Quick Value #242 - Curbline Properties (CURB)

Today’s idea:

Recently completed REIT spin-off

Differentiated real estate assets w/ advantages

Spun with huge net cash position (34% market cap)

Looking to deploy 1x market cap over next 3-4 years

Subscribe below for access to all Quick Value posts. As a reminder, premium posts mostly cover “top of the pile” ideas that are generally microcaps or special situations.

Quick Value

Curbline Properties (CURB)

Curbline Properties (CURB) is a recent real estate spin-off (completed October 1, 2024) from REIT Site Centers (SITC).

What they do…

Curbline is a real estate investment trust (REIT) owning 79 “convenience retail properties” in the US. It’s easier to paste snips from the Form 10 filing to describe this one…

A few comments about this business model…

Average square footage per property is ~34,000 — that could mean 2-4 leases per property in heavily trafficked but smaller footprints.

Compare that to peers like Kite Realty (KRG) with 28m square feet on 179 properties = 156,000sf per property. The ease and ability to negotiate those smaller footprints is significant; this is a potential “quality” factor.

Properties are “plug and play” requiring minimal capex when leases/tenants change hands — just about any tenant could work in one of these spaces.

There are no/minimal “anchors” — there are high-quality national tenants but the size of the property eliminates traditional anchor situation.

Lease durations see ~10% of square footage up for renewal on average each year.

CEO David Lukes summed up the business model on their last earnings call:

what I find really interesting is that when you have small format spaces, 30 by 60. So it's an 1,800 square foot unit. There's hundreds of businesses that can occupy that space close to the customer and up along the Curbline

(If you want to see some sample photos of these property types, there are a few pictures in the investor presentation linked at the bottom of this post.)

Why it’s interesting…

It’s clear that Curbline was viewed as the “crown jewel” within pre-spin Site Centers. These properties were getting most of management’s attention and they were recycling capital from asset sales into more curbline properties.

Post-spin, Curbline has 104m shares outstanding for a $2.34bn market cap. Net cash is $800m for a $1.54bn EV.

The balance sheet is where things get interesting…

Curbline was spun with $800m in cash, zero debt, and 79 owned properties (higher than the originally planned $600m cash and 72 properties). Real estate is traditionally a levered industry thanks to easy financing (real assets); so this net cash position is more than unusual.

So what are they planning for that net cash balance sheet?

If roll-ups exist in real estate, this company would qualify. Management intends to continue deploying cash on acquisitions for the foreseeable future. With $800m cash, $500m debt capacity, and retained earnings, they should have $1.7-2.2bn acquisition capacity.

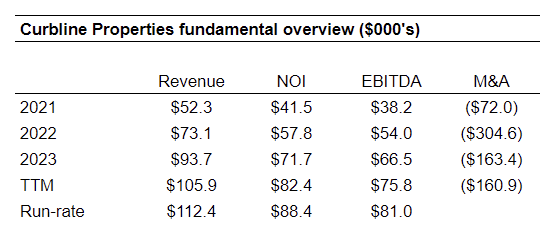

That’s in addition to the existing 79-property portfolio with ~$85-90m run-rate NOI and attractive fundamentals. Management anticipates 3%+ organic NOI growth over the next few years from the existing portfolio (population growth, lease renewals, etc.).

So what could this business look like in a few years?

Management commented on the last earnings call that they can deploy ~$500m per year with their current team. If total capacity is $1.7-2.2bn, then we’re looking at 3-4 to fully deploy the balance sheet.

It becomes a math exercise of what they’ll pay and what they’ll trade at. So far, acquisitions are getting done at 6.5-8% cap-rates and the stock trades at a ~5.7% cap-rate (using annualized NOI).

Here’s a simple scenario — Say they spend $2bn over 4 years and finance half with debt ($1bn)… At a7% cap-rate on purchases = $140m added. Tack on the current $88m grown 3% per year = $96m. So we have $236m NOI and $1bn debt with no equity issued… if that traded at a 5% cap-rate, the stock would be $36/share. This is an incredibly basic view of the situation, it will be more nuanced and complex.

Summing it up…

To recap — Curbline has: 1) an organically growing portfolio of differentiated real estate assets; 2) a massive net cash position (34% of market cap); and 3) a clear acquisition strategy to deploy >$1.7-2.2bn over the next few years.

I don’t own shares but this one is going on the watchlist… I’d like to better understand whether others are pursuing this strategy (at first glance it looks like AKR is), and how effectively they can buy assets.

Additional resources: