Quick Value #226 - Bloomin' Brands (BLMN)

Cheap restaurant stock with activist pushing for changes (and getting them)

Welcome to Quick Value

Every few weeks I’ll repost this reminder on what Quick Value is all about… Each week I’ll cover a new value investment idea in a Quick Value review. Here’s the scoop:

Idea generation — The goal is to keep the new idea process churning by working the watchlist. These are meant to be a jumping off point for deeper research (i.e. a surface level review).

Format — I stick to a format similar to Steinhardt’s 4 questions: what they do, why it’s interesting, and what it’s worth. [Technically, Steinhardt’s were: the idea, consensus view, variant perception, and catalyst.]

Weekly posts — Covers 1 new idea each week and rotates between free and premium posts. Premium posts lean toward micro/small caps and special sits.

Coverage focus — You’ll see lots of special situations (including virtually every spin-off) and an emphasis on small caps.

Past ideas — Check out past ideas here to get a feel for what’s been covered.

Today’s idea:

Beaten up restaurant stock (again)

Rapid sell-off since March (down ~40%)

Activist with 10% stake pushing for changes

Shares are cheap at 7x earnings / <5x EBITDA

Sign up below for access to all posts and monthly updates + occasional deep dives. Premium posts mostly cover “top of the pile” ideas that are generally microcaps or special situations.

Market Performance

Quick Value

Bloomin’ Brands (BLMN)

What they do…

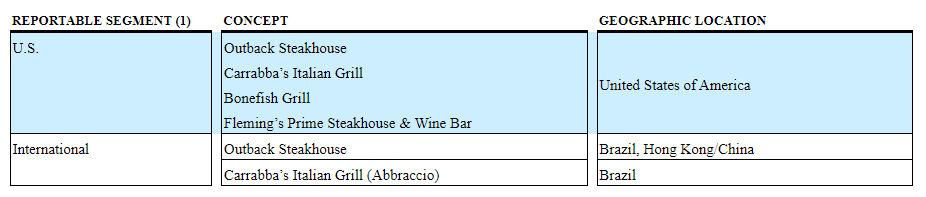

Bloomin operates a group of sit-down, casual dining restaurant chains like Outback Steakhouse, Carrabba’s Italian Grill, Bonefish Grill, and Fleming’s Steakhouse. As of 1Q24, they own and operate 1,162 restaurants and franchise another 289 restaurants across 46 states and 13 countries.

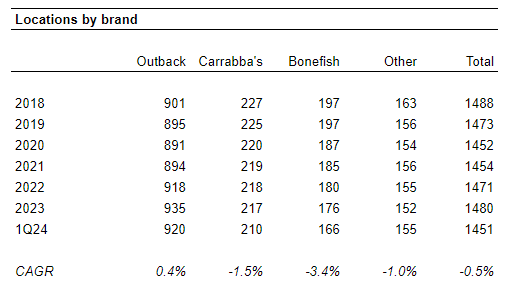

Outback is the largest brand with 920 locations out of 1,451 total (63.4%) and it’s the only brand that has seen location count growth over the past 6 years (though this is a bit misleading since domestic locations are down from 733 to 669 while international is growing).

Why it’s interesting…

Another beaten up restaurant stock

Activist situation

Buybacks & capital allocation

1) Beaten up restauranteur

The 3-year chart and YTD chart paint very different pictures. Shares were basically flat from March 2021 to March 2024 ($25-29/share), but since March 2024, shares are down nearly 40%.

Why?

A few reasons I can think of… after a strong post-COVID run, traffic is declining at every brand, inflation is catching up on the cost side, consumers are balking at restaurant price increases (look at inflation rates for “food away from home” below), and competition is ramping.

2) Activist situation

Starboard Value, with a ~10% stake in Bloomin, laid out their case for the stock in an October 2023 presentation and then in January 2024, Bloomin added 2 board members in an agreement with Starboard.

It’s a pretty simple thesis…

There’s a big valuation and performance gap between BLMN and peers like DRI/TXRH

Tons of opportunity for operational improvements — margins at BLMN are below peers

Improve capital allocation

Since Starboard joined the board, they’ve executed an accelerated share repurchase program and announced a strategic review for their Brazil operations (159 company owned locations).

3) Buybacks & capital allocation

Do any accelerated share repurchases go well? If you’ve got that much excess capital, just buyback your shares over time and enjoy the flexibility!

Bloomin executed a $220m ASR on March 1, 2024 (remember from earlier that shares started to nosedive around March 8th). That ASR program was done at ~$27/share vs. a current share price <$18.

They still have $130m remaining on the buyback authorization but didn’t mention how aggressive they’ll be following the ASR.

The dividend runs ~$83m a year for a 5.3% yield too.

Capex is a bit elevated too as they open new restaurants (40-45 in 2024). Average annual capex was ~$220m pre-COVID (2016-2019) vs. $324m in 2023 and an expected $270-290m in 2024-2025.

Summing it up…

Bloomin is on the cheaper side of the restaurant industry (note these EV/EBITDA multiples include leases in EV calculation).

In hindsight, the ASR was a bone-headed move as they levered up to execute that buyback. There’s still really low leverage but they’re opening new locations at a time of intense industry headwinds… still, shares probably don’t deserve to be this cheap. With their CEO retiring and the Brazil business up for sale, it could be an interesting one to watch…

If you made it this far and enjoyed the post, here’s 20% off the full membership — grab it in time for the 2Q24 portfolio review!

Enjoyed this format, keep them coming! Thanks for making the audio version