we’re doing here. Each week I’ll cover a new value investment idea in a Quick Value review.

Idea generation — The goal is to keep the new idea process churning by working the watchlist. These are meant to be a jumping off point for deeper research (i.e. a surface level review).

Format — I stick to a format similar to Steinhardt’s 4 questions: what they do, why it’s interesting, and what it’s worth. [Technically, Steinhardt’s were: the idea, consensus view, variant perception, and catalyst.]

Weekly posts — Covers 1 new idea each week and rotates between free and premium posts. Premium posts lean toward micro/small caps and special sits.

Coverage focus — You’ll see lots of special situations (including virtually every spin-off) and an emphasis on small caps.

Market Performance

Quick Value

Advance Auto Parts ($AAP)

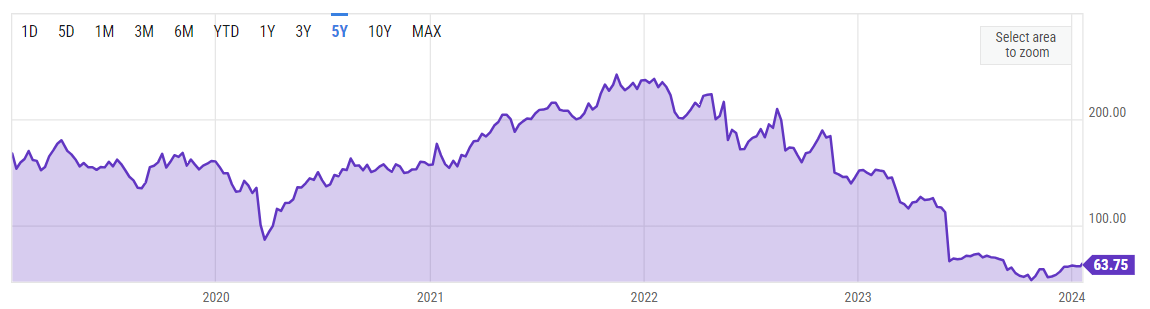

Advance Auto Parts has been a perennial value trap. Always looking cheap (especially compared to peers) but never providing investors with any outperformance. Maybe not never but at least over the past 5 years.

Shares got whacked in mid-2023 on a big guidance cut. Management left and the company is rebuilding.

Let’s see if it’s worth a spot on the watchlist.

What they do…

AAP is an auto parts retailer with ~5100 stores across the US and Canada under 3 brands (Advance Auto, Carquest, and WorldPac). They sell a huge catalog of auto parts from car batteries, to wiper blades, to oils and filters.

There are 2 distinct customer bases: 1) the “DIY” consumer; and 2) the “DIFM” professional market (think: car repair providers). Sales to pros were 59% of FY22 total sales.

Auto parts retailing is a growing industry with 2 main tailwinds: 1) expanding average vehicle ages (older cars need more repairs); and 2) total miles driven continues to grow (more vehicle usage = more repairs).

A quick word on what happened to send shares from $200+ to $60 — stated simply, it was an unexpected and rapid decline in fundamentals.

Mid-2023 was the capitulation point where 2023 margin guidance was slashed and EPS guidance fell 40%.

It didn’t stop there… margin and EPS guidance was cut again in August and November 2023.

Why it’s interesting…

1) New management and new game plan

AAP has a new CEO, Shane O’Kelly, who came over from HD Supply (the former parts supplier to “pros” within Home Depot). That was a pretty good business.

In my book, management changes (especially external hires) can be considered special situations. Especially if hard and fast changes need to be made or if there are dramatic changes in strategy.

Some announcements already out there:

Cost saving plan totaling $100m annual savings (net of reinvestment)

Selling both their Carquest and Worldpac businesses

Kitchen sink (maybe?) 2023 guide — margins cut in half, EPS cut by 70% — maybe a reset the bar situation for new management?

When AAP acquired Carquest and Worldpac for ~$2bn in 2014, they had a combined 1300-1400 stores and that count is likely higher today. So this is a meaningful asset sale that will change the look of the business and balance sheet.

2) Margins and performance way below history

I’ll set aside the fact that metrics are well below peers as those comparisons are off the charts. For now, AAP needs to focus on getting back to where they were.

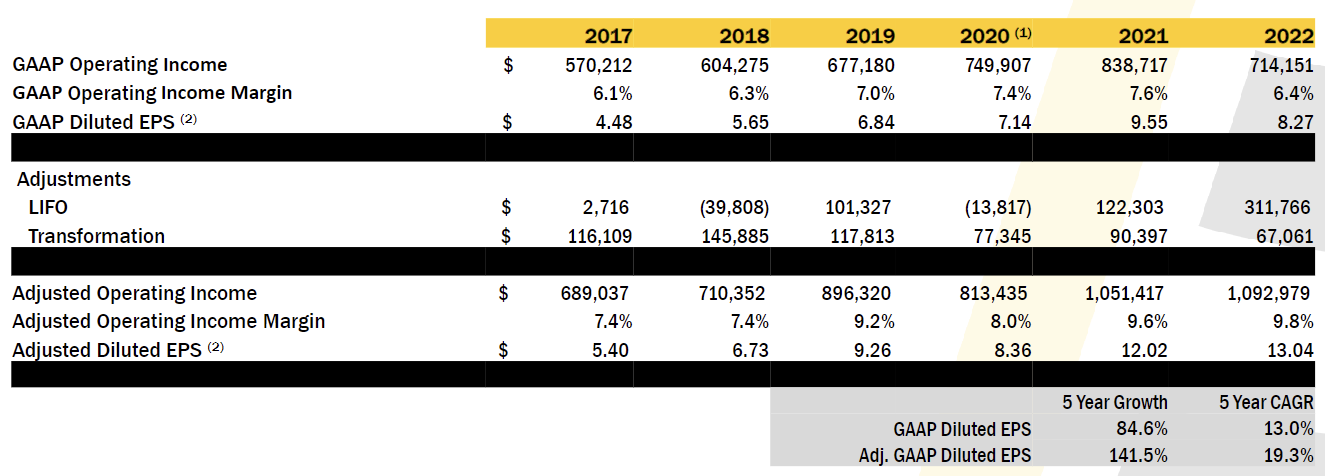

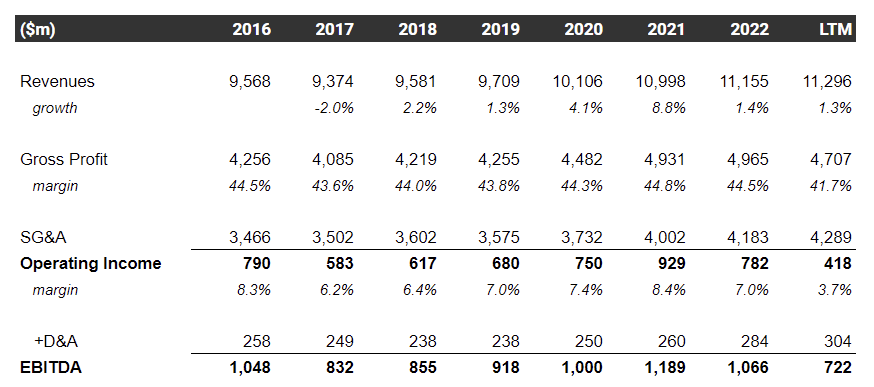

Operating margins were consistently 6-8% on a GAAP basis from 2017-2022 before the guidance cut to ~2% for 2023. That’s 70% below historic performance.

Yes, this makes for a mean reversion argument and that’s hard to substantiate. Especially when the sudden drop-off in performance is inconsistent with peer fundamentals.

Overhead seems to be a smaller part of the problem (though it’s still creeping up) but gross margins are where most of the underperformance stems. Through 9 months of 2023, gross margins were 40.8% vs. 2016-2022 at >44%. Supply chain, working capital management, etc.

Just for fun… 6% operating margins on an $11bn revenue base = $660m less $80m annual interest and a 25% tax rate = $435m net income or $7.30/share vs. current share price at $64 (8.7x P/E).

3) Capital allocation

Touching on this briefly despite 2023 being a year with virtually no free cash flow ($50-100m guidance).

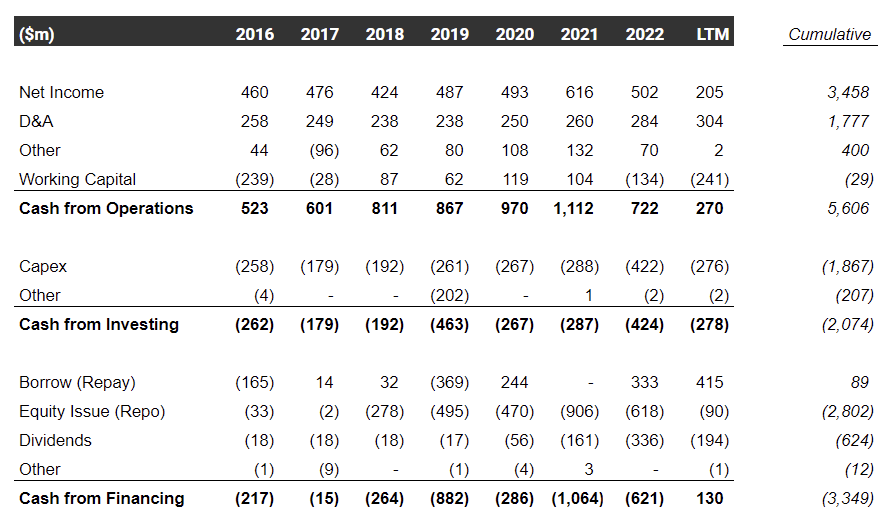

$5.6bn cumulative operating cash flow from 2016-2022

Capex intensity (% of sales) virtually unchanged from 2016-2022

90% of FCF went to shareholder returns — 75% on buybacks / 17% on dividends

Unfortunately, most/all of those buybacks were at much higher share prices and the dividend was cut (but not eliminated) earlier this year. Despite the emphasis on buybacks (remember, 75% of FCF), only ~20% of shares were retired from 2018 to today.

2023 is a wash as there won’t be any excess cash generated and I wouldn’t be surprised to see a complete pause in 2024 as they look to regain profitability and growth while selling assets.

I’m curious to see how management intends to deploy any cash generated from asset sales since the balance sheet appears fine (depending on your estimate for earnings recovery).

Summing it up…

I think I’ll need to spend the next few weeks covering the other auto parts retailers. It’s been too long since I’ve reviewed them.

At first glance, I like the setup of a new management team and it looks like a decent hire with a background in large SKU count, distribution, supply chain management, and sales to a “pro” market. The asset sales are interesting too… these are meaningful chunks of store count on the shopping block. What will they do with the cash? Even with operating margins at 2% they aren’t highly levered…

It’s almost not worth highlighting the discount to long-run median multiples because the discount is so significant assuming margins recover.

The big hang-up with this idea is the double dose of mean reversion — both in fundamentals (i.e. operating margins) and trading multiple.

What could that look like (again, just for fun)?

Using the estimate above ($11bn sales x 6% op margin less $80m interest x 25% tax rate = $7.30/share) and a 15x P/E would equate to $110/share or 70%+ upside. Again, we’re just playing with numbers until the execution makes sense…

Good Summary. This is a good space to look into! :)