Quick Value 2.7.22 ($CHE)

Chemed Corp - Quality business underperforming S&P over past 2yrs

Market Performance

Market Stats

PMI for manufacturing and services continue their above-average expansionary readings but they’ve slowed from recent highs — this is a measure of future business activity for manufacturing/service sectors.

Labor force is returning to pre-pandemic levels of ~164m people… At the latest reading of 163.7m, we’re less than 1m shy of the total labor pool measured before COVID started. Job openings have soaked up most of the returning laborers with minimal dent in the unemployment rate.

Quick Value

Chemed Corp ($CHE)

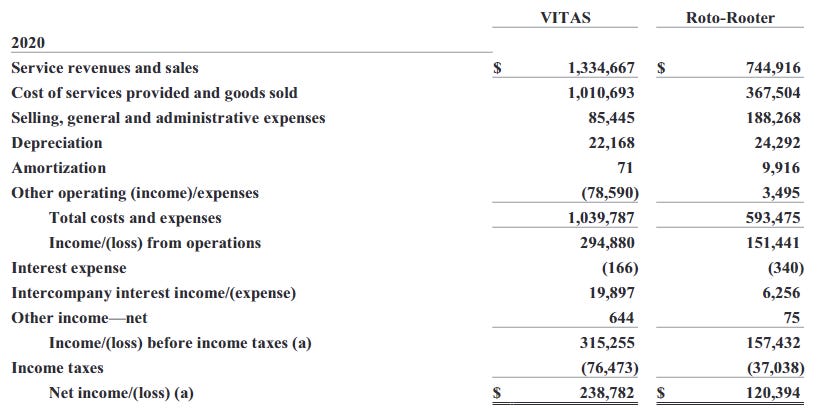

I was surprised to see this name show up on a list of market underperformers over the past 2 years. Chemed operates 2 non-related / non-integrated businesses in a HoldCo format — Roto-Rooter plumbing, drain cleaning, etc. to residential/commercial customers and VITAS hospice / home healthcare services.

Chemed has a pretty stellar decade+ track record of delivering consistent sales and earnings growth (with incredibly low volatility).

Both segments have a similar quality factor and growth trajectory to them so it’s not a case of good business / bad business.

There are some qualitative factors at play that make this an interesting / high quality business:

Both segments with plenty of growth runway

Chemed has been acquiring Roto Rooter franchisees at 6-8x EBITDA multiples — there were 369 franchisees vs. 127 company-owned locations at yearend 2020

Hospice and home healthcare is a large and growing market

Stable earnings — Chemed experienced no/minimal impact during the 2007-2010 period encompassing the GFC and again through the COVID pandemic

Consistent capital allocation — management has avoided splashy capital allocation moves by sticking to basic tuck-in acquisitions and buybacks while avoiding leverage — $1.9bn returned to shareholders from 2007-3Q21

Chemed has 15.4m shares outstanding x $468 share price = $7.2bn market cap. No net debt outstanding with this company. 2020 benefitted from ~$80m in CARES Act income so when backing that out, trailing pre-tax earnings were $320m — a 22.5x multiple.

There has been considerable multiple expansion at play but generally the stock price has followed suit with strong earnings growth. Only within the past ~2 years has the stock price started to diverge from earnings growth (and modestly so).

This one isn’t a cheap stock for a change; it’s a high quality business. There’s something to be said for owning a company that delivers very few surprises on a regular basis! It wouldn’t surprise me if they continued to deliver on long-term earnings / share price growth as seen in the past.