Quick Value #218 - The Aaron's Company (AAN)

Another retail turnaround story at <0.5x TBV with 6.5% yield and positive FCF

Today we’re covering:

Lease-to-own retailer in recovering industry

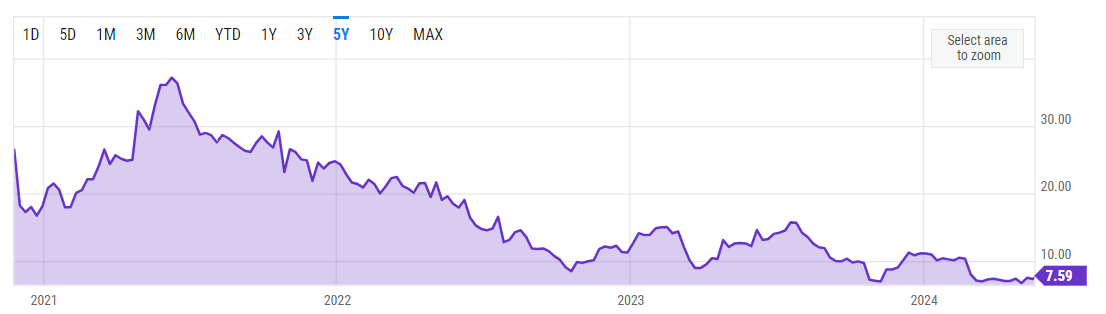

Shares down 68% over 5 years

Dividend yield at 6.5%

Low leverage at 1.5x net debt / EBITDA

Trades at 3.5x EBITDA, 10x FCF, 0.45x TBV on depressed fundamentals

Sign up below for access to all posts and monthly updates + occasional deep dives. Premium posts mostly cover “top of the pile” ideas that are either microcaps or special situations.

Market Performance

Market Stat

Quick Value

The Aaron’s Company (AAN)

I’ve been compiling a list of businesses catering to low income consumers that 1) benefitted tremendously from COVID-era stimulus; 2) have been experiencing a slowdown as those benefits unwind; and 3) look poised for a recovery sometime in 2024-2025.

What they do…

Aaron’s is a lease-to-own (LTO) retailer selling furniture, electronics, appliances, and other home goods to a primarily low-income consumer base.

They operate 3 brands — Aaron’s (1243 stores), BrandsMart (11 stores), and Woodhaven (furniture manufacturing division).

The typical Aaron’s store acts as a combo warehouse/showroom with an average 6,000 to 15,000 square feet per location. BrandsMart are larger, high volume stores with an average 96,000 square feet per location. For context, those BrandsMart stores are huge… CONN/BIG have average stores at 25-50k square feet and 33k square feet each.

Timeline of other events:

November 2020 — Aaron’s spun off PROG Holdings (PRG), a third-party financing provider partnering with other retailers.

April 2022 — Aaron’s acquired BrandsMart and their 10 stores in Florida/Georgia for $230m… the acquisition was underwritten with BrandsMart 2021 revenue at $757m while this segment did $604m in 2023. This was a bad acquisition near the peak.

Why it’s interesting…

Industry and business bottoming

Multiyear strategic plan

Valuation

1) Industry and business turn

Calling the cycle inflection is likely to be a challenge, but maybe the industry is already there?

First, a glimpse at YoY revenue growth since 2021 shows 8 quarters of very challenging revenue declines from 1Q22 to 1Q24 (note the positive growth from AAN 2Q22-1Q23 was from the BrandsMart acquisition).

But we’re seeing signs of life… Upbound (rent a center) posted 2 quarters of growth and Aaron’s is on the cusp of it.

Next, a key driver of future revenue growth at Aaron’s is the size of their lease portfolio (merchandise currently on lease to customers)… that portfolio declined at a slower rate in 1Q24 ( down 4.8% YoY vs. down 7-8% in previous quarters) with trends continuing to improve into April.

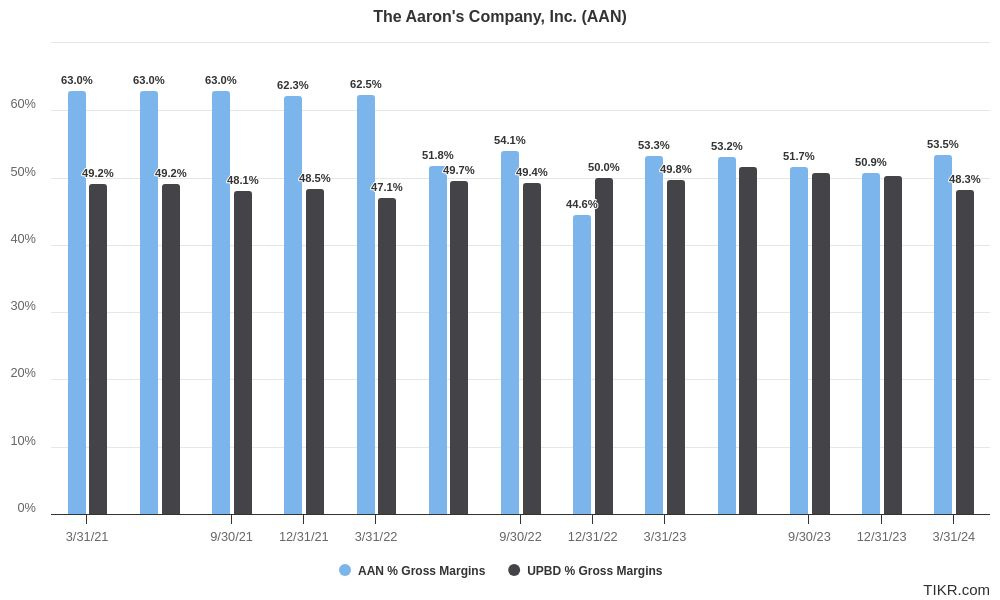

Third, gross margins look stable. And there’s a lot of operating leverage in this business with a large fixed cost base of retail stores, warehouses, and overhead personnel. At 50%+ gross margins, the flow through to net income / FCF should be significant with relatively minimal revenue growth (speaking mainly to the Aaron’s segment here).

Gross margins are stable for 8 quarters now:

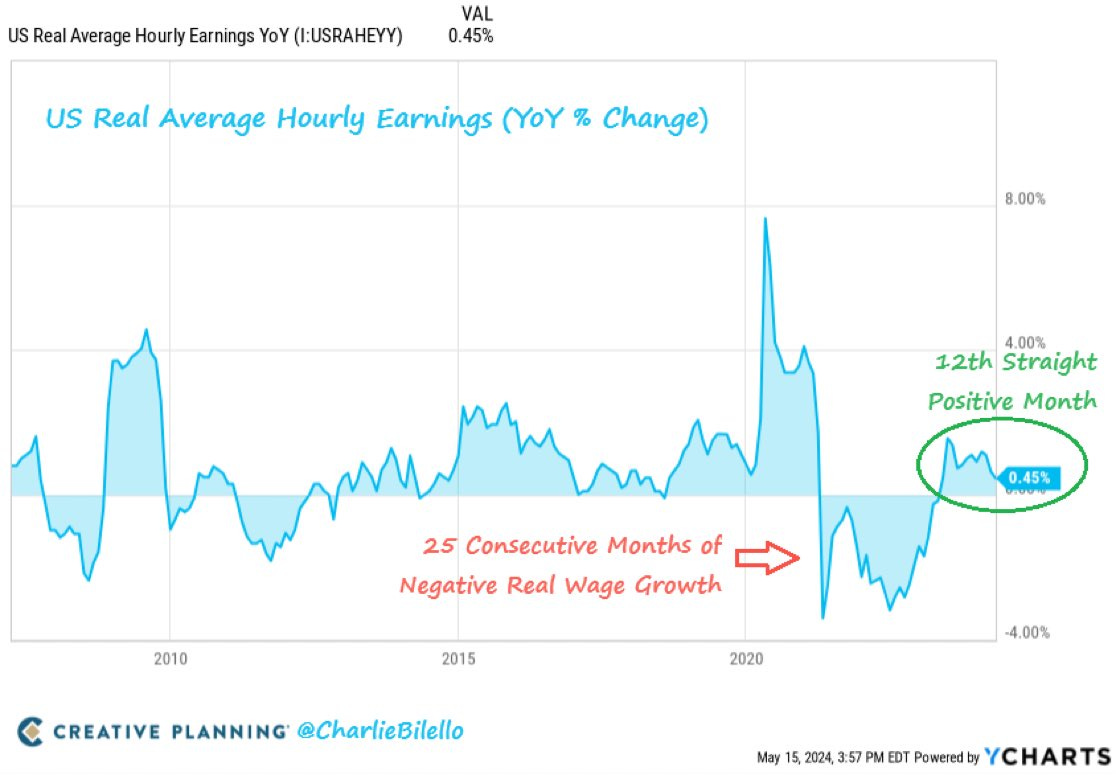

Finally, wages are growing faster than inflation while the personal savings rate is stable.

2) Multiyear plan

At the time of spin, management (still in place) laid out a 5-year plan which involved:

Closing a large chunk of stores to rationalize their footprint (i.e. consolidate 2 nearby locations down to 1)

Grow ecommerce

Selectively convert existing stores to a new “GenNext” concept

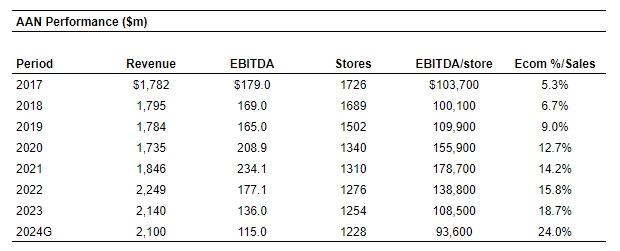

From the chart below, we can see the plan is working with 500 net store closures since 2017 and ecommerce up to 24% of lease revenues. Arguably, the revenue and EBITDA per Aaron’s store is much higher than the chart indicates; the 2022-2024 period includes a big portion of BrandsMart revenue with minimal EBITDA.

3) Valuation

Since 2021, EBITDA is down from $230m+ to $115m and the balance sheet went from net cash to ~$170m net debt. Shares responded by falling from $30+ to below $8.

Even with today’s depressed fundamentals, shares are trading at 3.5x EBITDA, 10x FCF, and 0.45x TBV.

Summing it up…

Management is the main question mark for me… this is the same team that spent $230m on BrandsMart which is expected to contribute $7-12m 2024 EBITDA (i.e. a >20x multiple for a <2% EBITDA margin business). I’m really struggling to see how BrandsMart fits with the existing business. There haven’t been many insider purchases either.

As for the core Aaron’s business, much like the rest of the industry, it sounds as though a recovery is on the way. EBITDA estimates for 2025 might already reflect that somewhat ($141m vs. $115m in 2024), but my guess is the operating leverage could be more significant.

But what are shares worth?

Net debt is $172m at 1Q24 but FCF was an outflow of ~$32m in Q1 with ~$20m expected for the year, less the $15m dividend payments = $135m yearend net debt. At 3.5x the upper end of EBITDA guide ($120m) = $420m EV. That works out to $285m equity value or $9.30/share (using 30.625m share count). Not a ton of upside but perhaps fairly conservative too.

The dividend works out to $0.50/share annually which is good for a 6.5% yield while riding out the recovery…

Clearly more to unpack and a more thorough comparison to Upbound/Rent-A-Center is warranted. Operating leverage and leases can cut both ways so another year of heavy sales declines could be very threatening.