Quick Value 2.13.23 ($DHR)

Danaher - High quality business w/ commensurate valuation; great future prospects + upcoming spin-off

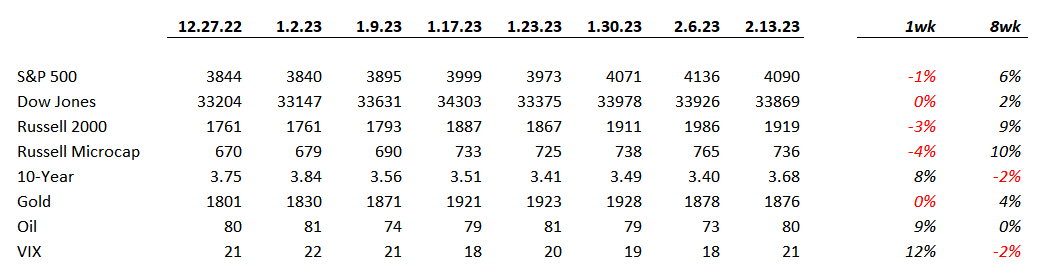

Market Performance

Market Stats

Homebuyer demand (per Redfin) is down 25% YoY but still above the Jan-Feb 2020 pre-pandemic baseline

Sales of existing homes falling faster than past recessionary periods including GFC (from MacroAlf on Twitter)

Quick Value

Danaher ($DHR)

I don’t normally look at perceived “high quality” businesses and typically prefer stocks that have been previous underperformers as opposed to outperformers (lower bar for expectations).

But Danaher is one of those Grade A businesses that just needs to be reviewed; especially since they’ve undergone such dramatic change over the past few years. Who knows? Maybe it’ll get unexpectedly cheap one day and I can be ready to swoop in.

What they do…

The corporate history of this business is wild… with roots as an industrial/tools business which later morphed into its current state as a mostly life sciences company. Danaher has long been active in M&A both as buyer and seller of assets.

Notable recent activity includes:

2016 spin-off of industrial business Fortive (FTV) now a $24bn company (which itself spun off Vontier (VNT) a ~$3.7bn company)

2019 spin-off of dental business Envista (NVST) now a ~$6.5bn company

2020 acquisition of GE’s biopharma business for $21bn

2023 upcoming spin-off of their environmental segment

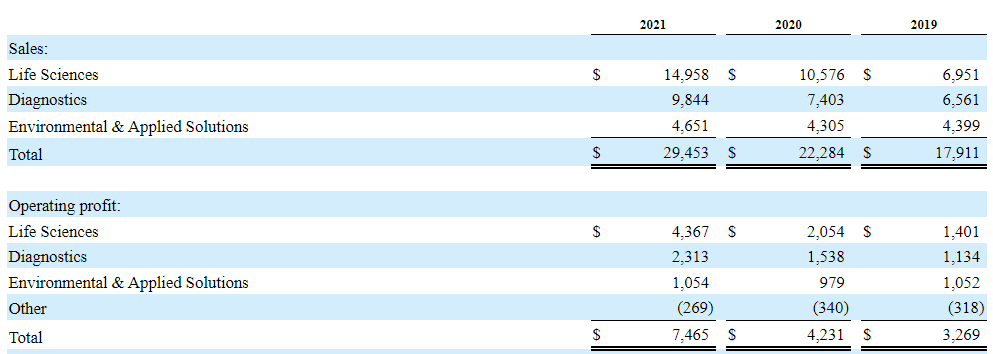

Danaher operates in 3 segments:

Life sciences — Equipment and consumables to healthcare/pharmaceutical customers in both R&D and manufacturing processes.

Diagnostics — Instruments, reagents, consumables, software, services sold to hospitals, physician offices, and medical labs.

Environmental — Basically 2 sub-segments here: water quality testing products and services; and product ID offerings like printing, packaging, barcode labeling, etc.

A breakdown of sales by product type shows the instruments and product ID pieces as very small and mostly flat while research/medical products have exploded.

Post-spin, here’s what Danaher will look like…

Why it’s interesting…

1) Fundamentals — Revenue and earnings have grown at a pretty remarkable rate considering they spun off 2 decent-sized businesses. I’m usually pretty skeptical on the ability to forecast long-term revenue trends but Danaher likely has great line of sight to 5-10+ years of good growth considering their role in the drug development process and this decades slew of blockbuster drugs coming off patent. Management is guiding to high-single-digit revenue growth long-term.

2) Unique capital allocation — Danaher doesn’t bother with share buybacks, nearly 100% of FCF is dedicated for M&A aside from a token dividend. Unlike other serial acquirers, they seem to manage it in a way that adds to the snowball. Equity issuance is rare outside of some stock comp.

A sample of recent deal-making: from 2019-2021, they spent ~$21bn on GE’s biopharma biz, ~$10bn on another large deal, and $2bn on 22 other small acquisitions. That’s $33bn spent on M&A vs. $16bn in FCF during that period.

Since 2016 (7yrs), sources & uses of cash have looked like this:

$38bn operating cash flow (~$8.5bn each of 2021/2022)

$5.6bn spent on capex ($1.2bn each of 2021/2022)

$40bn spent on acquisitions

$16bn funded from debt/preferred stock

$3.9bn spent on dividends

Free cash flow was $7bn in each of 2021 and 2022. Net debt is a very reasonable $13bn. There are ~746m shares outstanding and a $259 share price makes it a $193bn market cap so 27.5x FCF and 23.7x 2022 EPS of $10.95/share.

I’d love to own a business like this using Buffett’s 10x pre-tax earnings rule of thumb but it’s more like 20x today. Shares look priced for continued HSD revenue growth and mid-teens earnings growth (and that could absolutely be the case). I haven’t even touched on the famed Danaher Business System (DBS) which is their secret sauce operating methodology that ekes out so much efficiency and growth. For example, the surface purchase price ($21bn) for GE’s biopharma business was 17x EBITDA and seemed rich but since 2019, Danaher has been able to 2x the revenue run-rate of that business.

For now, I’ll consider this a wonderful business that’s worth a spot on the watchlist… At the right price, I’d happily own it.