Quick Value #214 - Standard Motor Products (SMP)

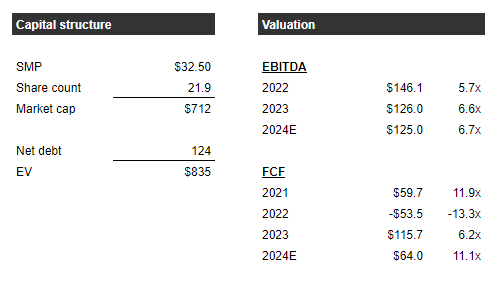

$715m market cap cheap auto parts manufacturer - 11x FCF / 6.7x EBITDA

Today’s post covers:

Plain vanilla cheap stock — 11x FCF / 6.7x EBITDA

Stable business with low leverage (<1x)

Cost headwinds going away in 2024-2025 — could be a nice earnings growth story from 2024-2026

Stock is flat over 10 year period (the contrarian in me is excited by these sorts of “low expectation” charts)

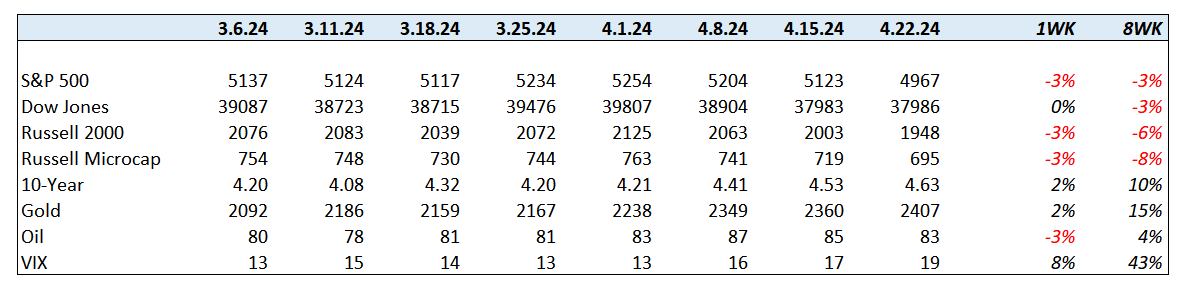

Market Performance

Quick Value

Standard Motor Products (SMP)

This one first popped up on my radar when I looked at (and invested in) the aftermarket auto parts business at Phinia (PHIN). SMP is a competitor in that space with intriguing fundamentals and valuation (and a punky track record).

What they do..

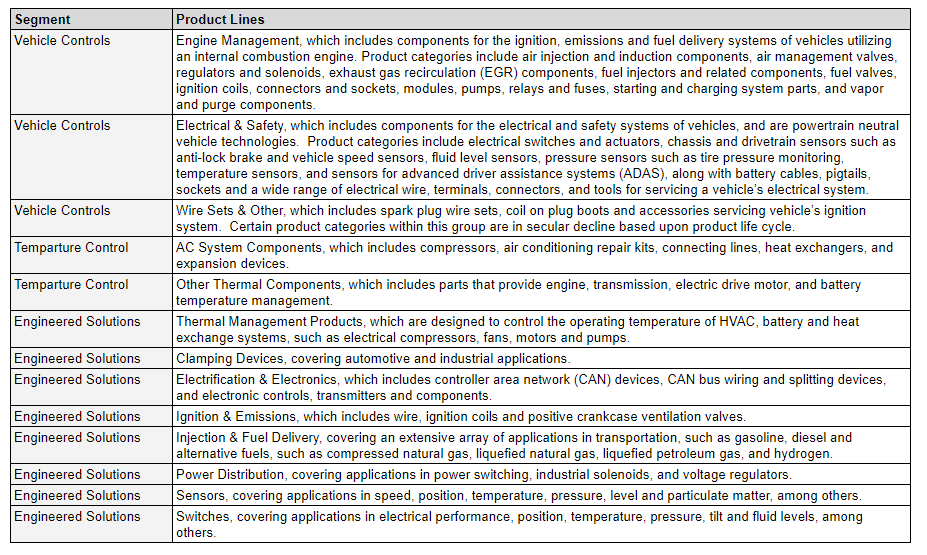

Standard Motor Products (SMP) is an auto supplier with a variety of product lines under 3 segments — Vehicle Controls (aftermarket), Temperature Controls (aftermarket), and Engineered Solutions (OEM).

It’s an extensive list of products with 79,000 SKUs (compares to 133,000 SKUs from Dorman Products and 37,000 SKUs at Motorcar Parts of America):

Think of it as an aftermarket parts business (both vehicle control and temperature control) plus an on/off-highway OEM parts business (engineered solutions):

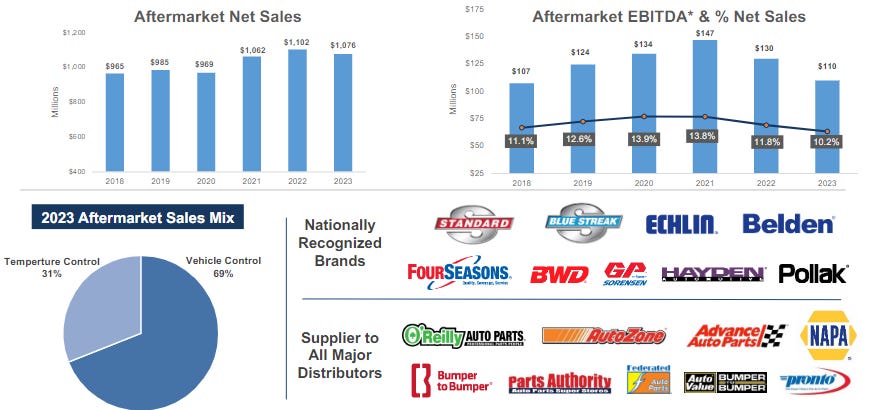

Aftermarket — $1.07bn 2023 sales. Includes both VC/TC segments. Sales mostly go to the auto parts retailers (AZO, ORLY, AAP, etc.) and those customers have been destocking inventory lately which hit 2022-2023 results.

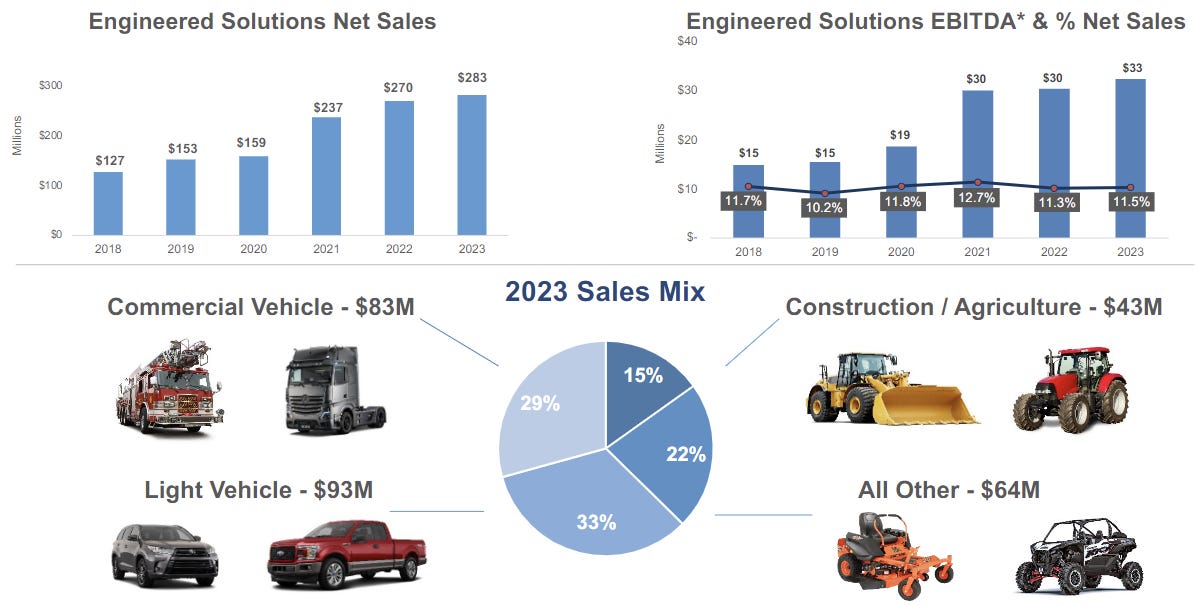

OEM — $283m 2023 sales. This side of the business is 2/3rd commercial, construction, ag, etc. and only 1/3 passenger vehicles.

Why it’s interesting…

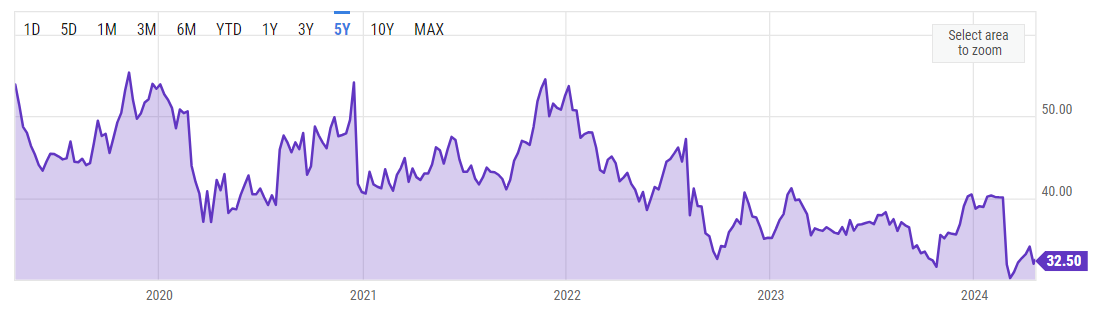

SMP has been an incredibly mediocre stock for its entire public existence… 10 years ago it was trading at $37 and today sits at $32. Ouch.

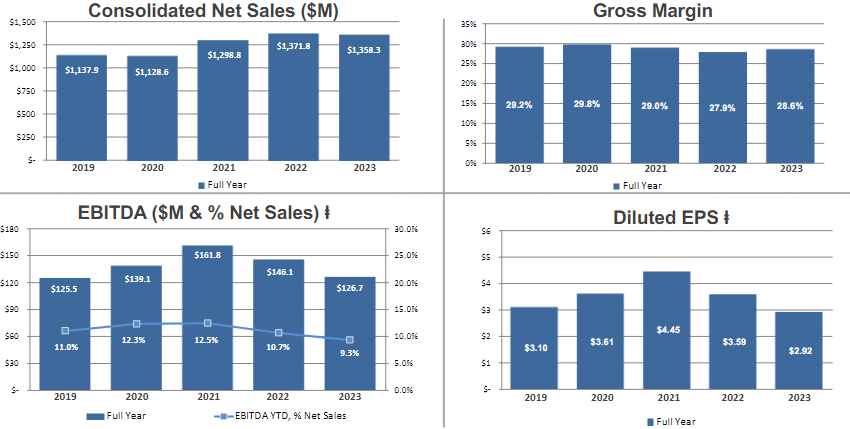

I’ve always assumed (right or wrong) that aftermarket parts is a decent business. Highly fragmented industry (depending on the product line) selling into a stable, non-discretionary end-market with a customer base that’s absolutely crushing it (AutoZone, O’Reilly, AAP). Revenue and earnings are stable but fundamentals have been erratic to say the least:

While results are definitely cyclical (EPS is flat over 5+ years), the company has several redeeming qualities:

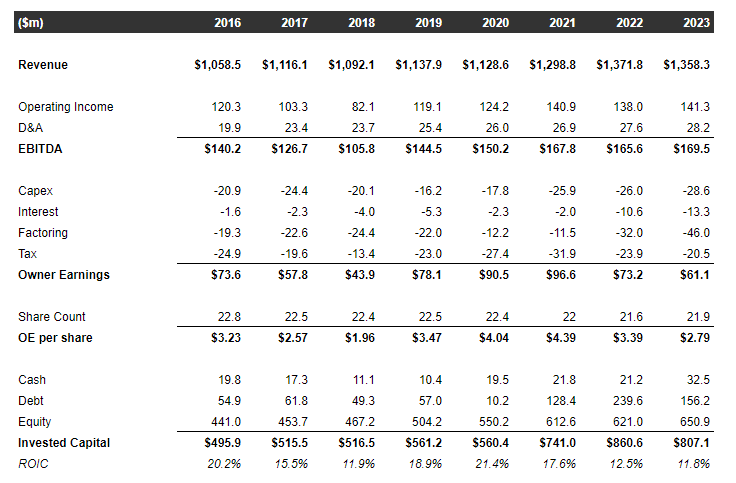

Consistently profitable (GAAP net income!) with mid-to-high teens ROIC.

Generate plenty of cash and run a conservative balance sheet (<1x net leverage).

Growing on/off-highway OE segment (engineered solutions) and stable aftermarket business.

Low investor expectations — long-running underperformer, minimal analyst coverage, etc.

Stock is cheap at 11x FCF (my estimate) and 6.7x EBITDA (2024 guidance)

Several one-off expenses hitting 2023-2024 that should lead to higher earnings in 2025-2026.

Planned sale of a distribution center should bring in another $20m+ cash proceeds.

That’s a lot going on so here is a chart highlighting the fundamental picture from 2016-2023… Revenue, interest, and debt jumped in 2021 due to a large acquisition (~$125m). There’s a modest dividend but capital allocation is going toward debt repayment lately.

There are 4 items still up in the air which could make this interesting over the next 2-3 years:

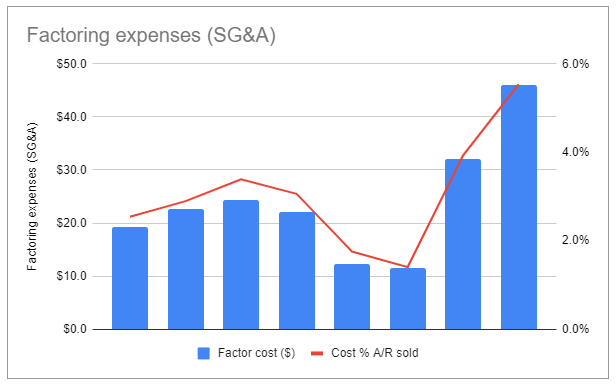

Factoring costs — SMP factors a large portion of receivables each year to expedite collections. In total they’re selling 60-70% of revenue annually and those costs have spiked thanks to higher interest rates. At $46m annually, this is running nearly $1.50/share after-tax! Much like debt on a balance sheet, this seems like a solvable problem…

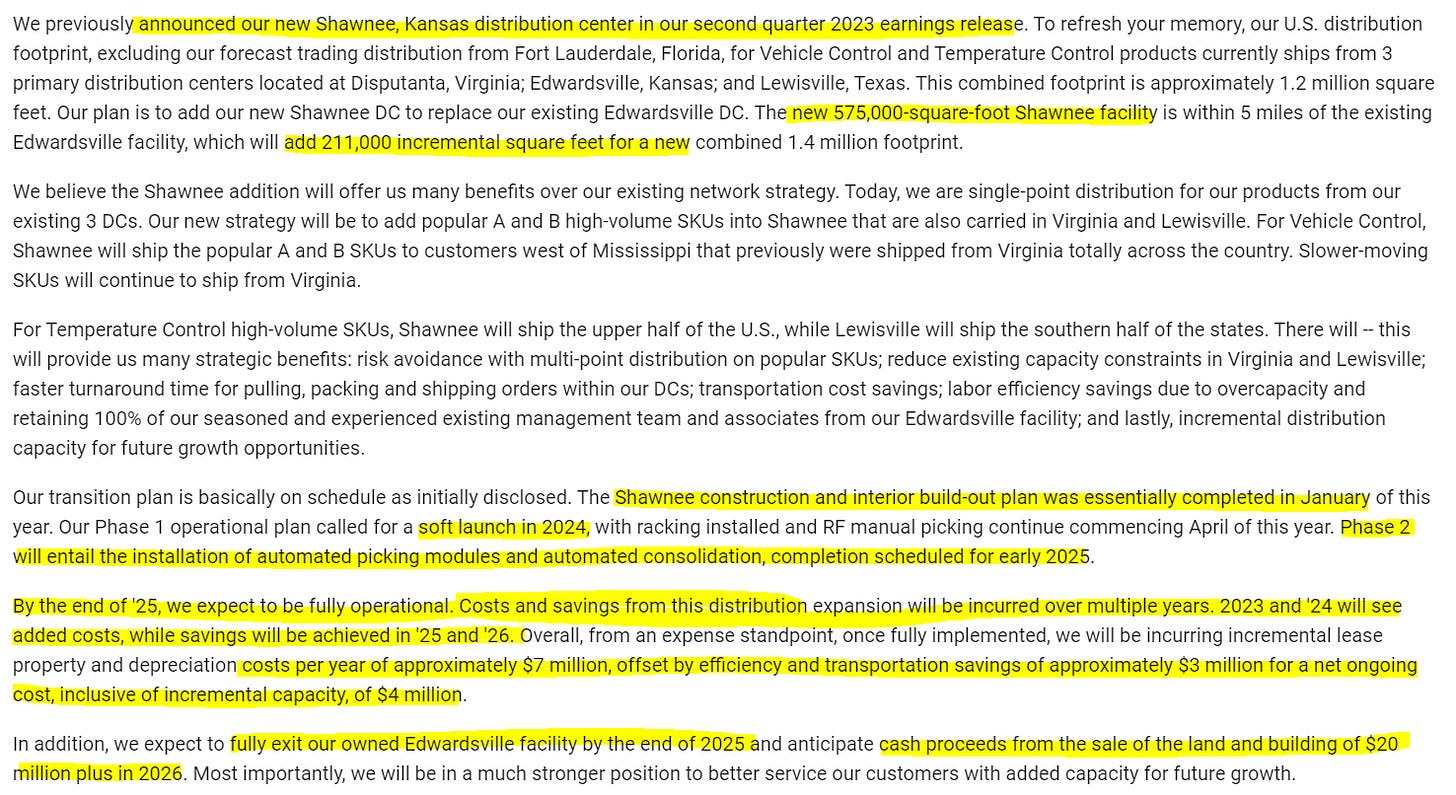

New distribution center — In 2023, SMP announced they would build a new distribution center to expand capacity and eventually close down and sell an older DC. The plan is to soft launch in 2024 with the new facility fully operational by end of 2025. The expense side of the equation is already being borne ($7m per year in opex + D&A) while cost savings won’t materialize until end of 2025 ($3m per year). That’s another $0.10/share after-tax to earnings just from the opex savings.

Sale of old DC — Once they’ve ramped the new facility, the plan is to sell the old one. Management estimates $20m in proceeds in 2026. A small but helpful boost to cash.

Potential sale — There aren’t any rumors on this one but Phinia (PHIN) has a slightly larger aftermarket business and consistently produces margins at 14-15% vs. 10-13% for SMP. Both SMP and PHIN have clean balance sheets with <1x leverage. A deal could make a lot of sense here with Phinia very interested in M&A and the opportunity for additional cost savings… Hmm…

Summing it up…

Management is guiding 2024 EBITDA flat from 2023 — $126m — backing out interest ($10m), capex ($25m) and 25% for taxes ($26m)… I get $65m in FCF or ~$3/share. Call it 11x P/FCF.

Most of the heavy lifting for the DC build-out and higher factoring costs are in the past… once those things ease up earnings could grow nicely from 2024-2026 with a nice cash boost from selling their DC down the road.

It’s on the cheaper end of the auto parts spectrum but at the higher end on margins and leverage… not an amazing business and capital allocation has definitely been a question mark (ineffective buybacks and potentially an acquisition at cycle peak?) but it’s one I’ll keep on the watchlist for sure…

Thoughts and feedback welcome!