Quick Value #240 - Everus Construction Group (ECG)

Construction services spin-off: a first look

Today’s idea:

Spin-off taking place next week (10/31)

Growthy construction services business (SpinCo)

Underlevered regulated utility and pipeline (RemainCo)

Subscribe below for access to all Quick Value posts. As a reminder, premium posts mostly cover “top of the pile” ideas that are generally microcaps or special situations.

Quick Value

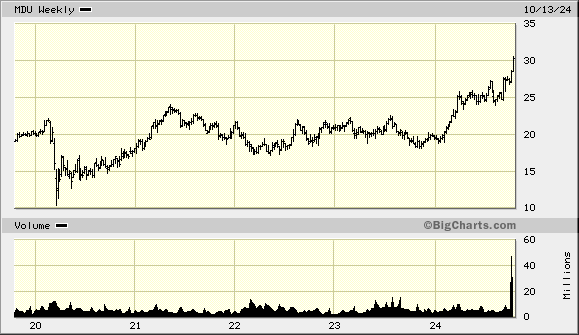

MDU Resources (MDU) + Everus Construction Group (ECG)

MDU is wrapping up a ~2-year break-up process where they’ll have spun off their aggregates business (Knife River), spun off their construction services business (Everus), and all that remains is a regulated utility and pipeline company (RemainCo MDU).

Everus Construction Group (SpinCo)

As the name implies, Everus provides construction services (much like MasTac, Emcor, etc.). There are 2 segments here:

Electrical & Mechanical (E&M) — 74% of 2023 revenue… Construction and maintenance of electrical and communication wiring and infrastructure, fire

suppression systems, and mechanical piping and services

Transmission & Distribution (T&D) — 26% of 2023 revenue… Construction and maintenance of overhead and underground electrical, gas and communication infrastructure, as well as manufacturing and distribution of transmission line

construction equipment and tools

Revenue and EBITDA grew 9-10% annually from 2019-1H24 with stable (but flat) margins around 8% (minimal operating leverage since this is a mostly variable business model).

Outlook — Between the CHIPS Act, IRA, and grid modernization bills, there is plenty of Government money padding the outlook. Can’t forget data center + AI growth... the tailwinds look substantial. Management is targeting 5-7% organic growth.

With those tailwinds in mind… here is management’s long-term financial model:

5-7% organic revenue growth

7-9% EBITDA growth

2-2.5% capex

1.5-2x leverage (1.3x at time of spin)

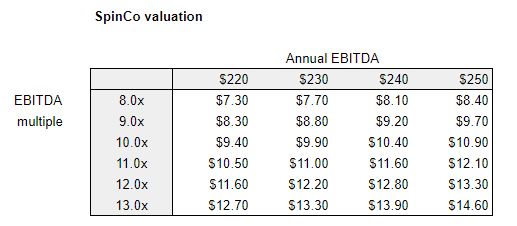

What could shares be worth?

The construction services industry has appreciated a ton lately… nearly the entire group is trading at 12-14x EBITDA or higher (MTZ, EME, KBR, FIX, PWR, etc.). Much like Everus, EBITDA for peers grew substantially over the past decade. So maybe there’s a combination of: 1) rewarding past performance; and 2) anticipating continued growth.

SpinCo will have $336m gross debt and $59m cash on hand at time of spin. Using 10-13x EBITDA, shares are maybe worth $9-13/share (that’s $36-52/share on the post-spin share count of 51m). There are $28m of anticipated dis-synergies for standalone costs so my EBITDA estimates could be 1-2 years out.

MDU Resources (RemainCo)

RemainCo is a combination of regulated utility and natural gas pipeline. They operate in northern states (MT, ND, SD, MN, WY, etc.).

On the regulated utility side, MDU services 1m customers with natural gas and 145k customers with electricity. They have a 737MW generation portfolio split 40% gas, 31% coal, and 29% renewables (mostly wind). On the pipeline side, they own 3,800 miles of natural gas storage and transportation. It acts mostly like a regulated utility (i.e. subject to FERC).

Again, revenue and earnings have grown nicely…

MDU exited most of their non-regulated pipeline business over the past few years so this is essentially a pure-play regulated utility now.

What could shares be worth?

MDU has 204m shares outstanding x $30/share = $6.15bn market cap. Pre-spin net debt is ~$2.3bn but they’ll receive a $200m related party loan repayment at the spin so call it $2.1bn.

My estimates of post-spin net income are probably off a bit but let’s call it $170-180m in 2024… under various SpinCo valuations, here is what RemainCo could look like on a P/E basis:

Most regulated utilities trade at 18-20x earnings so this looks pretty cheap if Everus comes out at a premium valuation. On another note, MDU has substantially less leverage than peers so perhaps there will be room for capital allocation beyond just rate base growth…

The spin-off is taking place on October 31st so we’ll get a look at this one soon!

Additional resources:

When-issued trading of $ECG at ~$49-50 (i.e. $12.50/share on pre-spin share count)... leaves stub $MDU at $16.50 which looks like a (potential) bargain...

R u holding both spin co and remain co?