Quick Value 2.1.21 ($DVN)

Devon Energy ($DVN) - recently merged oil and gas producer

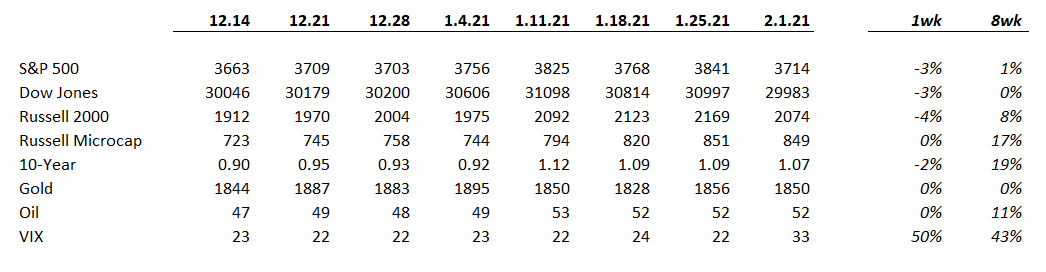

Market Performance

What a wild week… Huge spike in volatility (VIX) and most indices sold off (except for the smallest of companies).

Market Stats

Let’s run through a few quick stats on the various engines of economic growth. My view is a twist on the old GDP equation where GDP = consumer spending + business investment + government spending + net exports.

Federal Reserve / Money

We have money supply growth continuing to accelerate (despite lower velocity) and inflation running positive but below historic averages. This is a recipe for a continuing accommodative Fed.

Government

Not much commentary needed here. We’ve had 2 large stimulus programs already and a 3rd in the works.

Banking

Credit has been readily available during the pandemic

Consumer

I’ve mentioned over and over that consumer financials are flush right now. Consumer earnings and savings have been stellar since the pandemic and stimulus efforts began. Personal incomes have weaned off unemployment as well (down from 6.6% of total income in May to 1.6% in Dec).

Quick Value

Devon Energy ($DVN)

Last week I highlighted a few stats on the energy industry… So today’s post kicks off a series of Quick Value ideas in the energy sector.

I see 97 stocks headquartered in the US, with a market cap >$100m that are down 10% or more over the past year. Rightfully so. Even without the pandemic the energy sector was in the dumps…

Collectively, 32 U.S. shale drillers outspent their cash flow in all but three quarters since the start of 2014, according to the consulting firm Rystad Energy.

Back in September 2020, Devon announced a $12bn mega-merger of equals with WPX Energy in an all-stock deal.

Following the merger — Devon has 673m shares outstanding and a $16.50 share price makes it a $11bn market cap. With it being an all-stock deal, the net result was a fair amount of deleveraging.

Management highlighted the free cash flow profile of the combined business relative to oil prices — at $50 WTI, this is a roughly 11% FCF yield. Even at $40 oil, their profile shows cash generation.

Beyond that — management plans to get far more shareholder-friendly in their approach to deploying cash. Plenty more coming to dividends and share buybacks in the future.

After selling the EnLink midstream business in 2018, Devon used most of the proceeds to repurchase stock. Dividends have been negligible and FCF has only totaled ~$700 over 2.75 years.

The big takeaway here is the 180-turn in focus — away from growth / production and toward cash flow and shareholders.

Mr. Hager vowed the combined company would keep investment rates at 70% to 80% of operating cash flow and limit output growth to 5%, even in a more favorable oil-price environment. In addition to a fixed dividend, it also plans to implement a quarterly variable dividend that would distribute some of its available cash to shareholders.

The variable dividend is a great concept that’s underused in the US. Bigger payouts when performance is hot and protect the balance sheet when performance is poor.

Oil and gas may not be the greatest industry long-term but the world will not wean itself from oil overnight. If oil producers can stave off the temptation to blindly grow production in favor of cash flow (and mean it), then some of these scaled producers may do well. It’s also possible we see more of these all-equity mergers in the energy space.