Market Performance

Market Stats

Last week we ran through some economic fundamentals… This week let’s take a quick look at some market valuation metrics.

Under current S&P 500 earnings estimates, the index sits at 22.6x 2021 estimated earnings (based on Yardeni estimates) and 19.6x 2022 estimates.

If you’re comparing to historic valuation levels — we’re still a bit elevated even when considering 2022 estimates.

Alright, so it certainly seems that valuations are the one (or just the largest) blemish when considering future returns — both business and consumer sides of the economy are showing positive signals.

Consider that future estimates may still be too low… and part of the recent optimism is the strength in recent earnings results… As of Feb 2021, >80% of S&P 500 companies are reporting results above estimates!

Quick Value

ConocoPhillips ($COP)

Next up on the energy list is Conoco which is still down 25% over the past 1-year. Conoco is a large oil and gas exploration and production company. They drill oil wells and sell the oil they produce.

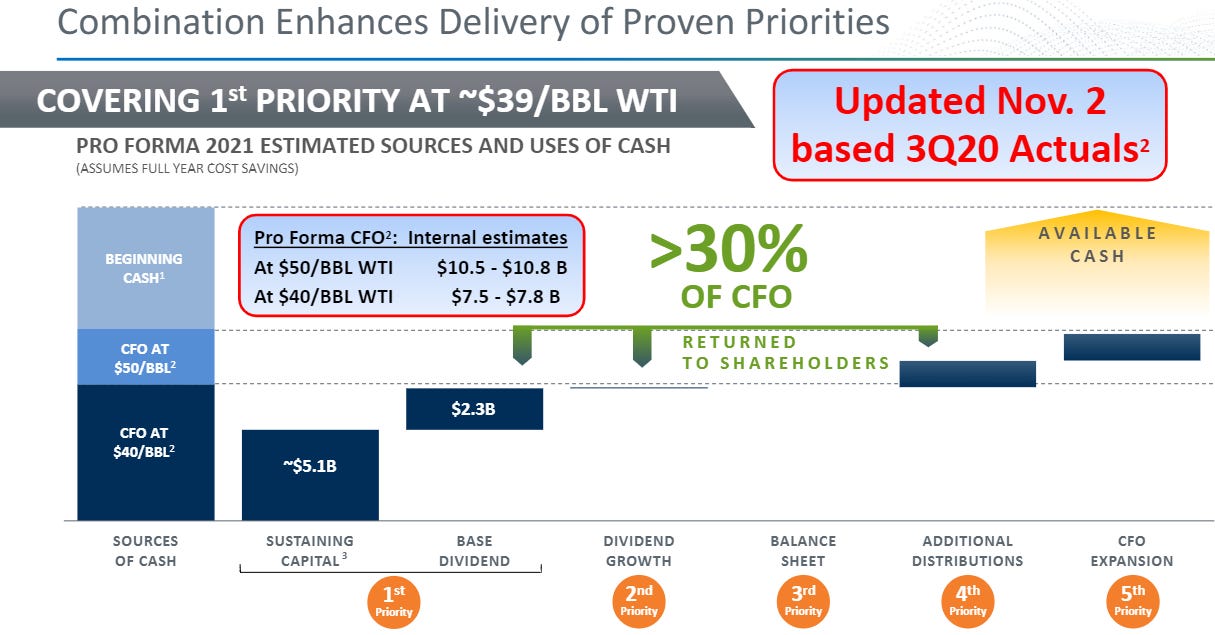

Like last week’s post on Devon Energy, Conoco recently completed a large merger of their own in Concho Resources. Another similarity, it was an all-stock deal… i.e. no new debt added to the combined company.

So the combined company has ~1.36bn shares outstanding and a $44.50 share price = $60.5bn market cap.

Just like Devon… Conoco is turning to a “shareholder-friendly” approach to running the business… This means returning cash via dividends and buybacks while investing in only sustaining capex until returns justify anything more.

At $50/bbl oil price (current price is $57), Conoco estimates $10.5bn in operating cash flow. Of which they think $7.4bn goes to sustaining capex and dividends (3.8% current yield). That would leave another $3bn for growth capex or more capital returns on this $60bn market cap.

What I find interesting about this situation along with Devon from last week is the major turnaround in management tone across energy companies. Here’s a quote from the latest Conoco earnings call:

Second, we're committed to growing free cash flow, and we're setting up the company to be a significant free cash flow generator. That means maintaining capital discipline, but also driving program improvements that enhance uplift efficiency. In other words, we're driving free cash flow growth, not production growth.

Here’s yet another major oil producer talking about generating free cash flow at the expense of production growth.

Estimates call for 2022 EBITDA of $12.8bn on this $75bn enterprise value nets a 5.9x EV/EBITDA multiple. Not much credit for a potential change in oil economics and/or a massive change in direction for industry capital allocation standards…