Quick Value #222 - Kennametal (KMT)

Cheap industrial (7.6x EBITDA) with low leverage (1.7x) and aiming for 20-25% EPS CAGR

Today’s idea:

Flat share price over 2 years (not a falling knife)

Manufacturer of components for heavy machinery

Reasonable valuation at 15x earnings, 7.6x EBITDA, 12.5x FCF

Growthy outlook — 4-6% sales CAGR / 20-25% EPS CAGR from FY23-27

Low leverage (1.7x) and capital allocation inflection (no M&A/buybacks since ‘14)

Sign up below for access to all posts and monthly updates + occasional deep dives. Premium posts mostly cover “top of the pile” ideas that are generally microcaps or special situations.

Market Performance

The performance spread between the S&P 500 (bigger stocks) and the Russell 2000 (smaller stocks) seems to be widening lately. I’m seeing more opportunities popping up lately…

Quick Value

Kennametal Inc (KMT)

It took me all of 30 seconds to add KMT to my watchlist…

Flat (but not a falling knife) chart over 5, 10, 15, 20 years? Check.

Reasonable valuation at less than 8x EBITDA, 13x FCF, and less than 2x leverage? Check.

Growthy outlook with 4-6% sales CAGR, 20-25% EPS CAGR, and >100% FCF conversion from FY23-27? Check.

What they do…

Kennametal is a manufacturer of tungsten carbide metal cutting tools and tooling used mainly in engineering, construction, energy, and industrial markets. Think drill bits used in heavy machinery.

Berkshire Hathaway bought Kennametal’s biggest competitor, Iscar, in 2006. Here’s how they described it in that year’s annual report:

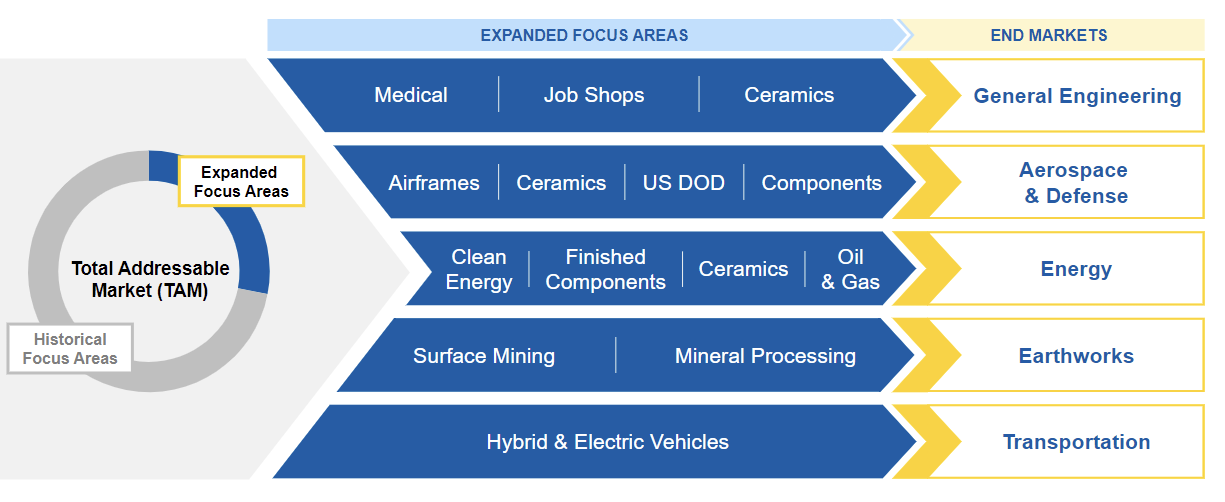

A few charts highlighting the business mix…

There’s a big international mix to Kennametal’s business too (>50% sales).

Why it’s interesting…

FY27 targets = substantial growth (maybe)

Shares are cheap relative to history and growth

1) FY27 targets

During their September 2023 investor day presentation, management laid out the following long-run targets from FY23-FY27… (the EPS CAGR caught my attention)

It was nearly a full year ago when these were presented and end markets took a dive since then, so I’m not sure how that’s impacting the end goal.

Let’s stick with EPS for a moment… a 20% CAGR from FY23-27 = a 2.07x total increase. FY23 earnings were $1.52 so we’re talking about $3.15/share as the FY27 target vs. a ~$24 stock. That would likely pencil out a nice IRR for the stock.

The question is whether these are still achievable.

Most of KMT’s end markets are declining in 2024 after a strong 2020-2023 recovery. From the Sep 2023 investor day to reporting fiscal Q3 results (3/31), they’ve lowered EPS guidance from $1.75-2.15 down to $1.40-1.55.

With the FY24 guidance reset, maybe we need to take $0.45/share off the long-run target of $3.15-3.70/share… assuming end market performance returns to normal in FY25-27 maybe the end goal is now $2.70-3.25/share? Still a nice CAGR from here…

2) Valuation & capital allocation

It feels like Kennametal has been running in place for years, if not decades (it’s a crazy flat long-term chart since the 1990’s). Shares look cheap, though in-line with long-run averages (15x earnings / 8x EBITDA). It’s more about the potential for market-beating earnings growth at a below market valuation that are intriguing here.

Free cash flow is starting to normalize too. After a period of heavy investment from 2016-2022 where they averaged $90m annual FCF, KMT produced $169m in 2023 and an estimated $150m in 2024 (~$1.90/share).

Capital allocation since 2014 or so has gone toward only the dividend (3.3% yield) and some modest deleveraging. There hasn’t been room for anything else. The last 2 years are bucking that trend and generating enough cash to pay the dividend and start a buyback program ($179m repurchased since FY22).

More cash should be coming over the next few years with buybacks and M&A as the leading outlets (aside from the dividend).

Summing it up…

KMT seems like a self-help story here… cyclical and currency headwinds be damned, they’re working to right size the cost structure of the business to produce cash flow. If their end markets picked up, that would add to the earnings growth story.

Maybe this company is on the cusp of a capital allocation inflection too?

The dividend consumes ~$65m per year and FCF averaged $90m from 2016-2022 which allowed no room for anything else. There hasn’t been an acquisition since 2014 and buybacks went 8 years before starting again in 2022… Hmm…

Would need to do a bit more work on the various end markets to understand what’s going on… China slowdown likely hampering the earthmoving business and energy producers are more focused on production than exploration… on the other hand, currency should be less of a headwind and capital allocation should help (if deployed properly). It would seem the Inflation Reduction Act should help this business too.

Worth adding to your watchlist.

Wish they would just commit to the shareholder returns. Why do they think they have an edge when it comes to M+A. They’ll get best by the PE shops all day long. Focus inwards, improve sales and margin, pay your owners! Easy!