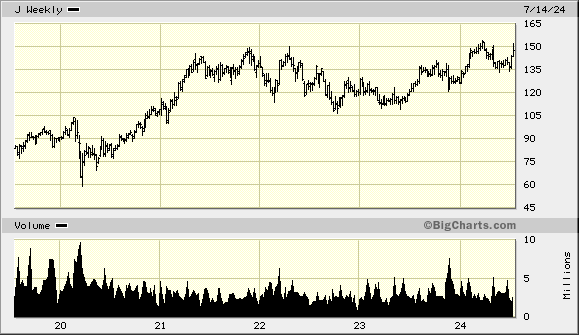

Quick Value #228 - Jacobs Solutions (J)

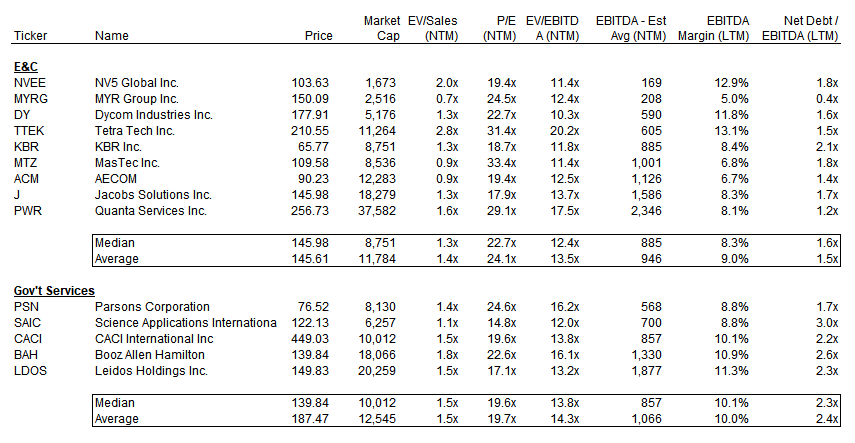

Spin/Merge creates #2 Government services player

Today’s idea:

RemainCo is professional services to E&C industry

SpinCo levered 3.8x / RemainCo virtually debt free

Shares trade at >20x FCF / ~14x EBITDA (reflects business quality)

Spin creates #2 player in Government services (comp to LDOS, SAIC, CACI, BAH)

Sign up below for access to all posts and monthly updates + occasional deep dives. Premium posts mostly cover “top of the pile” ideas that are generally microcaps or special situations.

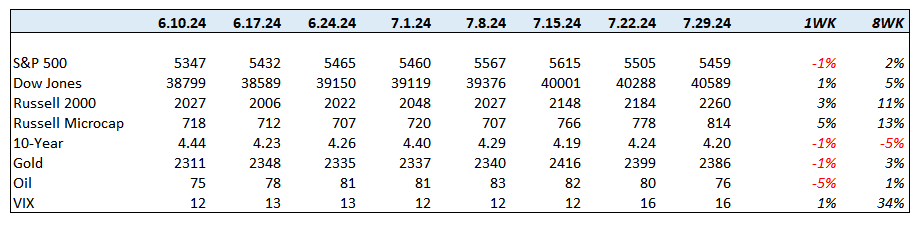

Market Performance

Quick Value

Jacobs Solutions (J)

In November 2023, Jacobs announced they were doing a spin/merge (Reverse Morris Trust) of their Government services business with private company Amentum to create a $13bn revenue pure-play Government services provider.

What they do…

This was formerly known as Jacobs Engineering but they’ve really transformed the business over the past 7-8 years. There are 4 segments today:

Critical Mission Solutions (CMS) — Government services to DoD, NASA, DoE, and nuclear agencies.

People & Places Solutions (P&PS) — Consulting, planning, architecture, design, engineering, project management, etc. for infrastructure projects, transportation, manufacturing.

Divergent Solutions (DVS) — Digital offerings like cloud, cyber, data analytics, etc.

PA Consulting (PA) — Consulting services to commercial and private sector clients. Jacobs owns a 65% stake in PA Consulting.

This is a really early look at the spin since we just got the Form 10 filing and haven’t seen specifics on forward guidance or balance sheets. Once completed, Jacobs will split into: 1) a pure-play Government services contractor similar to Leidos, Booz Allen, etc.; and 2) a leading E&C professional services firm.

The spin (actually a Reverse Morris Trust) is structured as follows:

SpinCo

This spin-off makes a ton of sense…

Government service providers have all performed extremely well for years and trade at big multiples of earnings and EBITDA right now. Jacobs clearly wants to capitalize on that. And by merging a clean balance sheet in their CMS business with a levered (but larger) Amentum, they’re creating one of the largest players in the space with modest debt.

Combined, this will be a $13bn revenue / $1bn+ EBITDA company. SpinCo will jump to the #2 industry position in terms of revenue and have a huge backlog of contracted revenue (3.7x coverage), but they’ll have the highest industry leverage by a mile (3.8x). For those interested in owning the space, maybe this will be a chance to get in on the cheap?

Amentum is PE-backed and took its current form after a $2.4bn acquisition of AECOM’s management services business in early 2020 (that deal was done at a reported 11.6x EBITDA multiple).

The CMS business and Amentum have minimal contract overlap so revenue is well diversified. It looks like they have a valuable nuclear business in partnership with BWXT as well. “In 2021, Amentum, in a joint venture with BWX Technologies and Fluor, was awarded a 10-year, $21 billion single-award IDIQ contract to lead the Savannah River Site Integrated Mission Completion Contract.”

Most contracts are cost-plus-fee (>60% of the combined business) with fixed-price and time-and-materials contracts rounding out the rest. Looks more like BAH/CACI and less like LDOS.

Combined EBITDA margins are in the 7-8% range (jumping to >8% after $50-70m cost synergies). Top performing peers are achieving >10% EBITDA margins and it isn’t clear whether that’s a target for SpinCo. Maybe we’ll find out during their investor day?

What could shares be worth?

There are puts and takes making this interesting…

Leverage is high — $4.2bn on ~$1.1bn EBITDA (after synergies) = 3.8x, but it’s really closer to 4x out of the gate

Combined sales and EBITDA CAGR since 2021 is 9-10%, which would put this at-or-near the top of peer group performance

Backlog is one of the biggest at 3.7x annual revenue

Contract concentration is low — no single contract makes up 5% or more of EBITDA

Capital allocation — likely constrained to repay debt for a few years unless substantial EBITDA growth continues

Giving them full credit for the fully synergized $1.1bn EBITDA and using a 12x EBITDA = $13.2bn enterprise value. Backing out $4.2bn net debt = $9bn equity value. Only 55% of that will go to Jacobs shareholders from the RMT so call it ~$5bn or $39.50/share. Much of the valuation depends on your view of future growth.

RemainCo

Post-spin, RemainCo is a professional services firm in the engineering & construction space. Think of this as front-end services like consulting, planning, design, architecture, etc. as opposed to the physical construction work.

Margins will improve significantly to 13-14% as they shed the lower margin Government business (7-8% margins) and Jacobs holds market leading positions in most areas they serve.

On a standalone basis, this is a $7.8bn revenue / $971m EBITDA business in FY23 with an eye to mid-teens margins (13-14%) in the short-term and eventually “Accenture-like” margins (~15-16%).

The balance sheet is pretty interesting here… call it $1bn cash and $3bn debt for $2bn net debt pre-spin. But they’ll get a $1bn dividend from the spin and retain a 7-8% stake in the spin-off. That stake could easily be worth another $500m to $1bn so let’s call it roughly zero net debt.

At 14x EBITDA (where the stock currently trades) = $13.6bn enterprise value and market cap or ~$109/share (125.2m shares).

What’s the outlook for RemainCo?

E&C firms have plenty of tailwinds at the moment with the IRA bill, chips act, regulatory changes, etc. (probably a big factor in elevated industry valuations). There’s also a mountain of aging infrastructure that needs replacement.

Summing it up…

It’s early for this idea so probably worth parking it on your watchlist until we get closer to the spin date. Also, shares are pretty expensive and naturally I’m anchored to where E&C companies were trading post-GFC / pre-COVID (7-8x EBITDA).

Just for fun, here are some hypothetical valuation scenarios anchoring on SpinCo as a starting point…

Government services are trading at 12-16x EBITDA but I’m looking at SAIC with <9% margins and 3x leverage as the best comp for SpinCo out of the gate; so let’s stick with a 12x multiple on $1.04bn.

If they grow EBITDA at a 5-9% CAGR from 2025-2027 and repay some debt, then perhaps you’ll get a mid-teens IRR from a 12x EBITDA starting point.

As for RemainCo… I’m likely underestimating the quality of this business, but 13-15x EBITDA doesn’t get me all that excited for a business tied to cyclical non-resi construction markets. Even if they’ll have a great balance sheet and plenty of room to deploy cash, it doesn’t look like much room for error.

Maybe SpinCo takes an initial hit from its high leverage and small relative size to pre-spin Jacobs? That could make it interesting… we’ll have to wait…