Quick Value #245 - Microcap Multi-Year Growth Story

This microcap restaurant has an excellent long-term growth runway

Today’s idea:

Recently completed 3 year turnaround story

Now in growth mode targeting 10% annual EBITDA growth

Moving to mix of owned and franchised operations (asset light)

Shares trading at 9.7x EBITDA and 15x operating cash flow

This week’s post is for paid subscribers. We’ll be back next week with a free edition of Quick Value!

Quick Value

Potbelly Corp (PBPB)

What they do…

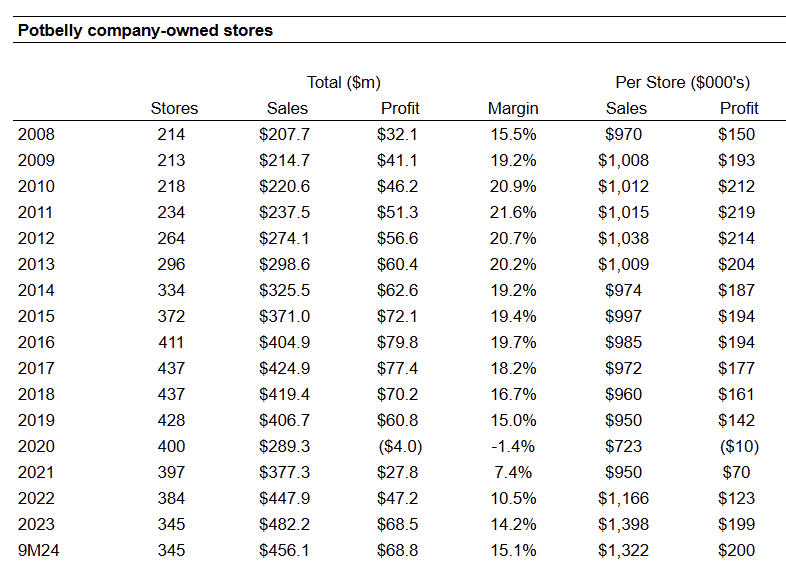

Potbelly Corp runs 435 sandwich shops (345 company-owned and 90 franchised). It’s a simple “fast casual” concept with shops averaging 1800-2300 square feet, an average ticket less than $11.50, and ~$650k total development investment.

PBPB came public in a 2013 IPO and quickly used those funds to grow store count. The concept didn’t carryover to new markets as anticipated (see the “per store” economics with revenue/profit per store falling from 2012 to 2019) and so the company had to reverse course and close stores beginning in 2018.

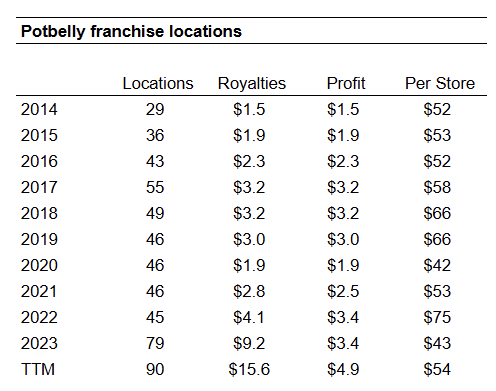

On the franchise side, Potbelly is up to 90 locations with the average store chipping in ~$54k of profitability to the parent company (though run-rate looks closer to $70k per franchised store).

Competitors — Subway is the big dog in the QSR/fast-casual sandwich market with 20,000+ locations doing <$500k per store. Jersey Mike’s has ~3,000 locations doing $1.35m per store (similar to Potbelly). Jimmy John’s has ~2,700 locations and ~$1m store sales average. Both Subway and Jersey Mike’s were sold to PE recently ($9.5bn and $8bn valuations for each). On the smaller end are Which Wich with >400 locations and Quizno’s at ~150.

Why it’s interesting…

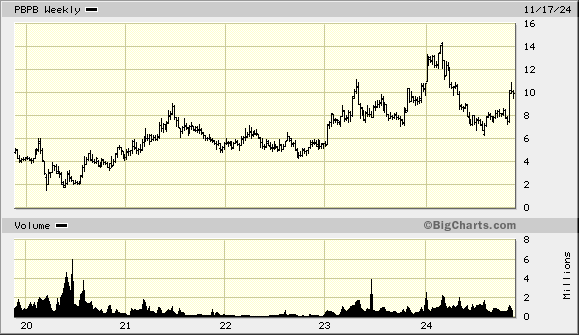

Looking at the 5-year chart, this is a stock up 2x over the past 5 years and more than 5x off its COVID-lows. I don’t typically look at names that have had a strong run. But Potbelly has the makings of a solid long-term holding…

1) Turnaround complete, early innings of growth story

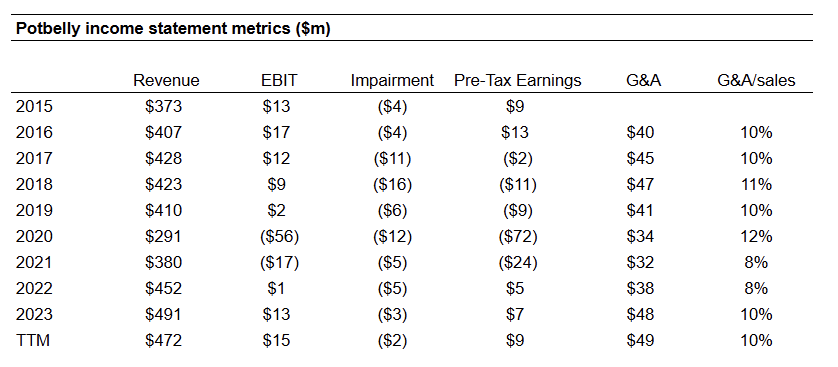

This is no longer a turnaround story — Store count peaked in 2017, from 2015-2023 they took $65m in impairment charges, pre-tax losses were $118m from 2017-2021, they raised $15m equity at low prices in 2021, and borrowed >$30m from 2020-2023. Yikes.

What happened and what’s going on now?

In 2020, CEO Bob Wright came over from Wendy’s (former COO) and started the turnaround process with seemingly simple changes — menu simplification, loyalty program changes, store layout simplification, etc. Since then:

Store count is growing (again) — total locations up to 435 from a 2022 low of 429 with plans to open 10+ stores annually

Store-level economics are improving — a new high-water mark of $1.3m sales per location and $200k profit per location (industry-leading metrics)

Same-store sales rebounding — +30% in 2021, +18.5% in 2022, +12% in 2023, and cooling to -1% or so in 2024 (albeit on the heels of good growth)

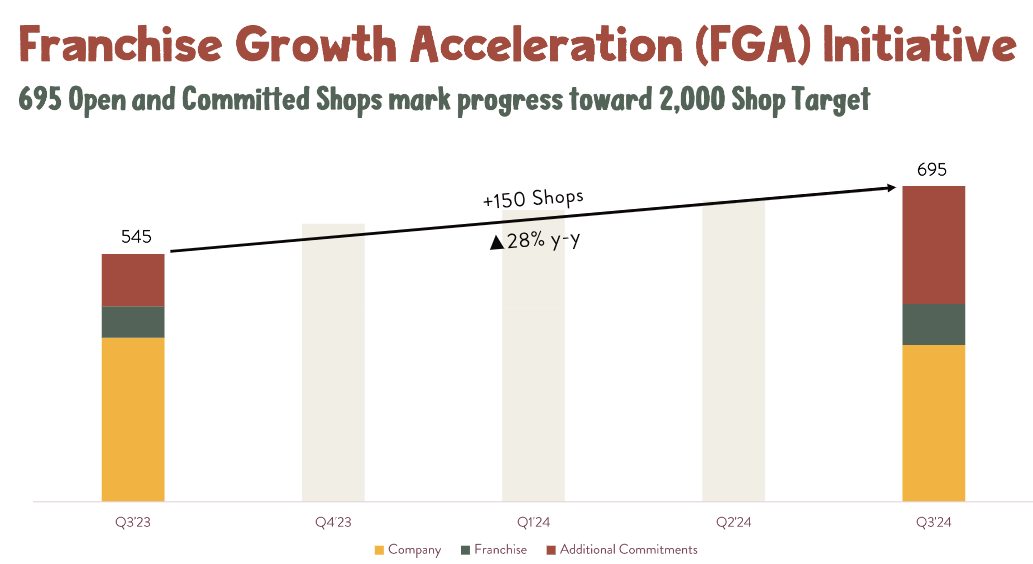

Ambitious total store goal of 2,000 locations — from 435 today and 695 in the pipeline

Franchise development is robust and starting to contribute meaningful earnings — franchise count up to 90 (3Q24) from 46 in 2020

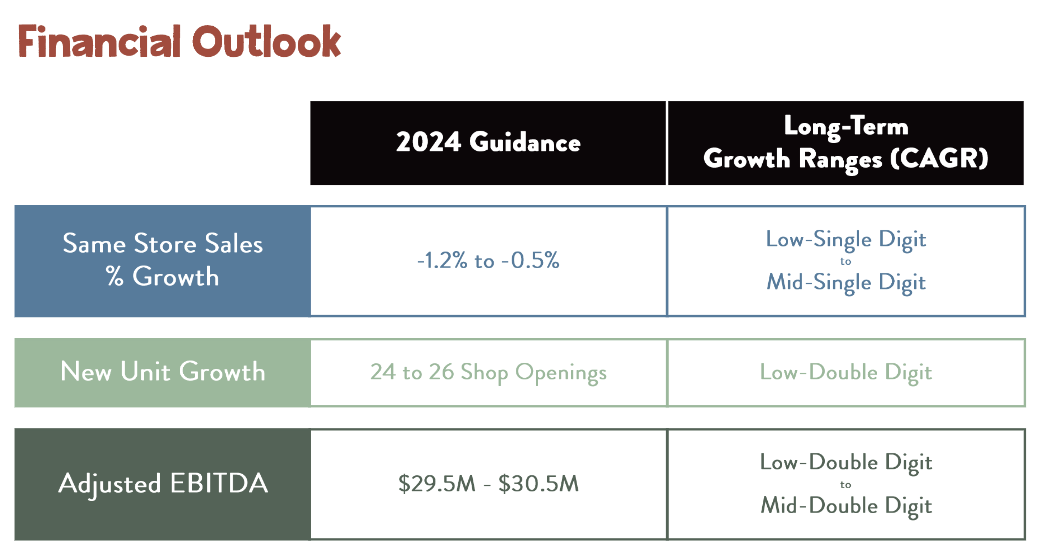

In 2024, Potbelly is guiding to $30m EBITDA and ~25 new store openings. 2025 should grow from there as store openings season for a year. Longer-term, they expect >10% annual EBITDA growth and 10+ new stores per year.

2) Budding franchise operations

Franchise locations are a small portion of the business today (21% of total store count), but it’s becoming a key pillar to profit growth. Current management has made it clear that franchising will be a big part of the future business model. Partially from converting existing company-owned locations and partially from new developments.

They “refranchised” 33 company-owned locations in 2023 which generated $6.3m in proceeds and have an eye to more refranchisings down the road.

The franchise pipeline is 260 commitments as of 3Q24 which would add ~$18m pre-tax earnings once fully deployed at $70k profit per store (that works out to $0.60/share). It will take many years for this to fully deploy and it doesn’t sound as though they’ll move to a fully franchised model anytime soon.

3) Valuation

Using an EBITDA multiple seems simple enough. But this company went from distressed to growing so we’re now seeing significant investments in store growth which makes cash flow a bit trickier. Operating cash flow is ~$20m but most of that is going toward store development right now.

Share count is 30m x $10/share = ~$300m market cap. Net cash is $8m or so for a $292m enterprise value. At $30m EBITDA this trades just under 10x but if EBITDA growth truly holds at 10% per year, then at $10/share you’re getting this business for ~6.6x 2028 EBITDA ($44m).

Summing it up…

Retail and restaurants are fickle businesses. But the trends look solid here. Looking ahead 3-5 years, I could see Potbelly as a 75/25 or 50/50 franchised business model generating significant cash for growth and buybacks.

A combination of cash from store operations and franchise sales would be more than sufficient to pay for new openings (estimated $650k per store so 10 stores = $6.5m investment). So perhaps there’s room for buybacks or other capital allocation along the growth curve… Hmm…

I don’t own shares of this one (yet) but if I could get comfortable with the growth plan (or if shares traded down a bit), then I could see myself holding this. It’s a simple business with clear store-level improvements. The franchise backlog all but locks in the long-term growth profile. And it doesn’t rely on short-term events (i.e. could hold for years).

Thoughts welcome!