Quick Value #236 - Lions Gate (LGF)

An interesting spin/stub situation

Today’s idea:

Recent transaction is 1st step toward split

Standalone studio business trading at <13x OIBDA

Stub valuation for STARZ media business at <4x OIBDA

Subscribe below for access to all Quick Value posts. As a reminder, premium posts mostly cover “top of the pile” ideas that are generally microcaps or special situations.

Market Performance

Quick Value

Lionsgate Entertainment (LGF)

This is essentially part spin-off and part tracking stock. A recent SPAC transaction took a 1st step toward the eventual separation of the Lions Gate studio business and media business (STARZ). There are technically 2 stocks at play here:

Lions Gate Entertainment (LGF) — eventually will become standalone STARZ media/streaming business… currently consists of 87.3% ownership in studio business (LION) and 100% of STARZ

Lionsgate Studios (LION) — pureplay studio business… content production and licensing with 20,000 titles in the catalog

The post-close transaction structure is a bit complex but there are 2 operating businesses here:

Media networks — STARZ generates subscription revenue in part from being included in cable packages and part from direct-to-consumer streaming services

Studio — movie and television studio generating revenue from a combination of licensing a 20,000+ title content library and producing films and shows

We’re going to take a different approach from the normal format today and look at each operating business and an overview of the transaction.

1) Media Business

Management likes to tout STARZ as the first media company to successfully navigate to a profitable streaming environment.

Looking at the segment performance chart above, they aren’t completely wrong. Segment profit is positive from the time STARZ was acquired in 2016 to today; although that profitability is down from >$460m in 2018 to $262m today.

Some stats on this business:

Margins are pushing 17-20% at the segment level which is consistent with AMCX/WBD

Management believes standalone OIBDA is roughly ~$200m (probably $260m segment profit less $60m standalone corporate costs)

Over 70% of revenue comes from digital as opposed to cable packages — i.e. mostly transitioned to streaming

Subscriber count isn’t growing right now

Peers (AMCX, WBD, PARA, CMCSA) are trading at 4-7x EBITDA so this business likely isn’t worth the $4.4bn paid for it back in late 2016

We’ll come back to the standalone/stub valuation for this business later…

2) Studio Business

Most film and TV studios are vertically integrated within other media companies (Disney, Universal/Comcast, Warner Bros, Amazon/MGM) so this is a unique standalone studio with flexibility to license or produce content for any media company.

Revenue and segment profit in the studio business grew from $2.4bn / $389m in 2015 to $2.95bn / $471m TTM — a 2.3% and 2.1% CAGR. Part of the recent jump in segment profit came from the December 2023 $375m acquisition of eOne, a ~6,500 title content library owned by Hasbro.

A quick word on business quality

Studios are interesting in that they historically command huge multiples of EBITDA/OIBDA but at the same time they carry tons of debt to finance content production (thus driving returns on capital down).

On the other end of that, they own a growing film and TV library (20k titles) which can be rented out at very high margins (since it was already produced, costs are basically zero).

That library revenue stream is pushing $900m (~30% of total sales) and likely to continue growing with streaming services’ renewed focus on profitability and less original content.

Cash flow is typically excellent depending on how much reinvestment goes into producing films or shows

From the merger proxy, management was projecting $380m in standalone OIBDA for the studio business in 2024 and $430m in 2025.

Transaction multiples are consistently >11-13x EBITDA in this industry with a few big names going for >27x EBITDA (MGM and DreamWorks).

Spin/stub valuation

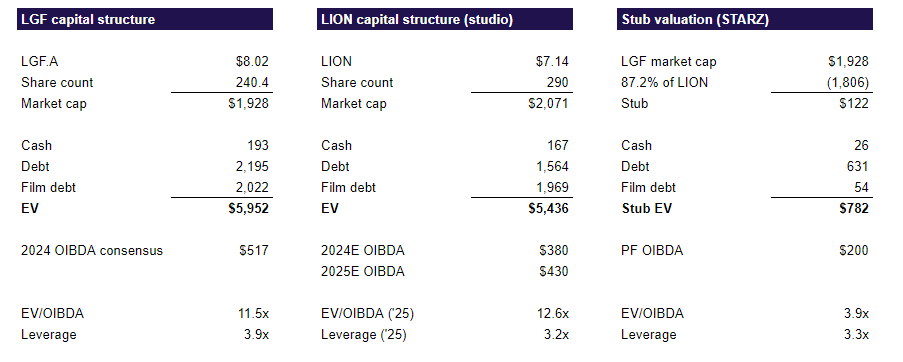

I’m sure there are some missing pieces to this, but here are my valuation estimates for the studio business and stub (STARZ)…

If they (LGF) spun off the 87% stake in studio (LION) to shareholders at today’s price, then you’re getting the STARZ business at <4x EBITDA with ~3.3x leverage.

At a ~$120m stub market cap, that probably works out to nearly a 100% FCF yield.

At first glance, the studio business at ~13x OIBDA seems pretty fair. But that might be missing the full picture. For starters, if you exclude production loans, then EV/EBITDA is closer to 8x which seems cheap. Second, this business converts a high percentage of OIBDA into FCF. Call it $250m interest and capex against $430m OIBDA = $180m FCF or an 8.7% FCF yield at today’s price. That seems pretty reasonable for a high quality and growing business.

Still some work to be done on this name but definitely worth adding to your watchlist…

Note — A formal separation hasn’t yet been announced but management thinks it will be an early 2025 event. Also, the formal capital structures for each business are in the works with some refinancing coming. All that to say: this is a very early look at the pieces here.