Quick Value #232 - Urban Outfitters (URBN)

Cheap mid-cap retailer (12x PE / 5x EBITDA) with 22% of market cap in net cash

Today’s idea:

Mid-cap apparel retailer

Trading at <12x P/E and 5x EBITDA

Huge net cash at 22% of market cap

High-growth brands compounding at 5.8% since 2013

Subscribe below for access to all Quick Value posts. As a reminder, premium posts mostly cover “top of the pile” ideas that are generally microcaps or special situations.

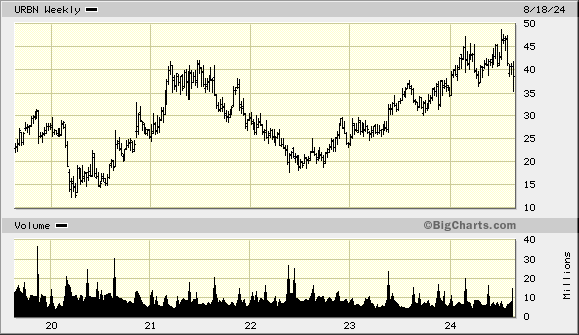

Market Performance

Quick Value

I try to keep track (loosely) on where I source ideas from and this one came from an unusual place… a Chartr newsletter highlighting underperformance at the Urban Outfitters brand which led me to take a closer look. Let’s see if there’s more going on here.

What they do…

URBN is a long-tenured (founded in 1970) apparel retailer with 3 primary brands (each founded in 1992 or earlier) and a few other offerings.

Urban Outfitters — 262 stores (179 in US), targeting 18-28 age demographic both men and women, primarily mall-based footprint with average store at 9,000sf.

Anthropologie — 237 stores (209 in US), targeting “sophisticated and contemporary” women ages 28-45; offerings include apparel, accessories, decor, furniture, etc.; located in specialty centers, upscale street locations, and malls with average store at 8,000sf.

Free People — 198 stores (183 in US), targeting women ages 25-30, most apparel offerings, smaller average stores at 2,000sf.

Most sales come from the direct-to-consumer channel via stores and websites ($4.68bn / 90.5% of FY24 sales). There’s a small wholesale offering ($255m / 5%) and even smaller subscription offering through their Nuuly segment ($236m / 4.5%).

Within the retail business, ~2/3 of sales come from the apparel category.

Why it’s interesting…

High growth brands

Capital allocation

Value

1) Growing brands

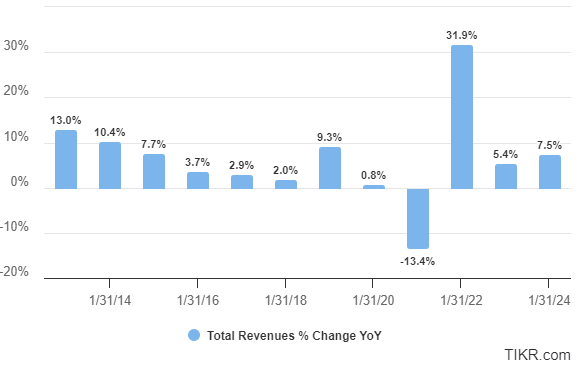

Anthropologie and Free People have long-term growth rates that most investors salivate over. Maybe they’re overshadowed by the declines at Urban Outfitters? UO is becoming less impactful to the overall company — it was ~48% of total sales in 2013 and now down to ~26% as of 1H25.

Over this 12.5-year stretch, total URBN sales have grown 5.8% annually with limited interruption during COVID.

2) Capital allocation

Despite opening >150 stores and growing top-line by 5% per year from FY15-24, URBN generates plenty of cash… more than $1.7bn cumulative FCF during that timeframe.

Growing retailers are typically less cash generative with new store capex demands and inventory growth. But URBN was able to convert ~88% of net income to FCF over the last 10 years (impressive).

What did they do with the cash?

Most of it went to buybacks… $1.85bn since FY15 (though 60% of that came in FY15-16). The rest is stockpiling in cash & investments on the balance sheet, now totaling >$8/share.

Maybe buybacks are set to pick up again…

From 2017-2022, URBN repurchased ~20m shares and then issued another 20m buyback authorization. They didn’t repurchase any shares in FY24 or 1Q25 and then bought back 1.2m for $52m in 2Q25. Hmm…

3) Valuation

Trailing EPS and EBITDA are $3.27 and $525m — at $39/share, it leaves the stock trading at <12x earnings and ~5x EBITDA with $770m net cash (~22% of current market cap).

Not only are shares inexpensive relative to history, but it’s also one of the cheaper retailers in the sector — median peer P/E is ~15x — despite being a top tier revenue grower. Hmm…

Summing it up…

What intrigues me most about this company is the combination of insider (founder) ownership, slow-and-controlled growth, shareholder-friendly management, and an attractive valuation (based on GAAP results too!).

It seems to check a lot of boxes.

While fashion is generally hard to predict, ultra competitive, etc.; this company and these brands have been successfully growing for decades. Hard to call them a fad or flash in the pan.

What could shares be worth?

Simplistically, we could call it 14-15x trailing EPS ($3.27) for a $46-49 target price. But most competitors aren’t growing at this rate and don’t have this big a cash position. Peers AEO/ANF trade at 12-17x earnings with more debt. Using ANF’s 17x multiple on $3.30 EPS = $56/share (equates to 14.5x earnings net of cash).

This one is worth following.

SMASHED IT

Excellent