Quick Value #238 - GXO Logistics (GXO)

Growing business in a growing industry

Today’s idea:

10% organic grower in tailwind-laden industry

String of acquisitions added debt and depressed share price

Shares reasonably priced for the growth (17.5x earnings for >15% EPS CAGR)

Subscribe below for access to all Quick Value posts. As a reminder, premium posts mostly cover “top of the pile” ideas that are generally microcaps or special situations.

Quick Value

GXO Logistics (GXO)

Have I ever mentioned I love these flatlining coiled spring-type charts?

What they do…

GXO was part of the Brad Jacobs / XPO Logistics “empire” which ultimately split into 3 companies:

XPO — LTL freight

RXO — freight brokerage

GXO — warehousing and fulfillment

GXO describes themselves as a “pure-play contract logistics” company, but really this is warehousing and order fulfillment, which involves storing customer product (usually consumer goods), picking and packing items as orders come in, and shipping them to an end-user. Oftentimes there are kitting, assembly, or other value-added services too. At the time of the 2021 spin, GXO was the 2nd largest industry player with 5% market share in a $130bn industry.

Other tidbits from from the 10-K and presentations:

“We provide our customers with high-value-added warehousing and distribution, order fulfillment, e-commerce, reverse logistics and other supply chain services…”

They operate “974 facilities worldwide totaling 199 million square feet of space, primarily on behalf of large corporations that have outsourced their warehousing, distribution and other related activities to us.” (For context, Amazon operates 626 million square feet of warehouse space).

Heavy international mix — 30% of sales and 40% of warehouse space in the U.S.

Significant consumer exposure (retail and consumer electronics) at 57% of revenue.

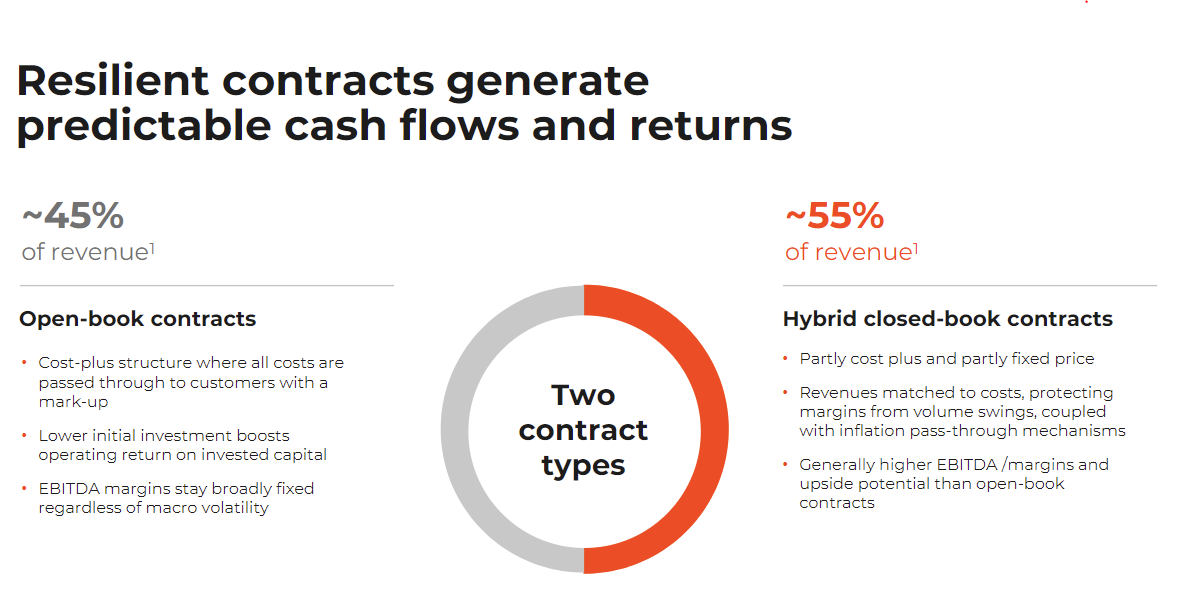

Most (all?) customers are on long-term contracts = decent revenue visibility. Two types of contract…

Open-book = cost-plus (i.e. stable margins, less operating leverage). These contracts make up 45% of sales.

Hybrid closed-book = mix of cost-plus and fixed price (i.e. greater operating leverage but creates underwriting risk). These contracts make up 55% of sales.

Why it’s interesting…

Long-term growth profile

Expectations reset

Reasonable price

1) Growth profile

Outsourced warehousing and fulfillment is an industry growing on the back of ecommerce shopping trends and renewed attention to supply chains. These “megatrends” allow GXO to post aggressive long-run targets for revenue and earnings growth.

Ecommerce has a 16% share of total retail sales, which is >$1.1tn annually. Most brands don’t have the growth profile of Amazon or the scale of Walmart, making outsourcing some (or all) of storage and fulfillment operations a smart move. This is an industry where scale matters — warehouse technology, automation, efficiency, lease commitments, etc.

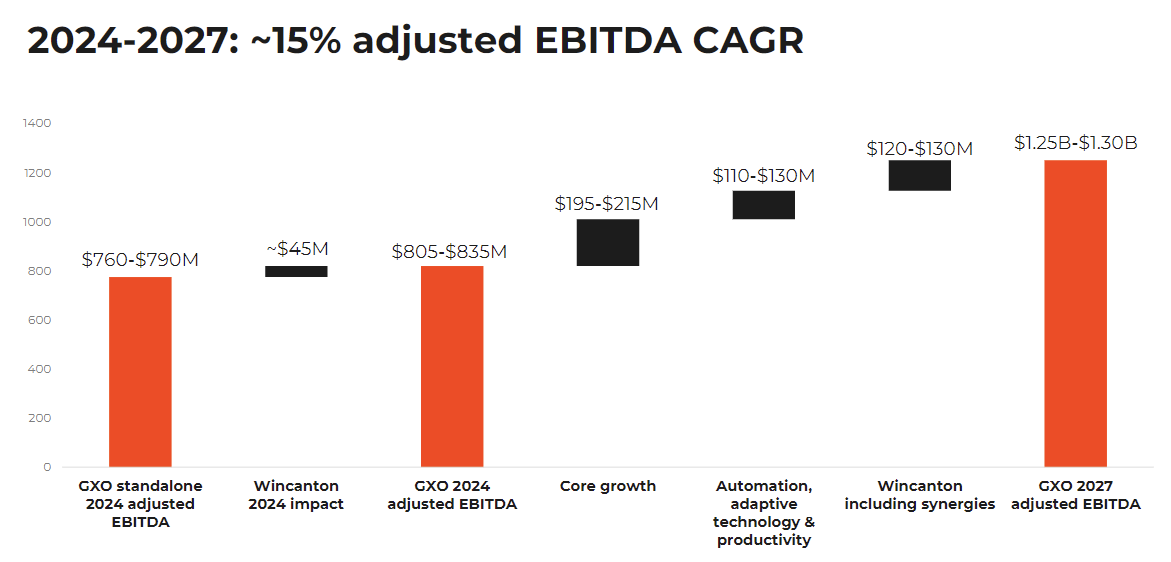

Back to those lofty targets… From 2024-2027, management is targeting 10% revenue growth and >15% earnings growth annually.

The 2024 mid-point guidance calls for $2.83 EPS which would turn into $4.30/share by 2027 if the 15% EPS CAGR holds.

A big piece of that growth is coming from a string of acquisitions starting in 2022 — in total, GXO spent ~$1.9bn on 3 acquisitions from 2022-1H24 which is probably 60% or so of the total capital at time of spin. They’ve added quite a bit of leverage and now need to execute.

What’s interesting here is whether GXO could continue that same financial model in the years after 2027. Will more consumer brands (and other industries) look to shed their distribution centers and burdensome fixed costs in exchange for their own “asset light” business model? All to GXO’s benefit? It wouldn’t be surprising to see this as a 5-10% grower for 10+ years.

2) Expectations reset

This is mostly a comment about the chart which is stuck at $40-50/share since mid-2022 with low(ish) volatility.

Valuation multiples continue to compress — both P/E and EV/EBITDA slowly drifting lower and dragging down median historic multiples.

Despite that, EPS and EBITDA trends are climbing and management thinks the next few years will be even better.

So we have a combination of: 1) flat stock price; 2) falling valuation; and 3) improving fundamentals. Hmm…

3) Reasonable valuation

Paying 17.7x earnings ($50 share price on $2.83 EPS guide) doesn’t sound extremely cheap. But considering the growth (>15% EPS CAGR) and high revenue visibility (long term customer contracts); it might be appropriate for a quality business with (perhaps) minimal volatility.

It seems even less cheap on a FCF basis when you factor in the 30-40% FCF conversion guidance. At $815m EBITDA that would be $285m FCF or $2.40/share (20.8x). But we’re given this FCF bridge indicating a big piece is growth capex (a phrase I strongly dislike) but let’s humor it…

Absent the growth capex, this would be a 60% FCF conversion business according to management. At $815m EBITDA = $489m FCF ($4.08/share) and at $1.25bn EBITDA = $750m FCF ($6.25/share). Certainly a lot cheaper even if you factor in a 10% conversion buffer for overconfidence.

Technically, there shouldn’t be any complaints about 30-40% FCF conversions if revenue and earnings are growing 10-15% annually apiece…

What could shares be worth?

At $50/share with 120m shares outstanding, this is a $6bn market cap. Net debt is $2.3bn at 1H24 (leverage = 2.8x on mid-point EBITDA guide). That works out to ~10x EV/EBITDA (ignoring lease liabilities in this calculation).

This idea is better suited for an IRR expectation and I’d expect shares to follow earnings over the next few years. There hasn’t been much progress on EPS lately ($2.85 in 2022, $2.59 in 2023, $2.83 guided in 2024) but those should start turning the corner soon.

If earnings grow 15% annually from here, then shares could return 15% annually as well.

Here is a snapshot of fundamentals dating back to the spin-off:

Summing it up…

If I were looking at buying 100% of this business for my personal holding company, it would pass just about every bullet on the checklist (very long-term industry tailwinds, long-term customers and contractual revenue streams, pass-through revenue to lessen cyclicality, scaled player, etc.). The exceptions would be low EBITDA margins (7-8%) and capital intensity (~3% of sales); meaning this will never be a huge FCF producer.

They’ve doubled down and added significant leverage to the balance sheet over the past 2 years (from $960m to $2.8bn) with a string of acquisitions. Along with some weak earnings trends recently, that’d be my guess as to why shares have been limping along lately.

Last few comments on this one:

Still plenty of work to do in validating the industry tailwinds and I’d love to see management incentives here (i.e. are they chasing revenue and EBITDA growth at the expense of FCF and EPS?).

Leases are significant and should probably be treated like debt, but they mentioned tying customer contracts to lease durations which is pretty impressive.

Valuation is probably reasonable-to-good if you believe in the growth story through 2027 and beyond.

I’m keeping this on the watchlist for now but plan to do some more work on it to better understand the trends and competitors (i.e. where does Amazon fit into the picture?).

Thanks for reading, leave a comment if you’re following this name! Sign up for the newsletter if you enjoy posts like these!

Additional resources:

Good write-up. And now I see it is in play, so I guess your thesis is validated! I am scratching my head a bit about the valuation - is there a margin of safety here? FCF yield is 2%. Negative tangible book. Hard to get too excited about 14x 2027e earnings.

how much credibility does the plan have?