Quick Value 2.14.22 ($IAA)

IAA Inc - 22% selloff in this salvaged auto auctioneer

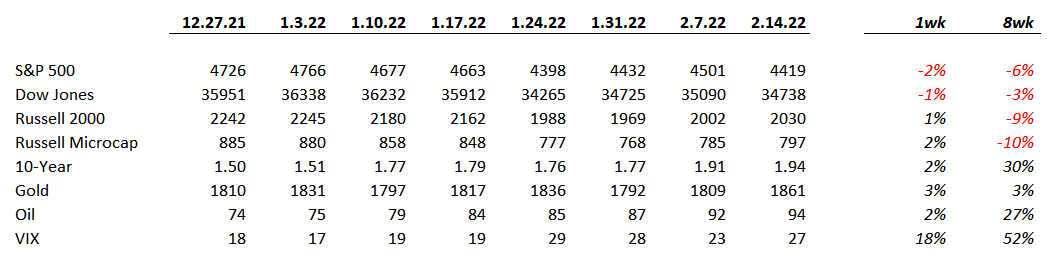

Market Performance

Market Stats

Quick Value

IAA Inc ($IAA)

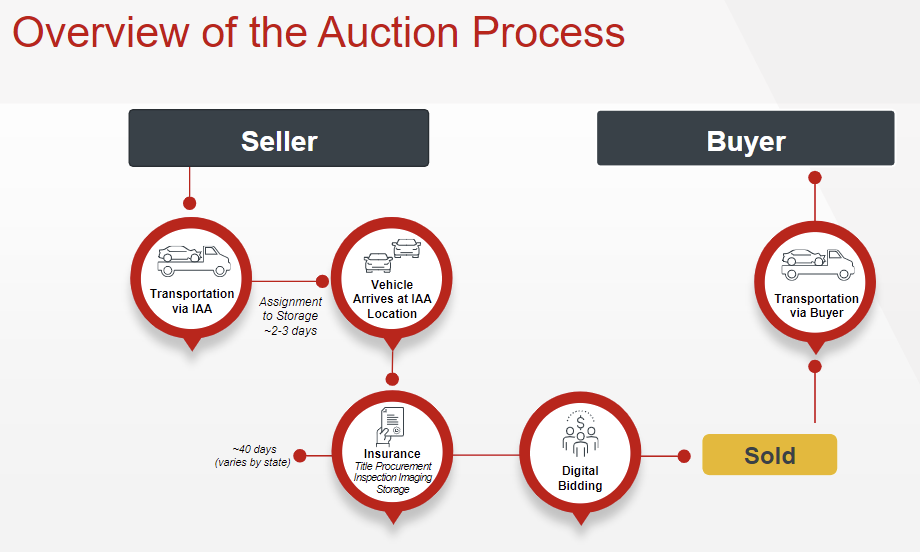

I like to keep tabs on stocks that are down big to see if there’s anything to uncover. IAA was spun off from KAR Auction Services in 2019. IAA is the salvage auction auction portion of the old KAR — i.e. they operate marketplaces to auction off totaled, damaged, or low value vehicles.

So IAA operates in a niche subset of the overall vehicle auction environment.

The stock was off 22% on Friday, what’s going on?

EBITDA guidance of $525-575m looks unexciting compared to $547m in 2021

This implies a pretty big margin headwind with revenue growing 14% from $1.83bn to $2.1bn in FY2022

Inflation is weighing in… from labor, to towing, mix of purchased vehicles vs. consignment sales, etc.

EPS was $2.39 in 2021 — down from COVID-impacted $1.54 in 2020 and $1.61 in 2019

IAA has since substantial multiple compression — from trading at >15x EBITDA to 10x or lower today, the multiple is starting to reflect a potentially slower growing business

Cash flow has been north of $300m each of the past 2 years — IAA made a $260m acquisition in 2021 and just kicked up a share repurchase program with $40m in buybacks

Here’s the full FY2021 highlights and FY2022 guidance:

At a now lower $36 share price x 135 shares outstanding = $4.86bn market cap. Net debt is $1.24bn as of 4Q21. That $6.1bn enterprise value would be ~11x EBITDA. Not insanely cheap but a hefty discount to competitor Copart ($CPRT) trading at 18x EBITDA. There’s likely some structural reasons for this discount as well but it could be worthwhile to monitor IAA from here.