Quick Value #244 - JELD-WEN (JELD)

Door and window maker down big this year; trading at 13x earnings / 7x EBITDA, now a turnaround story

Welcome to Quick Value

Every few weeks I’ll repost this reminder on what Quick Value is all about… Each week I’ll cover a new value investment idea in a quick review. Here’s the scoop:

Idea generation — The goal is to keep the new idea process churning by working the watchlist. These are meant to be a “jumping off” point for deeper research (i.e. a surface level review).

Format — I stick to a similar format of Steinhardt’s 4 questions: what they do, why it’s interesting, and what it’s worth. [Technically, Steinhardt’s were: the idea, consensus view, variant perception, and catalyst.]

Weekly posts — I’ll covers a new idea each week and rotate between free and premium posts. Sometimes these will cluster on a single industry or timing of events (spins, reorgs, etc.). Premium posts lean toward micro/small caps and special sits.

Coverage focus — You’ll see lots of special situations (including virtually every spin-off) and an emphasis on small caps.

Past ideas — Check out past ideas here to get a feel for what’s been covered.

Today’s idea:

Beaten up stock — fell 30% on Q3 earnings / down 46% YTD

Operates in an industry with major tailwinds

Shares trade at 13x earnings / 7x EBITDA

Margins half of peer group

Quick Value

JELD-WEN Holding Inc (JELD)

I’ll take a look at just about any stock that falls ~30% on the heels of an earnings miss; oftentimes there’s a sufficient “reset” in investor expectations to make the stock interesting. Let’s see if that’s the case with JELD-WEN.

What they do…

JELD is a global manufacturer of doors and windows for both residential and non-residential markets. This is the market leader in doors and a top 3 producer of windows.

Some revenue stats as of FY23:

Sales mix is 89% residential (46% new construction / 43% repair & remodel) and 11% commercial.

Geographic mix is 73% US and 27% Europe.

Product mix is 63% doors, 21% windows, and 16% ancillary products.

Why it’s interesting…

Investor expectation reset

Attractive industry

Fundamentals

1) Expectations reset

It’s been a tough year for JELD during earnings reports. The stock was down 25% on Q1 earnings and down 30% on Q3 earnings. Shares are down 46% YTD.

But… a string of big earnings misses = lower confidence in the stock and management and big guidance resets + lower analyst estimates = lower confidence in the stock and management. Things can get exciting when those conditions mix.

This doesn’t guarantee a bottom in the stock or fundamental trough (still need to look at the industry and fundamentals!), but it’s much more likely that estimates will extrapolate continued pessimism from here (i.e. it’s a good time do some work on the name).

2) Attractive industry

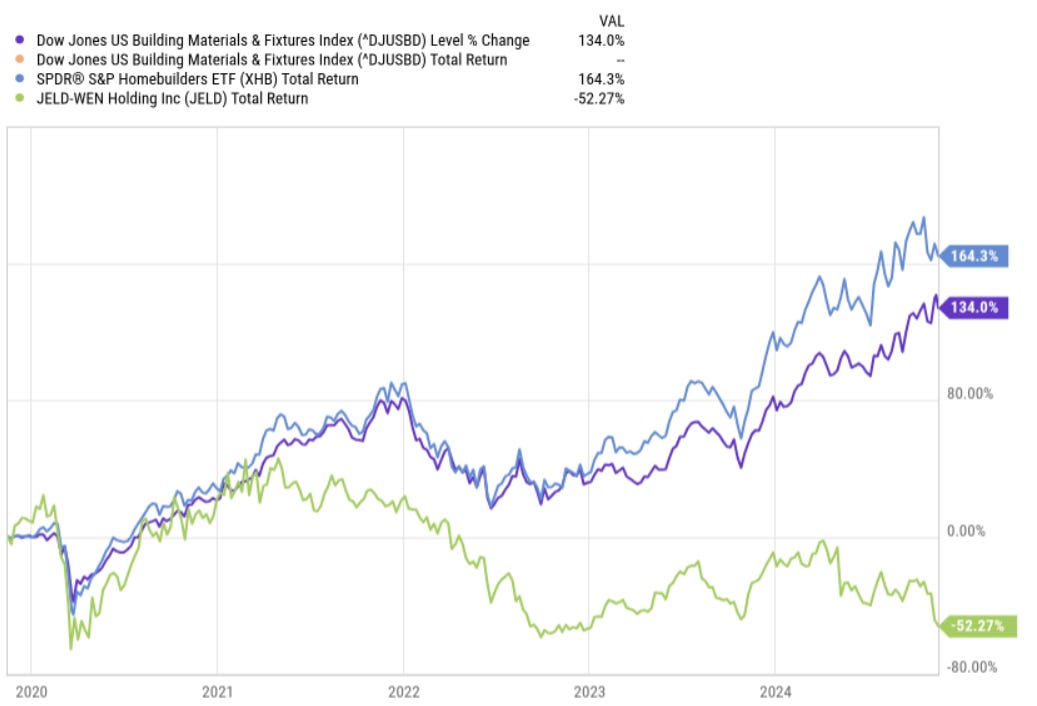

Homebuilders and building suppliers have been on fire for years now — both groups are +130-160% over 5 years:

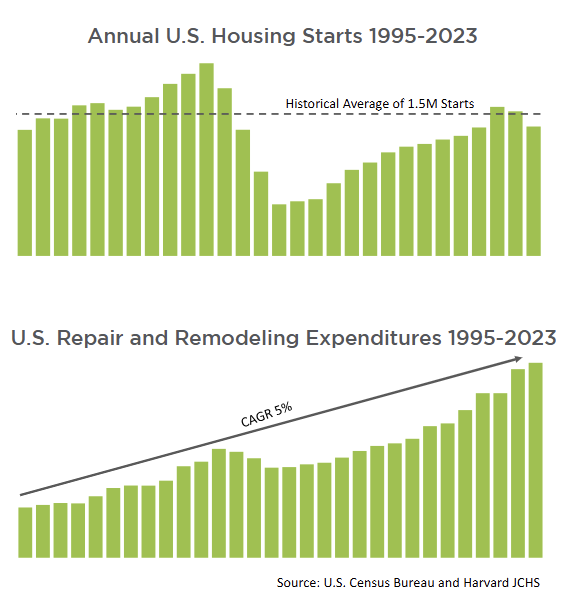

Logically, this makes sense. Housing starts continue a post-GFC recovery (though have slowed lately) and repair & remodel spending is still going strong (again, slowing a bit in 2024).

Not surprising that most of the stocks in these indices are expecting 5%+ revenue growth over the next 3 years (on top of 10-25% revenue growth over the past 3 years).

What is surprising is JELD’s terrible performance during this stretch of industry strength. I ran a screen for building suppliers with a negative 5yr return and JELD was the lone participant… At the same time, 2 of JELD’s peers (Masonite/DOOR, and PGT Innovations/PGTI) were recently acquired at good multiples. Hmm…

3) Fundamentals

This should be a good cash-flowing business. From 2017-2023, EBITDA averaged $330m per year on $4.24bn average revenue (7.8% margins). Cumulative FCF during that period was $1.06bn — of which ~$360m spent on acquisitions, $670m on buybacks, and $750m to repay debt (a $367m divestiture in 2023 helped with deleveraging).

The recently acquired 2 close peers (Masonite and PGT) had EBITDA margins >15% which is double JELD’s historical performance and recent guidance. Here’s a look at financial performance going back to 2017:

At $10/share with 85m shares outstanding, JELD has a $850m market cap. Net debt is roughly $1.1bn for a $1.95bn EV. Shares are trading at ~13x earnings ($0.70-0.80/sh), 7x EBITDA ($273m) with 3.7x leverage.

Upside math is fairly simple with such low margins — 10% EBITDA margins at $3.7bn revenue = $370m EBITDA. At 7.5x EBITDA less $1.1bn net debt = ~$20/share. And $370m EBITDA is where the company was guiding up until the Q3 report. BUT…

Q3 guidance cut was brutal — from $380m EBITDA to $273m and a big portion of that $273m relies on yet-to-be-completed $115m cost saving initiatives:

Some questions I’d look to answer here:

Why is revenue so weak (dating back to 2017) despite industry tailwinds?

Why are margins half of peers?

Structural differences or operations-induced?

Can the current management team (in place since 2022) fix this situation?

Summing it up…

So we have shares severely beaten up, falling revenue despite an industry that’s on fire, and margin performance well below peers (2 of which were just acquired). Current valuation isn’t demanding but continued revenue declines is a major risk and leverage is headed in the wrong direction.

Still plenty of questions left to answer but this one seems worth a closer look…

Drop a comment if you’ve looked at this one or peers!

turtle creek has been involved with jeld for a few years. in a rare attribute, they are one of few suggestivist managers that know the limit of their operational value-add.

they are a great group, but comment rarely and infrequently, and usually ~1 yr after they have initiated aid. it is unclear whether turtle creek have even traded successfully around the volatility here, which is a unique hallmark of a suggestivist value manager.

Did you check out Wordline SA already? They got whacked completely. Down from the 90s to 6,5€, trading at around 4x EV/EBITDA. Could be a nice turnaround story...