Quick Value #204 - EnerSys ($ENS)

Growing mid-cap industrial trading at <13x P/E

Today’s Quick Value idea is a plain vanilla cheap stock (12.5x P/E)… although one with decent growth prospects (8-10% revenue CAGR through FY27). Management hopes to double the size of this business across several metrics by FY27 and the starting valuation is pretty inexpensive.

Market Performance

Quick Value

EnerSys ($ENS)

What they do…

EnerSys manufactures and distributes batteries and battery systems to 10,000+ customers in a variety of industries (utilities, energy, industrial, healthcare, automotive, etc.). In aggregate, they compete in a $30bn industry with 12%+ market share.

There are 3 operating segments:

Energy systems — Products and services primarily for utility, telecom, and industrial customers.

Motive power — Batteries for electric forklifts

Specialty — Batteries for automotive, trucks, satellites, aerospace & defense, and medical devices

Historically, EnerSys got most of their sales from lead acid batteries which require a hefty amount of maintenance and infrastructure. This was (and might still be) a key part of the bear argument for the company. They’ve done a nice job moving away from that product line over the past 6 years:

Note: the company held an in-depth investor day presentation in June 2023; link to those slides are here.

Why it’s interesting…

1) Earnings inflection on the horizon

Earnings per share grew at a measly 2% annual rate from FY17-23 ($4.75 to $5.34) but they’re on a path to eclipse $8/share in FY24 and grow to $11-13/share by FY27…

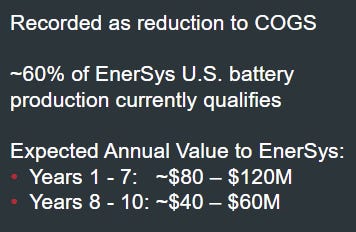

Why? A large portion of the increase stems from Inflation Reduction Act (IRA) benefits that started in 2023 and run for 10 years. Those benefits add $80-120m per year for the first 7 years… taxed at 25% that’s a $1.50-2.25/share increase to EPS!

Other operational areas are expected to contribute to the earnings inflection over the next few years but on the surface it looks like the IRA benefits have the most immediate boost.

2) Growth outlook — 8-10% revenue CAGR

Sales are tied closely to capex spending across several industries: telecom, broadband, utilities, warehousing (forklifts), EV charging, etc. Fortunately for EnerSys, most of those industries are very capital intensive!

Management believes several of these areas are experiencing megatrends that should fuel growth for years to come… like grid modernization, data center growth, warehousing and fulfillment growth, transition from ICE to electric forklifts, 5G / small cell expansion, rural broadband expansion, etc.

Blended, it works out to 8-10% annual growth from FY23-27 with consistent performance across each segment:

By FY27, EnerSys plans to significantly increase the size of the business while leaving room for more depending on capital return programs. From $5.34/share in FY23 to $11-13/share in FY27 = 22% EPS CAGR.

3) Capital allocation and underleveraged balance sheet

This is a really clean and underleveraged balance sheet with net leverage at 1.4x EBITDA as of 9/30/23. Management is targeting 2-3x but plans to stay near the low end of that range.

Capital allocation has been conservative with sparse acquisitions, a token dividend (not growing), and intermittent large buybacks. Note that buybacks have merely offset dilution with a small reduction in overall shares since FY16.

EnerSys expects to generate $1.2-1.6bn cumulative FCF over FY24-27 (vs. $500m during FY20-23). That’s more than 1/3 the current market cap over the next 4 years. With the balance sheet in already-good shape, much of that will be available for deployment.

Summing it up…

This looks like a sleepy little business with a low profile and a promising outlook. Margins and ROIC are good and the valuation is consistently below their peer group.

Past results make this one look like a mediocrely run company for many years. The IRA benefits seem to be a shot in the arm for earnings and perhaps there are tailwinds across each segment.

It reminds me of the WK Kellogg (KLG) story with a heavy organic growth element and an investor base that seems skeptical on the execution and industry. If EnerSys can make headway, they might see a hefty re-rate over time…

Just spit-balling, if they achieve the low-end EBITDA outlook by FY27 ($850m) at close to peer industrial valuations (10x) = $8.5bn enterprise value. Less $662m net debt (as of 9/30/23) and 40m shares outstanding = $196/share price target… >2x today’s price. And that has zero credit for the $1.4bn cumulative FCF or buybacks.