Quick Value 2.22.22 ($LUMN)

Lumen Technologies ($LUMN) - big selloff on weak 2022 guidance; may be a good time to take a look

Thanks for sticking with me on the rain delay this week… We welcomed our 2nd child recently and it’s been slow to catch up!

Be sure to check out the new website here and sign up if you haven’t already!

Market Performance

Market Stats

Some stats on retail sales…

Retail sales still growing — at a double digit YoY pace in January 2022 vs. January 2021

Consumers spending ~70% of wages/salaries — above multi-year highs

Housing related spending has ballooned more than most categories from ~$500bn pre-pandemic to a recent ~$675bn

Quick Value

Lumen Technologies ($LUMN)

Every value investor gets drawn into looking at this one every once in a while. Lumen is the former CenturyLink / Level 3 Communications which merged in 2017. Back then, they were targeting pro-forma EBITDA of ~$11bn and a $2.16/sh dividend — today, EBITDA is $8.4bn and the dividend has been cut to $1/sh.

Lumen offers voice and broadband services to business and residential customers. Mostly businesses at 72% of 4Q21 sales. It’s pretty widely known that the copper wire portion of the voice/internet business is in decline. Growth portions of the business have not (yet?) lifted the whole boat here.

Here are some quick bullets on this one:

The stock took a dive from $12-13/sh down below $10 after reporting weak 2022 guidance — this was how it made it back on my to-do pile

Lumen announced a pair of transactions for $7.5bn and $2.7bn to sell a portion of the ILEC business and LatAm assets for 5.5x and 9x EBITDA — another reason I added Lumen to my to-do pile

Leverage is expected to remain unchanged at ~3.6x debt/EBITDA following the asset sales

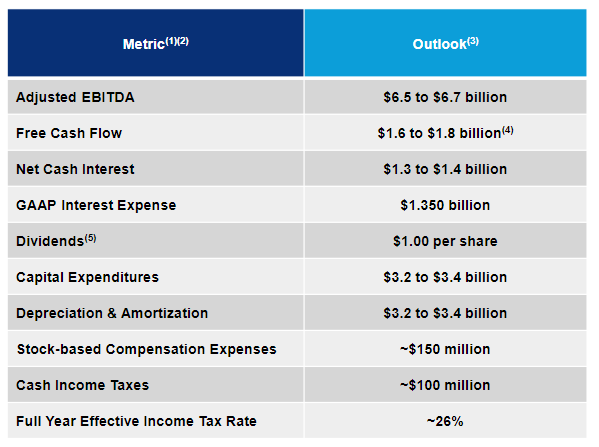

2022 guidance includes half-year portion of the planned divestitures — ~$0.85bn EBITDA

With management turning up the capex spend to try and turn around the growth picture, analysts are questioning whether the $1/sh dividend can be adequately covered at $1bn per year — 2022 guidance implies just north of $1bn in FCF following the asset sales mid-year

On the capital allocation front — management continues to reiterate the dividend as a top priority (at $1bn per year) with the next objective as bringing debt down to 2.75-3.25x leverage (which may be a few years away still)

With ~1bn shares outstanding, LUMN is a $10bn market cap around $10/sh — with the pending asset sales, net debt could be close to $18bn for an enterprise value of $28bn or so

2022 EBITDA excluding the sold businesses looks more like $5.6-5.7bn which puts the stock at <5x EV/EBITDA

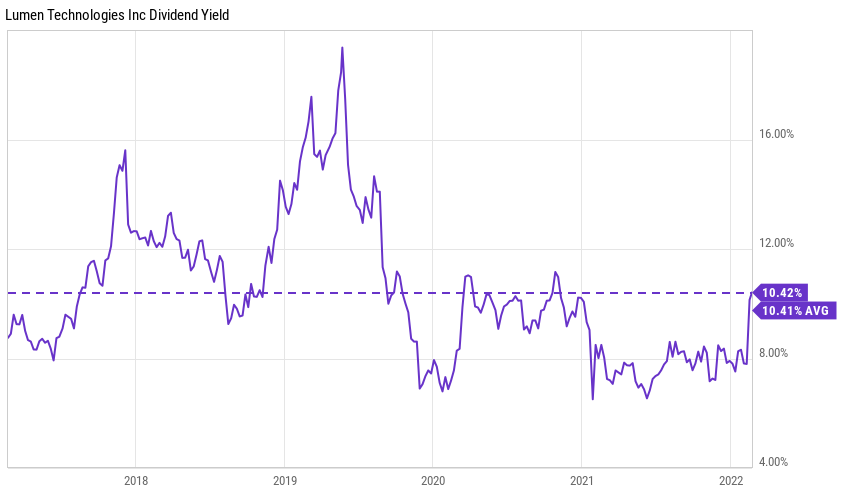

The dividend yield at 10%+ may indicate a dividend cut is on the way but that yield is actually right in-line with the 5yr average