Quick Value #220 - Denny's Corp (DENN)

Franchisor at 10x FCF with big buyback plans

Today we’re covering:

Another restaurant stock — 96% franchised

Shares down 65% over the past 5 years

Shares are cheap — 7.3x EBITDA and less than 10x FCF

Heavy buybacks — share count down 48% since 2010 (5.5% CAGR)

Since beginning our share repurchase program in late 2010, we have allocated over $700 million to repurchase approximately 67 million shares

Sign up below for access to all posts and monthly updates + occasional deep dives. Premium posts mostly cover “top of the pile” ideas that are either microcaps or special situations.

Market Performance

Quick Value

Denny’s Corporation (DENN)

I’ve been on a bit of a restaurant kick lately and even took a “research trip” to a fast food chain for last week’s post. This one stood out as incredibly cheap on a sector screen, so I thought I’d take a closer look…

What they do…

Denny’s owns and operates the Denny’s brand and Keke’s Breakfast Cafe brand. At yearend 2023, they had 1,631 restaurants — 1,558 franchised/licensed restaurants and 73 company operated.

Some notes on the business:

Core Denny’s brand is a “local diner” concept open 24/7 in most locations

Sales are split between 4 dayparts — breakfast (27%), lunch (36%), dinner (21%), and late night (16%)

96% of Denny’s locations are franchise-owned (86% for Keke’s) and royalty rates are ~4.4% of gross sales

Keke’s, acquired in 2022 for $82.5m, is a smaller breakfast concept only in Florida

Average unit volumes are >$3m per Denny’s location and $1.8m per Keke’s location (although unit margins are lower than fast food counterparts)

Despite being a franchise-heavy business, they still get ~47% of revenue from company-owned locations

Why it’s interesting…

Franchise-heavy business

Valuation hitting new lows

Buybacks

1) Franchise-heavy business

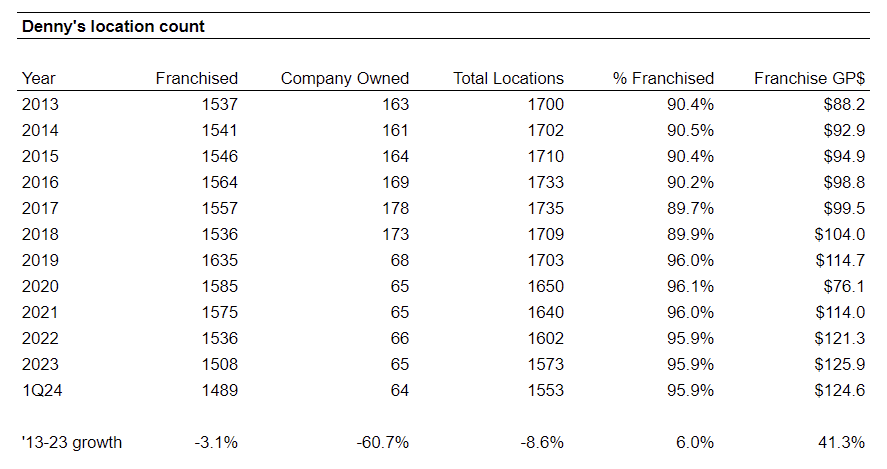

In 2019, Denny’s moved from 90% franchised to 96% as they sold 100+ company-owned locations to franchisees.

Despite the total number of Denny’s locations declining by 147 (8.6%) since 2013, franchise gross profit hit a record high in 2023 at $126m.

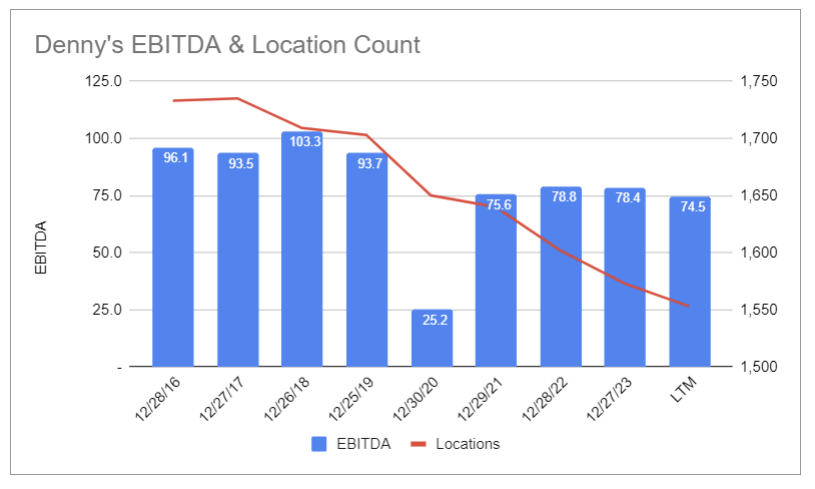

On a consolidated basis, the company isn’t back to pre-COVID levels of EBITDA ($96m average from 2016-2019) but revenue/EBITDA is recovering and generally stable ($76m average since 2021)…

Franchising is a good business when done right (asset light, recurring revenue, high margins, etc.), but they depend on profitable franchisee economics and either stable or growing unit counts.

The 2 charts above highlight the challenge in looking at restaurant stocks with large fluctuations in company-owned vs. franchise-owned units over long stretches.

That said, it looks like the core Denny’s brand is trying to find a bottom in optimal location mix. Management expects a net decline of 10-20 restaurants in 2024 despite plans to open 40-50 new locations (12-16 under the Keke’s brand and the remainder under the Denny’s brand).

2) Valuation

This is really fascinating, below is a before & after chart of:

P/E multiple (with median)

NTM EPS estimate (rolling 12-month)

Share count

BEFORE COVID (2014-2019)

POST-COVID (2021-2024)

So before COVID, this was a company steadily growing EPS and reducing share count while trading at 22x earnings or better.

Since then, EPS is choppy (though not declining), share count is still falling (excluding an issuance they did in 2020), and the stock trades at ~11x earnings. Amazing how quickly things can change.

Also, Denny’s is one of the cheaper restaurants in its peer group. (Note: this isn’t a fair representation of EV/EBITDA or leverage with lease treatment, but you get the picture.)

3) Buybacks

The charts above highlight the declining share count well enough… but to reinforce this management team’s view on shareholder returns — buybacks are significant and since 2016 they’d be running 10-20% of the current market cap.

Summing it up…

If I had confidence they could hold their unit count on the core Denny’s brand I’d be all over this one…

The stock went from an earnings grower at 20x to potential value trap territory (see charts above). And given the cost inflation headwinds (especially in California), this is probably the right price for the stock (7.3x EBITDA / 10x FCF).

I’m impressed with the EBITDA stability since 2021, but my guess is this likely eats into profit margins at the franchisee level. Also, the buyback pace is slowing ($20m annualized vs. $40-50m over the past 4 years).

Maybe the Keke’s brand will get them to net zero unit declines (or even positive), but that’ll require capital investment to accomplish.

This one’s worth watching… although if they stabilize the core brand, shares could easily be worth 25-50% more than today’s price.

Is Keke's like a First Watch? I've seen those restaurants but have never visited. May have to try it.