Quick Value 2.22.21 ($CVX)

Chevron ($CVX) - Warren Buffett just bought $4bn of this oil major

Market Performance

Market Stats

The 7.4% year-over-year growth in retail sales in January 2021 was some of the best growth we’ve seen in years — since 2011 specifically.

Probably a big reason for the optimistic GDP forecasts for 2021 — CBO predicts 3.7% GDP growth for the year while other wall street banks are predicting GDP growth at even higher rates…

Quick Value

Chevron Corp ($CVX)

Wrapping up a series on energy names with one of the big dogs. Warren Buffett’s Berkshire Hathaway purchased $4bn worth of CVX in the past quarter. And similar to the past 3 Quick Value names, Chevron recently completed a large acquisition — acquired Noble Energy for $5bn.

Starting with some of the basics:

CVX — $96 per share

Shares — 1.925bn

Market cap — $185bn

Net debt — $39bn

Chevron is an integrated oil company doing everything from drilling and producing oil, refining oil products, and operating a network of gas stations.

There are 3 major things to point out in the “what’s going on with Chevron right now.”

Cash flow has dried up thanks to oil price declines — from

Capital expenditures have dropped on par with operating cash flow

Dividend commitment has increased during this time

A 10-year cash flow statement tells the story fairly well… Operating cash flow from $40bn per year to $10bn per year and capex as high as $38bn down to $9bn. All while the dividend has grown to $9.7bn per year.

That dividend makes for a ~5.5% yield at today’s price. Management argues the dividend breakeven level is $55/bbl oil price — roughly where current prices stand.

Chevron likely owns some assets that are less sensitive to oil prices such as the gas stations and refineries. It appears there’s a mix of self-help to owning this stock as well as a general bet on oil prices increasing…

Here’s what the company is currently working on… Plenty of cost reductions, maintaining the debt level, and boosting free cash flow by 2x in the next 5 years.

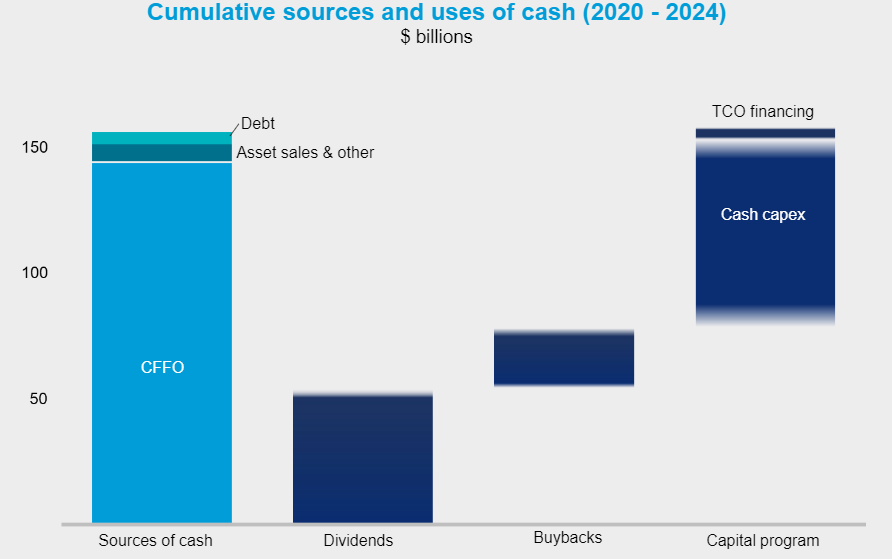

Looks like they anticipate a big jump in operating cash flow under the current oil price environment (compared to 2020 at least), maintaining the dividend near current levels, adding in some share buybacks, and keeping a lid on capex.

Nothing dramatic but shares could be rewarded if they execute. Although it’s still heavily dependent on oils prices which are largely out of their control.