Quick Value #230 - Zoom Video Communications (ZM)

Mountain of cash (>40% of market cap) and trading at 15x FCF (ex-SBC)

Today’s ideas:

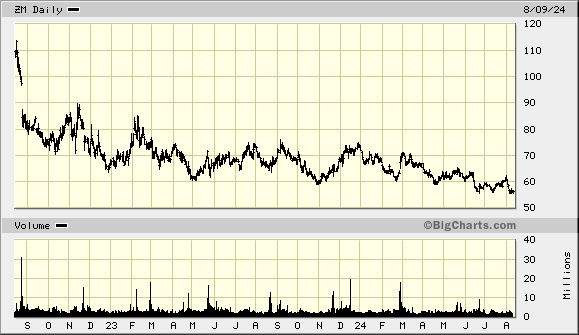

COVID-era darling down 90% from highs

Huge net cash position (>40% of market cap)

Trades at 15x FCF ex-cash (includes stock-comp)

Starting to buyback shares ($1.5bn authorization) + M&A

Sign up below for access to all posts and monthly updates + occasional deep dives. Premium posts mostly cover “top of the pile” ideas that are generally microcaps or special situations.

Market Performance

Quick Value

This was a COVID-era darling and is down ~90% from COVID highs (>$550/share to ~$56). Surprisingly, fundamentals have held up well and the stock might be in value territory with a decent growth profile.

What they do…

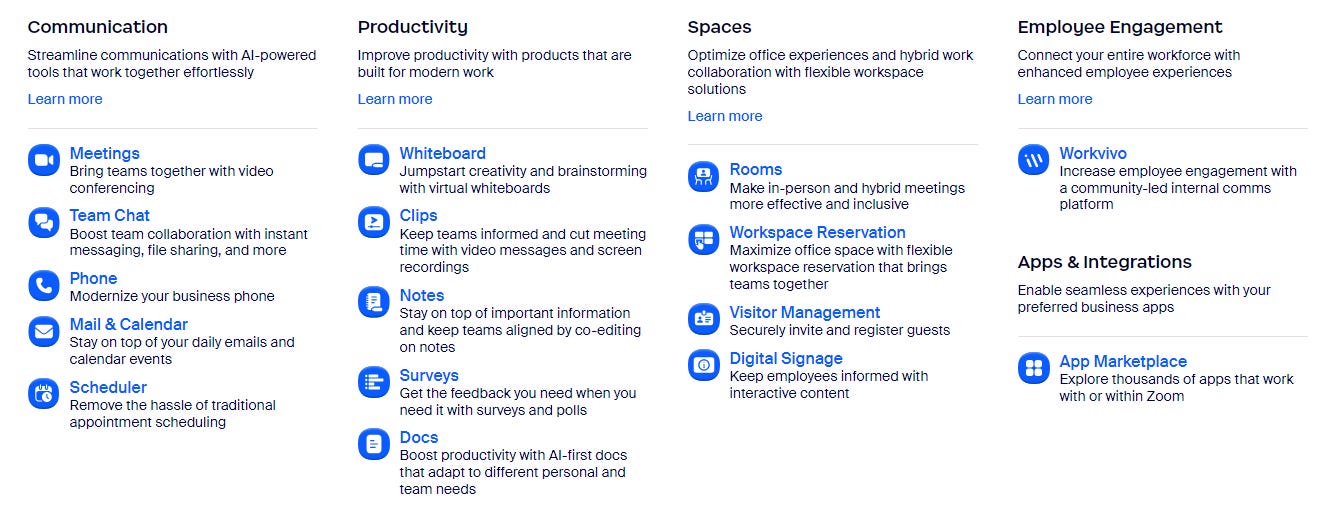

Zoom should be fairly well-known by now, Zoom Meetings are practically ubiquitous at this point. The company is building a “suite of apps” in the communications space (similar to bundled products by Zoho, Microsoft, Google Workspace, etc.). Check out their website to see various products and pricing; generally, it’s a more robust set of products than competitors with comparable prices.

From their November 2022 investor day presentation, phone and collaboration (i.e. meetings) were the primary markets served ($34bn TAM), but they’ve expanded into new markets via internally created product offerings. Contact center, webinars/events, sales products, etc.

Enterprise customers account for >58% of revenue and churn is ~3% monthly. There’s a lot more to the offerings but the key point is that they’ve developed most products internally while new launches (i.e. Contact Center launched 2 years ago) are starting to chip in.

Why it’s interesting…

Critical mass + still growing

Mountain of cash = optionality

1) Growth profile

I find it really impressive that Zoom nearly 10x’d revenue from pre-COVID to today ($484m to $4.6bn) AND they continue to grow from that higher baseline, albeit at a slower rate of 2-3% YoY.

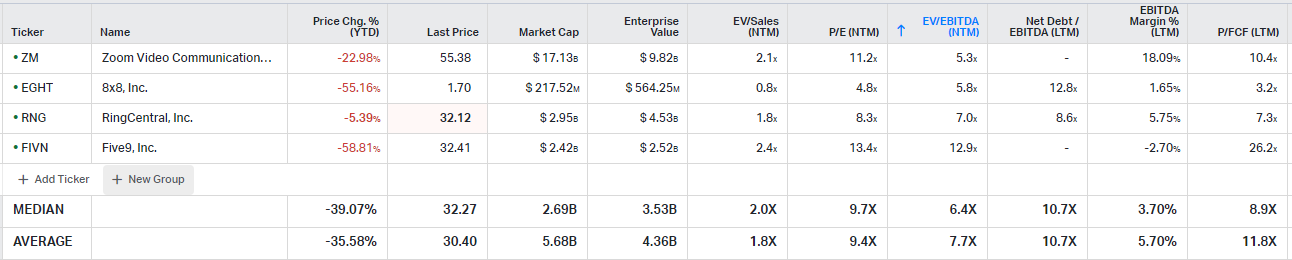

Below is a chart of TTM revenue for 2 competitors (RNG, FIVN) and another COVID-era darling (PTON). We can see that Zoom was on the smaller side in mid-2019 and is now substantially larger. They’ve continued to grow revenue YoY every quarter since.

Revenue is expected to grow 2% in FY25 to $4.615bn vs. $4.527bn in FY24. FCF guidance is ~$1.46bn in FY25 (vs. $1.47bn in FY24 and $1.2bn in FY23). Excluding stock-comp, I get $641m FY24 FCF ($2.01/share).

2) Capital allocation optionality

To date, capital allocation has been mostly a non-factor. Zoom achieved GAAP profitability years ago but they’ve allowed cash to pile up on the balance sheet.

There were a few savvy moves along the way — during the COVID run-up, they raised $2bn by issuing equity at $340/share and then repurchased $1bn in 2023 at ~$90/share. Since then, cash has grown and buybacks are trickling ($150m repurchased in 1Q25).

As of Q1, Zoom has >$24/share in net cash & investments.

Management says they’d like to make an acquisition but they’re waiting for the right deal to come along, including both fit and value.

Summing it up…

At what price does this get really interesting? I’m not entirely sure but it might be close.

At $56/share, you have a business growing top-line 2-3% annually with ~$2/share in cash earnings and $24/share in net cash.

It’s a stable and profitable business with a lower growth profile than most software investors would prefer, maybe that’s the opportunity. Perhaps there’s some disruption risk with AI and contact center customers? Other communications-focused software providers are looking cheap as well. Note these figures are “adjusted” and include SBC.

A big part of the valuation comes down to stock-comp treatment too. I’ve included it to try and get a cleaner look at the valuation but maybe this is the right price for a business with ~half the market cap in cash and $2/share of earnings? I’d be interested in this at a price closer to 10x FCF + net cash (call it $20/share for the slow-growth operating business and $25/share for the cash pile). Remember, my estimates are excluding >$1bn annual SBC, so it’s considerably more conservative.

Hmm…