Quick Value #231 - Canadian Microcap

Cheap facilities management business at 5x EBITDA / <8x FCF

Welcome to Quick Value

Every few weeks I’ll repost this reminder on what Quick Value is all about… Each week I’ll cover a new value investment idea in a Quick Value review. Here’s the scoop:

Idea generation — The goal is to keep the new idea process churning by working the watchlist. These are meant to be a jumping off point for deeper research (i.e. a surface level review).

Format — I stick to a format similar to Steinhardt’s 4 questions: what they do, why it’s interesting, and what it’s worth. [Technically, Steinhardt’s were: the idea, consensus view, variant perception, and catalyst.]

Weekly posts — Covers 1 new idea each week and rotates between free and premium posts. Premium posts lean toward micro/small caps and special sits.

Coverage focus — You’ll see lots of special situations (including virtually every spin-off) and an emphasis on small caps.

Past ideas — Check out past ideas here to get a feel for what’s been covered.

Today’s ideas:

Canadian microcap in facilities management industry

Shares are trading at 5x EBITDA and 6x FCF with low leverage (1x)

Balanced capital allocation with M&A and shareholder returns (5.6% yield)

This week’s post is for paid subscribers, check back next week for a free edition of Quick Value. As a reminder, premium posts mostly cover “top of the pile” ideas that are generally microcaps or special situations.

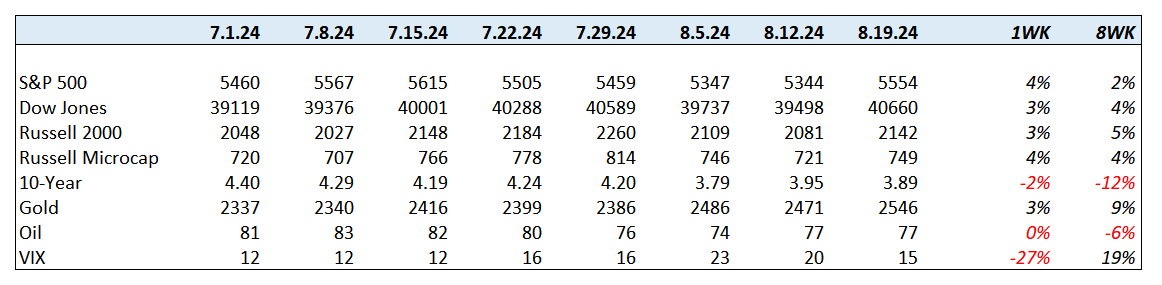

Market Performance