Quick Value #208 - GE Vernova ($GEV)

Upcoming GE spin-off - Vernova & Aerospace

This one was recently profiled in Barron’s but I wanted to take a closer look to see how to play the upcoming spin-off. GE is wrapping up their break-up with the spin-off of the Vernova power gen business and Aerospace business. Let’s take a look at each piece and what they might be worth…

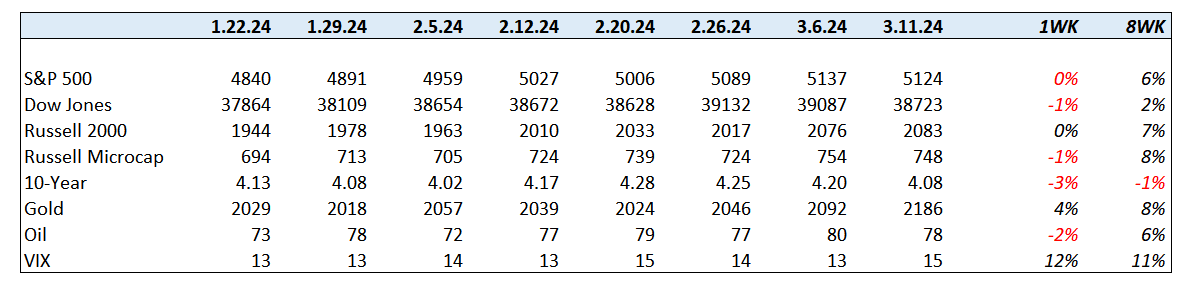

Market Performance

Quick Value

GE Vernova (GEV)

I’ll try to keep this as concise as possible but for my own notes I prefer to look at both RemainCo and SpinCo to reference at the time of spin. I won’t be able to cover every aspect of each company so be sure to check into them further.

As a starter, GE has 1.09bn shares outstanding x $168/share = $183bn market cap. (Also pretty wild this was a $140bn market cap just a few months ago.)

RemainCo (GE Aerospace)

What they do…

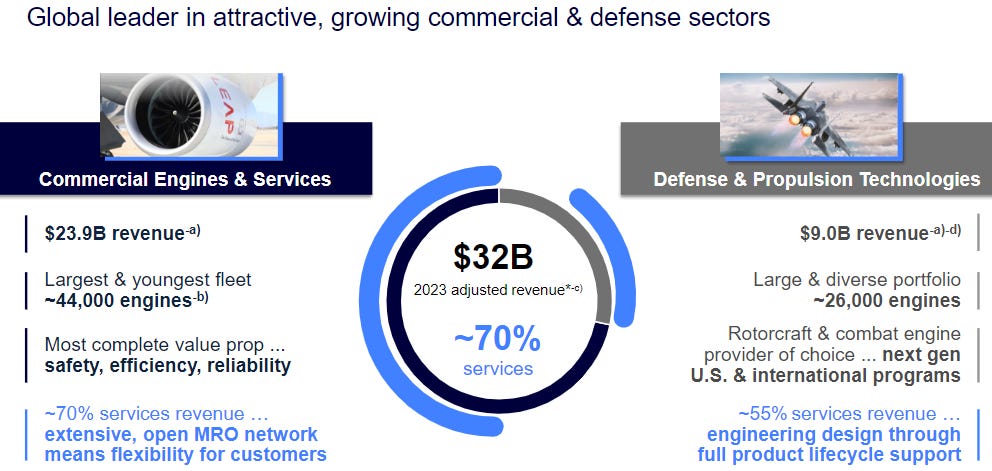

Most will perceive this as the crown jewel. GE Aerospace makes engines for commercial and military aircraft. They also provide aftermarket parts and services. Services make up roughly 70% of total revenue making it a pretty stable business.

It’s also a business with tremendous long-term tailwinds with the growth of commercial air travel and ever-expanding defense budgets. The installed base of GE engines has grown >60% since 2000:

What do the financials look like?

Aside from the pandemic-induced dip in 2020-2021, results have historically been stable and growing. This segment has yet to eclipse the revenue/profit high watermark set in 2019 but they’re closing in fast.

Here is management’s financial model through 2028…

Pretty impressive figures really… a business growing top-line at HSD/DD, operating profit that will nearly 2x to $10bn by 2028, and FCF converting around 100% of net income.

From a capital allocation standpoint they plan to return >100% of FCF to shareholders over the next 3 years.

What it’s worth…

RemainCo should command a high multiple… it’s growing, generates a lot of cash, has very long-run tailwinds, etc.

I’ll use operating profit which is guided $6-6.5bn in 2024 and $7.1-7.5bn in 2025 as a starting point. Well-run industrial peers trade at 15-20x EBITDA but may not have this level of organic growth. Using 20-25x $6-7bn operating profit = $120-175bn EV.

GE (pre-spin) has ~$22.7bn cash & investments and $21bn debt (there are some liabilities that could be considered debt-like but I’m ignoring those for a moment). Vernova will take ~$4bn cash so perhaps Aerospace is left with net debt of around $3bn.

That $120-175bn EV estimate less $3bn net debt and 1.09bn shares = $107-158 per share.

You could argue this undervalues the future potential of the business if they achieve those 2028 targets. Let’s say they repurchase $25bn of stock from now until 2028 and hit the $10bn operating profit target. At 20x ($200bn) and zero net debt (by then) we have a $150bn market cap… say share count falls to 0.9bn and you have $222/share by 2028… (though that feels a little blue sky to me)

SpinCo (GE Vernova)

What they do…

Vernova sells equipment, services, and software to the power generation industry (mainly utilities and grid operators). They break it into 3 groups:

Power — Equipment and services for power generation. Largest installed base of gas turbines in the industry.

Wind — Turbines, blades, services, etc. for onshore and offshore wind generation.

Electrification — Equipment and services for electricity transmission & distribution.

The long-term need for additional power generation is significant (Form 10 highlights a 50% increase required by 2040) and Vernova sits in that value chain working directly with large scale utilities and grids.

At its core, this looks and feels like an E&C (engineering & construction) company with solid service businesses to support new-build backlogs. Results can be erratic at times if projects are underwritten poorly (as has been the case with Vernova for many years). Only ~45% of revenue comes from services.

What do the financials look like?

As a segment within GE, Vernova has been losing money for years, and 2023 was the first taste of a successful turnaround.

Segment operating margins were in the mid-teens from 2013-2016 before dropping to zero/negative. As a reminder, GE acquired the Alstom power gen and grid business in late 2015 for $13.5bn — the estimated $3bn cost synergies never materialized and actually went in the other direction.

The 2017-2018 period kicked off a dramatic downturn in for large scale equipment. GE also sold a few power businesses in 2017-2018 to raise cash. Aside from that, the business has not recovered to 2013-2015 margin levels.

Fast forward to today — the business is recovering from losses to earnings and set to generate meaningful cash flow for the first time in a while.

Here is where they plan to take the company through 2028:

What it’s worth…

Well-run industrials like Dover, Ametek, Fortive, etc. trade at premium 15-20x EBITDA multiples but most of those have 30% or better margins. Global conglomerates like Siemens, Mitsubishi, Schneider, and Hitachi trade at 10-12x EBITDA but they too have better margins (15-18%).

So what’s a good comp group for this lumpy and optimistically 10% EBITDA margin business?

I think a group of engineering & construction peers makes sense here. The margin profile is similar and the “new build construction” element overlaps with Vernova well. Historically, companies like MasTec, Dycom, and Quanta traded around 8-8.5x EBITDA but lately it’s more like 10-12x or more.

If we give Vernova credit for 6-8% EBITDA margins (“high end of mid and high single digits”) on $35bn revenue = $2.1-2.8bn EBITDA. Net cash will be ~$4bn at the time of spin and using a 10-12x EBITDA multiple and the old GE share count of 1.09bn = $23-34/share price target (that’s $92-138/share using the 4:1 spin ratio).

Some factors that could make it more/less attractive than that:

Revenue growth at MSD rate… 2024 outlook just now eclipsing 2019 sales levels

Expanding EBITDA margins… from “high end MSD” to “low end HSD” to 10% is quite a leap on top of MSD revenue growth… i.e. EBITDA could be growing 15% per year

On the other hand, this is still a very cyclical business with potential for poor project underwriting (E&C has occasional blow ups)

Summing it up…

I’ve got the 2 pieces pegged at:

RemainCo (Aerospace) valued at $107-158/share

SpinCo (Vernova) valued at $23-34/share ($92-138/share post-spin)

Sums up to $130-192/share vs. the current price of $168. The play would be current GE shareholders dumping the lumpier SpinCo business and ascribing a ton of value to the Aerospace behemoth.

I’d be pretty interested in picking up Vernova at a price tag that heavily discounts the success of those future targets…

Other reference materials: