Quick Value #273 - FTV/RAL spin-off

SpinCo = Ralliant (RAL), RemainCo = Fortive (FTV)

Today’s post:

Fortive (RemainCo) spinning off Ralliant in a few days

Stock is trading at 17.1x FCF (pre-split) with low leverage

Both businesses are part of the Danaher “coaching tree” (i.e. quality)

RemainCo = quality + organic growth / SpinCo = M&A + capital returns

Pre-split shares of FTV underperforming S&P 500 & industrials since 2016 spin

Quick Value

Fortive (FTV) & Ralliant (RAL)

Ticker: FTV

Price: $70

Shares: 340m

Market cap: $23.8bn

Valuation: 17x FCFI don’t normally care for high-multiple “quality” stocks and initially wrote this one off despite my cardinal rule to review every spin-off. However, after skimming some numbers, looking at comps, and seeing the long-term underperformance; I think there might be something here…

Fortive (FTV) is set to spin-off Ralliant (RAL) on 6/28/25 with when-issued trading beginning on 6/25/25. Shareholders will get 1 share of RAL for every 3 shares of FTV (that means 340m FTV shares out and 113m RAL shares out).

So what’s the scoop?

Before taking a deeper dive, I started with the shareholder letter from the Form 10 filing which gave me some helpful nuggets… it sounds like Ralliant will be the “cash cow” focused on M&A + capital returns; while Fortive will pursue organic growth.

Let’s take a closer look at each piece…

SpinCo (Ralliant)

Ralliant will operate as 2 segments: 1) Test & Measurement; and 2) Sensors & Safety Systems. These businesses are typically small dollar amounts tied to larger projects in industries with nice tailwinds (utilities, defense, semis, etc.). Tektronix had been in the Danaher portfolio since 2007 and Qualitrol since 1986 (these are long tenured businesses).

Trailing revenue is $2.1bn with $430m FCF which represents roughly a third of pre-split Fortive. Ralliant spent $1.45bn to acquire test equipment maker EA Elektro Automatik in January 2024, but trailing results are flat with 2023 and 2024 which isn’t promising.

EBITDA margins are expected to drop 220bps from standalone costs (25.7% to 23.5%), so that could hit FCF by $45m or so. Management outlined the following multi-year financial plan:

3% organic growth + 1% M&A growth = 3-5% annual sales growth

S&S margins in high-20s + T&M margins at mid-teens to low-20s = low-to-mid-20s combined EBITDA margins (surprising how poor T&M margins are?)

2% capex = 95% FCF conversion (>$1bn cumulative FCF through 2028 = $300-340m per year depending on how you look at it)

$1bn net debt = 1.9x leverage

What are shares worth?

There are some close peers: Keysight (KEYS), Teledyne (TDY), and Ametek (AME) trade at 17-18x EBITDA and 20-24x FCF. They have EBITDA margins of 22%, 24% and 31% so Ralliant will fit nicely with 23.5% EBITDA margins after standalone costs.

FCF is perhaps the best valuation measure for these businesses; it’s a close proxy to earnings given the high conversion rates and revenue/margin performance is very stable over time.

Trailing FCF is $430m inclusive of the EA acquisition, but excluding standalone public company costs. Call it $385m. At 17-20x = $6.5-7.7bn equity value or $58-68 per share (113m post-split share count).

I’m interested in this one at $44 post-split (~$15 pre-split) which equates to 13x FCF. My biggest concern is the “$1bn cumulative FCF through 2028” guidance which implies significantly lower FCF than what I’ve described.

RemainCo (Fortive)

Fortive was a 2016 spin-off from Danaher so you know they’re dialed-in operationally with their own version of the Danaher Business System. In 2020, they spun-off their transportation business Vontier (VNT).

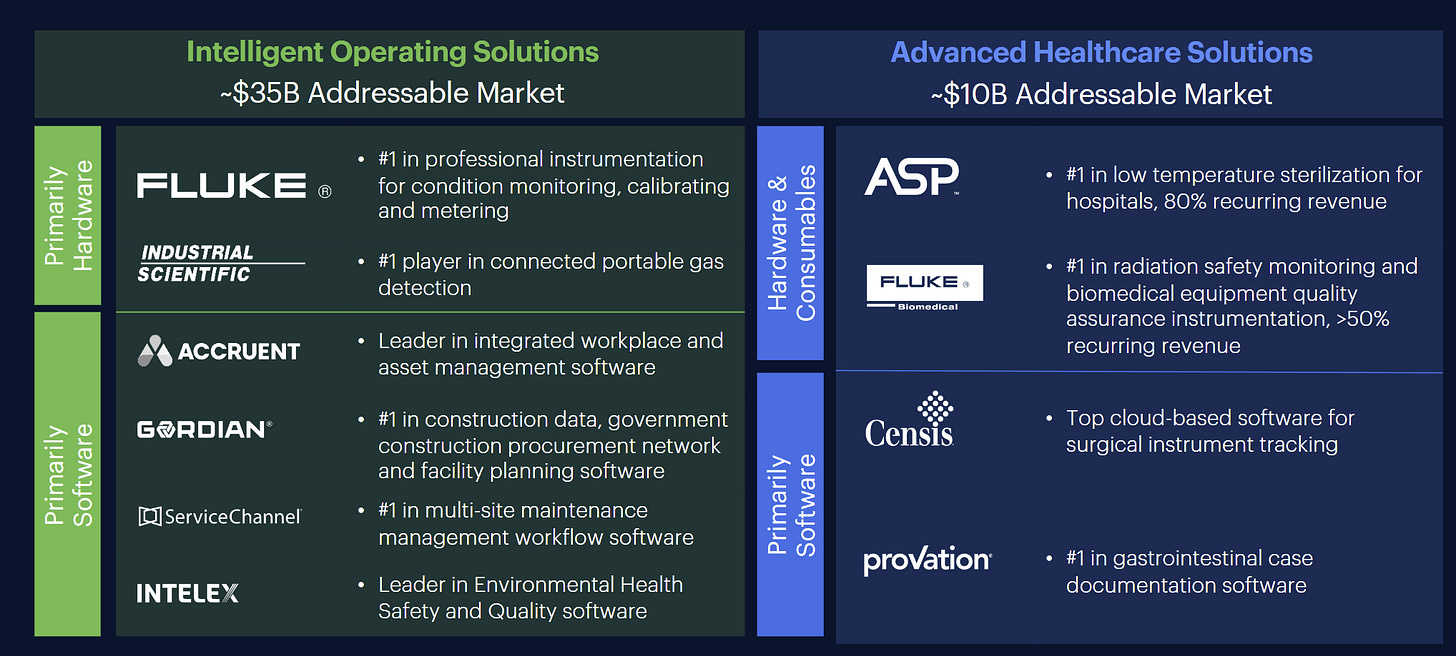

RemainCo will have 2 segments, both with a mix of hardware (51% of sales), software (28%), and consumables (13%) revenue.

Advanced Healthcare Solutions (AHS) — 30% of sales, 80% recurring revenue, 26% EBITDA margins

Intelligent Operating Solutions (IOS) — 70% of sales, 35% recurring revenue, 34% EBITDA margins

Interestingly, Fortive shares have been a dud since the initial 2016 spin (granted, you would have gotten shares of Vontier along the way):

But this is a high-performing industrial conglomerate, how could it possibly underperform the market?

Let’s look at the consolidated cash flows and where management has been allocating capital…

Interesting… FCF was flat from 2018-2023 despite $9.5bn spent on acquisitions during that timeframe. That sounds like capital destruction? You’ll notice 5 years with >$1.5bn acquisition spend apiece… most of these were larger deals at RemainCo and some at lofty software multiples (7-10x revenue).

Software company Accruent in 2018 at 7.4x sales (IOS)

J&J’s “sterilization & disinfection” business in 2019 (AHS)

2 software companies in 2021 at 10x sales each (IOS & AHS)

EA Elektro test maker acquired in 2024 at ~14.5x EBITDA (part of RAL)

After 2021, RemainCo has been on a ~3.5 year hiatus from making acquisitions. So perhaps they’re finished building out the foundation for this organic growth machine?

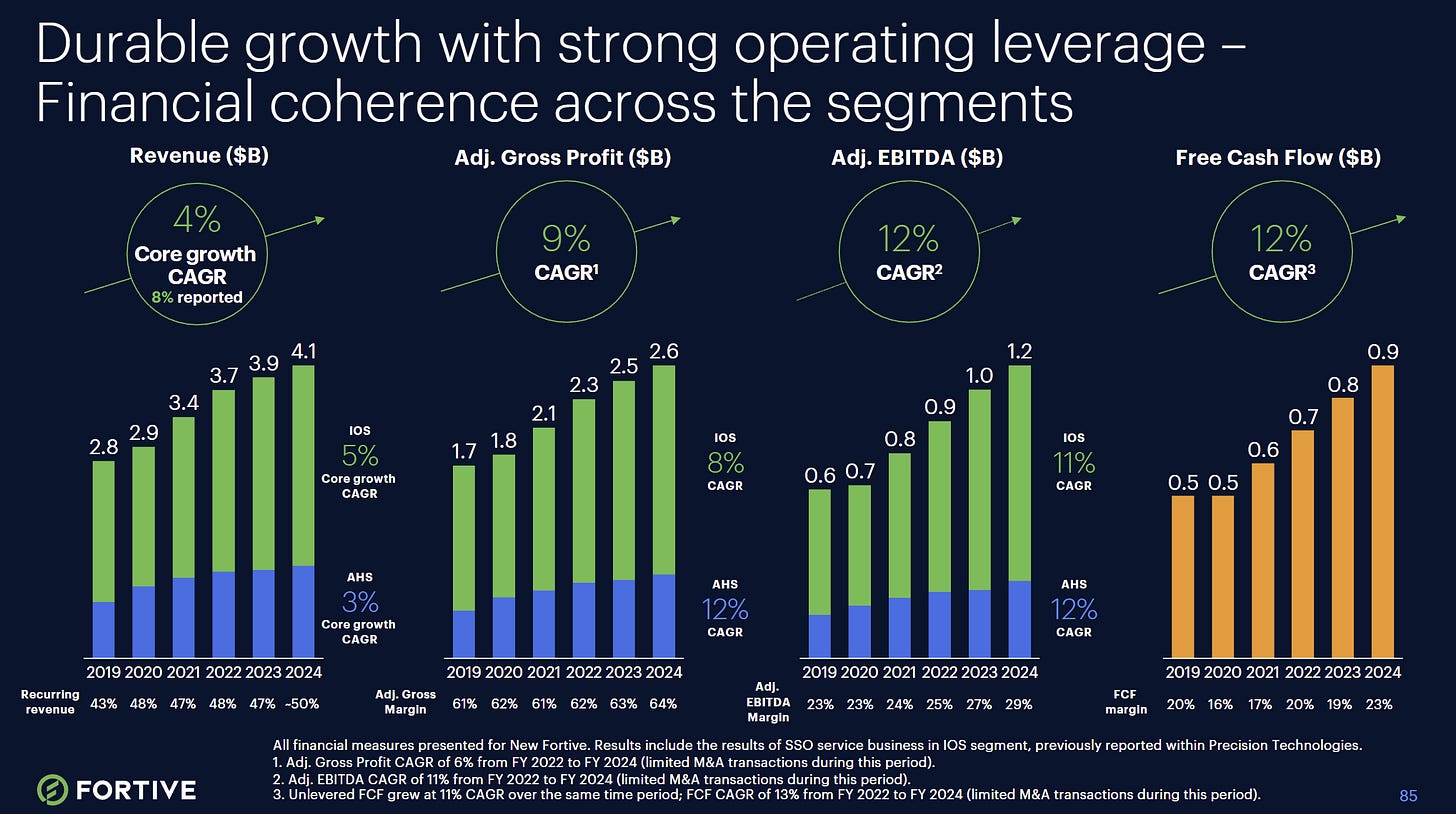

Fundamentals certainly look much better than Ralliant. And most/all of this performance is organic.

Here are the fundamentals by company:

So Ralliant is flattish since 2022 and RemainCo is growing top-line and FCF nicely. Management is targeting:

3-4% revenue growth (organic) with 50% recurring revenue mix

29% EBITDA margins (close to industry best-in-class)

HSD EPS growth

$1.2bn net debt = 1.7x leverage (targeting 2.5x gross debt)

Back to the FTV share price underperformance…

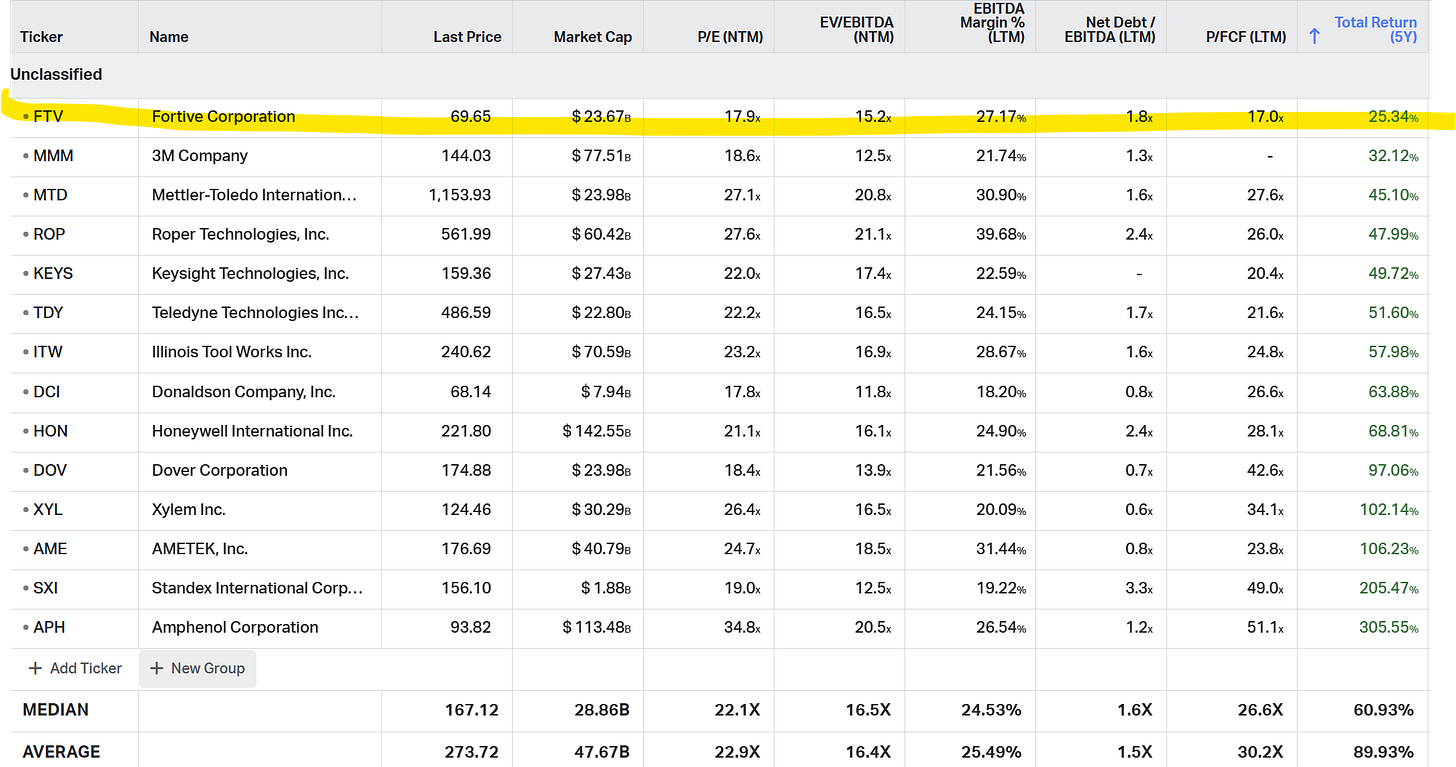

This stock is the worst performing industrial conglomerate over the past 5 years by a good margin. It’s also the cheapest stock in the group based on earnings/FCF despite top-tier margins and solid growth in the RemainCo segments…

Hmm…

This is beginning to feel a bit like a GoodCo / BadCo situation (though Ralliant is likely a much better business than your typical BadCo).

Without digging deeper into the underlying business/industry, Fortive appears to be a world class business deserving an industry multiple (20-23x).

Assuming flat FCF of $960m ($2.82 per share) at 20-23x = $56-65 per share. I’m probably a buyer of this piece at $45 (16x FCF) though I’d be surprised if it gets there.

There are 2 ways to look at this situation:

Buy today and you’re getting RemainCo Fortive at a “cheap” 17.1x FCF for a business worth much more than that

Wait and see if 1 side of the split becomes more/less attractive. Based on the fundamentals, maybe Ralliant gets overly punished, etc.

Disclosure: I don’t own shares of Fortive, but I might be a buyer depending on initial trading prices.

Resources:

Early read:

FTV at $53 = ~18.8x FCF ($2.82/sh)

RAL at $48 = ~14x FCF ($3.40/sh)

I think there's some risk to my FCF estimates for RAL... planning to watch it