Quick Value #234 - Lamb Weston (LW)

French Fry producer at 9x EBITDA / 13.7x earnings

Today’s idea:

French Fry producer with shares down 55% from 2023 peak

Stable cash flows and industry leading market share

Capex projects ending in FY25 = higher FCF coming

Shares trade at 9x EBITDA and 13.7x earnings

Subscribe below for access to all Quick Value posts. As a reminder, premium posts mostly cover “top of the pile” ideas that are generally microcaps or special situations.

Market Performance

Quick Value

This idea was sourced from a big 1-day drop in July 2024 (from $80 to $53). I’m a sucker for investigating these 30% drops to see if there’s an overreaction to an otherwise sound long-term story. Let’s see what’s going on here…

What they do…

Lamb Weston came public in a 2016 spin-off from Conagra. It was intended to separate the branded consumer products (Conagra) from the commercial potato business (Lamb Weston).

LW is a producer of frozen potatoes with the majority of revenue coming from french fries sold to restaurant chains (both QSR and full-service) and foodservice distributors. Less than 20% of FY23 sales came from consumer-facing retail sales (i.e. grocery stores). McDonald’s accounted for 14% of FY24 sales (May yearend).

They’re the #1 frozen potato producer in North America and #2 globally behind food conglomerate McCain Foods.

Why it’s interesting…

Beaten up share price = expectation reset?

Stable cash flows + lower capex coming

1) Beaten up share price

The stock being down isn’t a good reason to buy… but it’s possible for overreactions to happen. So what happened here?

4Q24 (May yearend) results were pretty bad:

Sales down 5%

Adjusted EPS down 40%

Adjusted EBITDA down 15%

FY25 guidance was more of the same — sales & EBITDA flat, EPS down ~10%

A few years of inflationary price increases in the restaurant industry are catching up to most companies in that value chain, including Lamb Weston. Here’s what management had to say on the earnings call:

…the operating environment has changed rapidly during fiscal 2024 as global restaurant traffic and frozen potato demand softened. In fact, the downward traffic trends accelerated during the back half of the year and into early fiscal 2025.

This has led to an increase in available industry capacity in North America and Europe. We believe this industry supply-demand imbalance will persist through much, if not all, of fiscal 2025.

Lamb Weston is contributing to the supply/demand imbalance with a multi-year capex project to increase capacity… over the past 3 years, capex jumped from $290m to $654m to $930m… with plans to spend another $850m in FY25.

The big question is whether these headwinds are temporary from runaway pricing and capacity additions or if results will get worse for a while longer. FY26 seems to be a pivotal year…

2) Cash flows

Aside from the pandemic, cash flows are stable and growing.

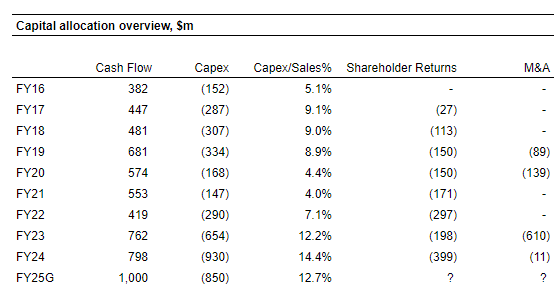

Below is a table summarizing cash flows and capital allocation since 2016 (note the spinoff was completed in FY17 so a portion of this time period is including within Conagra):

Capex projects from FY23-25 are notable here. Management anticipates a significant stepdown in capex beginning in FY26, but that likely leaves them with little/no room for allocation elsewhere in FY25.

What could normalized cash flows look like?

Let’s say capex intensity falls from >12% to 9% (FY17-19 average). On sales of $6.7bn = $600m capex. Assuming operating cash flow holds around $1bn annually = $400m FCF or $2.78/share.

That leaves the stock trading at ~23x FCF (not crazy cheap). Every $100m lower capex = $0.70/share additional FCF.

Summing it up…

Food & beverage stocks typically command higher multiples thanks to their high margins and stable “staple-like” earnings profile. Lamb Weston is a bit different since this is more of a B2B business with less branded consumer products.

Some questions remain… was FY25 guidance appropriately reset or could results be worse? Sales and traffic trends at restaurants are pretty bad; although they’re all getting aggressive on promotions to drive activity. That could help LW at the expense of the restaurants.

Shares seem appropriately priced here too… peers are trading at 10-11x EBITDA which equates to a $78 share price at 10.5x.

Keeping this one on the watchlist for now…

Good write up! I have been watching this one as well since that 30% drop. This could be a very interesting opportunity once the consumer stabilizes again and restaurant sales start to improve. Keep up the good work!