Quick Value #251 - Liberty Global (LBTYA) + Sunrise (SNRE)

A look at recently completed SpinCo and post-close RemainCo

Today’s idea:

Recent telecom spin-off trading at 8.4x EBITDA

Plans for near-term (2025) dividend imply 8.6% yield

RemainCo = operating companies + levered investment portfolio

NAV for RemainCo could be $30/share (vs. $13 current share price)

This marks year 7 of Value Don’t Lie / Quick Value write-ups! Thanks for your support. As always, drop a note with stocks you want to see covered and check out past posts here to get a sense for both free and premium write-ups.

Quick Value

Sunrise Communications (SNRE)

My original intention this week was to cover the Sunrise Communications (SNRE) spin-off from Liberty Global (LBTYA). But candidly, I started looking and just wasn’t all that interested. Granted, I’ve only taken a surface-level look so please tell me if I’m missing something… Liberty looks much more compelling here.

Sunrise Communications (SNRE) — SpinCo

Sunrise is the #2 player in broadband, mobile plans, and cable TV in Switzerland. It’s a mature industry in a developed economy with the top 3 players having 70-100% market share in each category. Publicly traded Swisscom (SCNM) is the market leader in each category.

Before jumping into Sunrise… Note that Swisscom has huge market share, very little leverage, and a reasonable valuation at ~7.5x EBITDA. This 20-year picture of operating cash flow and FCF shows a capital intensive business with no growth over a very long timeframe:

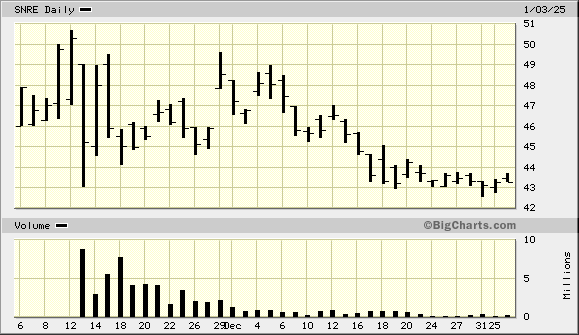

Sunrise was spun with ~96m shares (technically 70m class A and 25m class B) x $43 current share price = $4.1bn market cap (USD). At 0.9x USD to CHF exchange rate, that’s a CHF3.7bn market cap. You could argue the value between A and B shares but I’m skeptical the market would ever truly credit that argument (the B shares have 1/10th the economic value of an A share). Net debt is ~CHF5bn as of 6/30/24 (per prospectus) for an EV of CHF8.7bn.

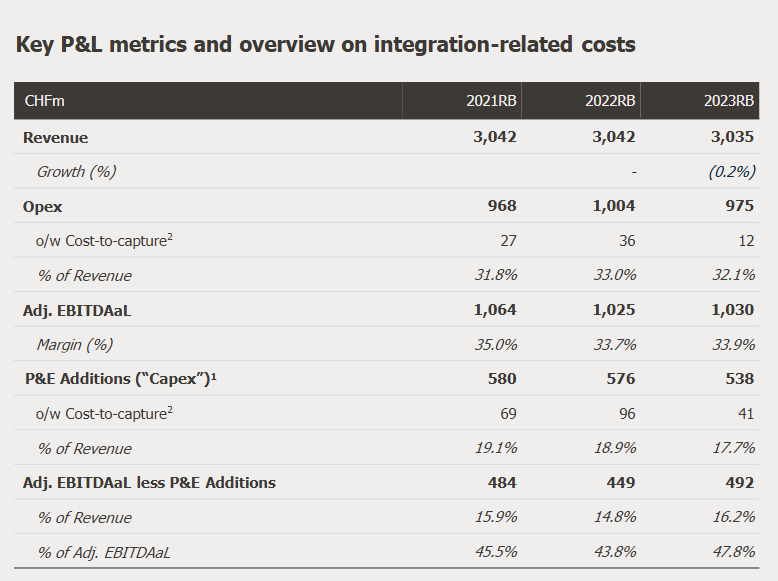

From 2021-2023 both revenue and EBITDA are basically flat. Trailing EBITDA is CHF1.03bn (8.4x) with 4.85x leverage. This looks like a levered equity story.

The 2024-2025 and midterm outlook calls for more of the same… revenue expected to be “broadly stable” which sounds like 0-1% growth (maybe -1% to +1%) annually. Most (all?) FCF growth is coming from declining capex (16-18% in 2024 down to 15% in the midterm).

Once Sunrise hits 3.5-4.5x leverage, expected mid-2025, they plan to turn on a CHF240m dividend or USD $3.70/share (8.6% yield) vs. Swisscom trading at a 4.4% yield. Note the B shares get 1/10th the dividend so I’m taking the CHF240m over 72.6m share count.

Sunrise is a levered, capital intensive, and low-to-no growth business in a stable market with a high yield and a reasonable valuation (but not dirt cheap).

As a final reference, here are some long-run metrics for market leader Swisscom. Median EV/EBITDA at 7.4x, median yield at 4.4%, leverage consistently below 2x.

Sunrise looks fairly valued at $43/share… Maybe the right comp for this is legacy LBTYA or other levered cable companies? Or maybe the yield on this is a way to play super low Swiss government rates?

What does Liberty Global CEO Mike Fries have to say about it?

Sorry, Mike; but yes, this is most definitely a levered equity story (with a nice potential yield).

Liberty Global (LBTYA) — RemainCo

So where does the spin-off leave Liberty Global?

On a recent call, CEO Mike Fries said about the Sunrise spin:

Today, that company, which represented before the spin, roughly 20% of our proportionate EBITDA in our telecom group now is about 45% of our market cap. I'll let that sink in for a second.

Post-spin, RemainCo LBTYA will consist of:

Three wholly-owned and consolidated operating subs (Telenet in Belgium, Virgin in Ireland, and UPC in Slovakia)

Two 50%-owned JVs (VMO2 in the UK and VodafoneZiggo, VFZ, in the Netherlands)

A portfolio of various listed and unlisted investments

The bulk of operating EBITDA will come from Telenet going forward while the UK & Netherlands joint ventures are likely the most valuable non-consolidated assets. Remember: financial statements, balance sheet, cash flows, etc. do not include operating results from these JVs, they are footnote disclosures.

There are 357.5m shares outstanding x ~$13/share = $4.65bn market cap (USD). At 9/30/24, cash was $2.35bn, and debt was $15.9bn. We know they sent $5bn net debt to Sunrise so net debt drops to $8.55bn. That’s a pro-forma EV of $13.2bn after the spin.

Operating EBITDA in 2023 was ~$1.23bn (10.7x multiple) but we need to add the JV and investment values.

The investment portfolio totaled $14.5bn at 9/30/24 with the bulk of it attributed to those 2 joint ventures (a combined $9.56bn or 66%). Here’s a breakdown of everything in there:

That $14.5bn works out to $40.55 per share. Wholly-owned operating businesses are likely worth at least the net debt balance of $8.55bn (that’d be a ~7x EBITDA multiple), so at first glance it looks like there’s a big price-to-value discrepancy here?

Other factors to keep in mind:

JVs produce regular cash dividends even though non-consolidated — call it $1.3-1.4bn (USD) in FY24 or $3.80/share and FY23 looks like $594m ($1.66/share)

Operating companies ex-Sunrise (i.e. RemainCo) are negative cash flow — Telenet going through some capex (screenshots below with FY24 FCF guide and FY23 FCF)

Buybacks — Liberty continues a blistering buyback pace ($16bn total over past 8yrs)

Other spins or sales — Management is talking up additional asset sales or spin-offs to unlock value… timing is unclear but it looks like they are working to close the value gap

Summing it up…

Sunrise is a levered dividend story in a stable market. Could be an interesting way to sit on your hands and generate some income. Liberty RemainCo is part operating company and part levered investment portfolio. Buybacks have been ineffective at driving shareholder returns for many years so management is taking steps to unlock value elsewhere.

I don’t own either of these but would be more inclined to own Liberty Global… say the operating businesses cover the debt (implies 7x EBITDA) and a 25% discount to the investment portfolio ($10.9bn) = $30.50/share implied value vs. current $13 share price.

Clearly this is an overly simplified view and you’d need to unpack the underlying performance at each sub + JV. But as a starting point, there’s a hefty discount gap here and a drive to unlock it.

Resources:

Hi VDL, I agree that Sunrise is not particularly interesting. I own some Liberty stocks and I sold Sunrise shortly after the spin-off.

Be careful with 2024 FCF guidance slide. It's a bit misleading - distributions from JVs (850mln and 300mln) should be divided in half. I don't know why, but they showed full amounts distributed by these companies, even though they get only 50% of them.