Quick Value #210 - Solventum (SOLV)

Healthcare spin-off from 3M (MMM) coming early April

3M is trying to “pull a GE” by breaking itself up. They’ve spun off their food safety business into Neogen (NEOG), now they’re splitting into a 1) healthcare business; and 2) an industrial/consumer business.

Let’s take a look at what each piece might be worth…

(Sign up below for access to all posts!)

Market Performance

Quick Value

Solventum ($SOLV)

3M (MMM) is on a major slump for a formerly high quality business. They’ve underperformed the market by a wide margin over 10 years.

To solve for this, they’ll be spinning off their healthcare segment which is expected to start trading in early April 2024. As usual with spin-offs, I’m taking a quick look at both SpinCo and RemainCo to try and peg a valuation for each. These are rough estimates so do your own work.

SpinCo (Solventum)

1) What they do…

Solventum is the healthcare segment tucked inside 3M. There are several businesses here:

MedSurg (56% of 2023 sales) — Surgical supplies and wound care products (IV systems, surgical drapes, surgical tape, stethoscopes, creams, pumps, etc.)

Dental (16%) — Orthodontic and general dentistry products like bonding adhesives, aligners, fluorides, and dental equipment.

Health IT (16%) — Software products for physician documentation, coding, classification, speech recognition, etc.

Purification & filtration (12%) — Filters, purifiers, cartridges, and membranes (i.e. used in dialysis treatments and open heart surgery oxygenators). This segment has a large non-healthcare element to it (industrial, drinking water, etc.).

Each of these segments operate in large and growing markets:

The former CEO of Zimmer Biomet (ZBH) was brought in to run the company and 2023 sales were $8.2bn with adjusted operating income of $2bn.

2) The financial picture and outlook

Combined sales were flat from 2021-2023 and that was broad-based across each segment. Generally, this is a high margin business (>20% operating margins) with excellent cash generation. It will spin with ~$8.4bn in debt adding $500m or so in annual interest expense.

Segment financials:

Guidance for 2024 calls for:

Revenue growth of (2%) to 0%

EPS of $6.10-6.40 — on a 173m share count ($1-1.1bn)

FCF of $700-800m — $4.00-4.60/share

Capex of $400-500m — up from $250-300m within 3M

Long-term, management expects to get back to growing and hit those MSD market growth rates. From a cash flow standpoint, they’ll spend the first 2 years post-spin deleveraging and reinvesting organically (i.e. capex). I’d be surprised if there is much of a dividend here (if any).

3) What it’s worth

This business should trade at a significantly higher multiple than RemainCo (given their problems in consumer-facing businesses). The caveat is the higher leverage and lack of recent growth compared to peers.

Many of these competitors (listed in the Form 10 filing) have similar profiles with 20%+ EBITDA margins and 4-6% growth outlooks (though Solventum isn’t quite there yet). The median EBITDA multiple is 13x with a wide range of 10-25x.

Using a 10-12x multiple on $2.35bn 2024 EBITDA ($8.1bn sales x 22% op. margin + $560m D&A) = $23.5-28.2bn enterprise value. Net debt is ~$7.7bn at close (3.3x leverage) so call it a $15.8-20.5bn equity value.

That works out to a $91-118.50/share price target (or $29-37/share on pre-spin share count).

RemainCo (3m)

1) What they do

Legacy 3M will be left with a collection of industrial and consumer businesses (still a conglomerate):

Safety & Industrial — Abrasives, adhesives, tapes, personal safety products (including masks), etc.

Transportation & Electronics — Films, bonding solutions, etc. for industrial and automotive applications (think reflective tape on road signs).

Consumer — Mostly stuff in the home; cleaning supplies, bandages, tapes, post-its, command strips, etc. (this is likely the most cyclical business in the portfolio)

3M brought in a new CEO from L3Harris to turn the business around.

2) Financial picture and outlook

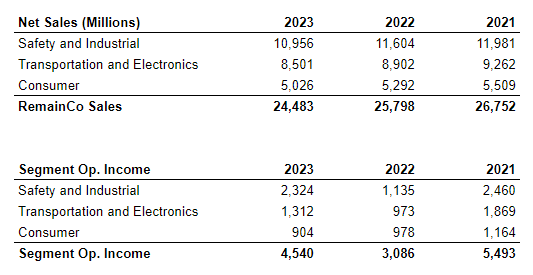

Each of the segments within RemainCo have been struggling the past few years (and perhaps longer than that). Sales fell 4.3% per year from 2021-2023 and earnings are down.

The 2024 outlook calls for revenue growth flat to LSD in both the safety/industrial and transportation/electronics segments while consumer is expected to decline LSD. It’s likely 3M will see overall sales declines in 2024. Recent comments from their CEO on market outlooks:

There aren’t a lot of bright spots on fundamentals turning the corner yet… (hence why 3M is so cheap right now)

3) What it’s worth

I’m looking at this 2 ways… 1) 3M’s historical trading multiple as a standalone company; and 2) industrial/consumer conglomerate peers

On the former, 3M historically trades at ~10x EBITDA but they’ve been significantly higher at points. On the latter, high-performing industrial conglomerates like Dover, ITW, and Fortive trade >20x EBITDA but 3M isn’t in the same neighborhood when it comes to financial performance.

Here’s a simple framework for both SpinCo and RemainCo. I’ve used 8.5x EBITDA at 3M as a discount for the lack of growth and potential liabilities from PFAS/earplug lawsuits.

I get to $81/share using an 8.5x EBITDA multiple on $5.6bn 2024 EBITDA for RemainCo.

Ignoring lawsuit liabilities for a moment, 3M will have an excellent balance sheet with less than 0.5x leverage at the time of spin. I’m guessing they’ll take advantage of the spin to cut the dividend but that should be viewed positively… 3M hasn’t made an acquisition since 2019 while competitors are doing small/medium deals each year, maybe this opens up capital allocation flexibility that hadn’t existed before?

Summing it up…

That works out to $110-120 per share for pre-spin 3M based on:

SpinCo (Solventum) — $29-39 per share based on 10-12.5x EBITDA

RemainCo (3M) — $81 per share based on 8.5x EBITDA

As usual in these situations, the opportunity lies in how they start trading. What’s interesting here is the potential for a clear line to be drawn between GoodCo (healthcare) and BadCo (3M). Or if they use it as an opportunity to slash the dividend, both pieces could get hit.

Additional information

Thanks for the writeup. I'm relatively new to investing so any intelligent translation of the situation is very helpful

I work in the health industry and have purchased and used 3m (now, solventum) products for many years. Their products were probably consistently the highest priced from at least 15 years ago but widely recommended and used by medical and dental specialists. They are most definitely good products but competitors were gradually offering more similar products at lower prices. There are not many 3m/solventum products I use today but of the things I use, there is no alternative that I trust.

I noticed a few of the comps are not great comps. Eg. align tech solely focuses on aligners. Solventum's aligner offering is ok at best and given what I haven't heard about it, most definately not a large part of their revenue. At a quick glance, it seems all of they don't really compete with each other substantially on the medical/surgery side. I know it may be just so we can get a good estimate of the relative business value but I'm not sure it works so well for the listed companies.

I'd probably remove the top 3 multiples but that would still agree with your multiple and estimates. I can see it's offering compares closer to a combination of Dentsply, Envista and ICU. Interestingly, it's trying to compete on multiple fronts while these other companies only have one.

Looks like I've got a lot more digging to do.