Quick Value #224 - Sunrise Realty (SUNS)

CRE spin-off coming July 9th

Today’s idea:

CRE finance spin-off

Large cash balance at $67m

Clean balance sheet with $115m assets and no debt

Positive net income and large potential earnings power

Sign up below for access to all posts and monthly updates + occasional deep dives. Premium posts mostly cover “top of the pile” ideas that are generally microcaps or special situations.

Market Performance

Quick Value

Sunrise Realty (SUNS)

What they do…

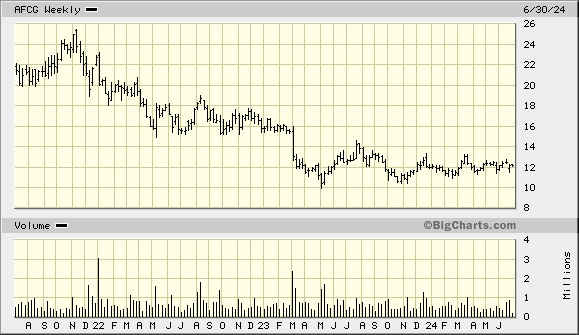

Sunrise Realty is an upcoming spin-off from AFC Gamma (AFCG).

SpinCo is a CRE finance business starting out with 2 loans and $115m in total assets. RemainCo will continue operating their cannabis lending business. Both are externally managed by Leonard Tannenbaum’s firm, SRT.

How SUNS describes their model:

SUNS’ focus is on originating CRE debt investments and providing capital to high-quality borrowers and sponsors with transitional business plans collateralized by CRE assets with opportunities for near-term value creation, as well as recapitalization opportunities. SUNS intends to create a diversified investment portfolio, targeting investments in senior mortgage loans, mezzanine loans, whole loans, B-notes, CMBS and debt-like preferred equity securities across CRE asset classes.

Sunrise will start with 2 loans on the balance sheet at a $46m carrying value yielding ~16%. There’s an LOI out for another loan that hasn’t closed yet.

Total assets (and equity) will be $115m at the time of spin in some combination of cash and loans. Management highlighted a pipeline of $815m in lending opportunities but no framework or financial model for the company (i.e. overall targeted leverage, ideal loan portfolio, size, etc.).

Pro-forma earnings are $2.3m with the external management fee included and an assumption around yield on cash. There are another $0.9m public company costs + other G&A not included in that, so call it $1.4m run-rate net income per quarter with the existing portfolio ($5.6m annualized).

Why it’s interesting…

Small and likely overlooked

Solid balance sheet

Earnings potential

AFC Gamma is a $250m market cap and Sunrise will get a ~third of the existing equity and a quarter of the total assets in the spin. So this will be a small one. Pre-spin, AFC Gamma has book value at $310m and trades at 0.8x P/B. That same multiple would equate to a $92m market cap for Sunrise.

But Sunrise will be spun off with virtually no liabilities and a big slug of cash to deploy ($67m for now, but the final amount depends on whether they close on a loan prior to the spin). Maybe that deserves to trade closer to 1x book? At the same time it’s a highly concentrated portfolio of assets and probably will stay that way.

Based on 6.9m shares outstanding, tangible book value is $16/share.

What could potential earnings be?

Let’s say they lever up the $115m equity 2:1 and deploy $230m into CRE loans yielding a similar 16%. Call that $36m in annual interest income. With $115m financed at 8% = $9.2m interest expense. Throw in $6-7m for SG&A including the management fee and we get $20m or so annual earnings or $2.90/share on 6.9m shares outstanding. Probably need to incorporate some loan loss provisions in there too. G&A might creep higher by then, but it’s a starting point.

The external management situation is a bit squishy here. Both CRE loans at Sunrise were syndicated from the manager, SRT, who also participated in both loans. Their incentive fee has a low hurdle based on run-rate earnings, so G&A could ramp fairly quickly.

Summing it up…

This is an interesting little special situation. Maybe there’s an opportunity for a mispricing. AFCG is already trading slightly below CRE finance peers at 0.8x book and a ~16% dividend yield. But the balance sheet is in good shape (low assets/equity ratio).

Sunrise will have a great balance sheet to work with but it’s small and the track record untested…

Hmm…

Did you end up buying into this? Insiders buying aggressively last week around $11-12