Market Performance

A quick check-in on YTD performance:

S&P 500 down ~11%

R2K down ~12%

Microcap index down ~10%

Market Stats

Consumer confidence/sentiment looking a bit shaky at the moment; the sentiment survey in particular has been taking a nosedive lately

Inflation has notched another large YoY increase of 7.9%… that’s 12 straight readings above the Fed target of 2%

Quick Value

Carvana ($CVNA)

So this one is truly a departure from my usual value-based stocks trading at low multiples of earnings or cash flow but it caught my eye when they announced they were buying the US physical auto auction business from ADESA ($KAR) for $2.2bn.

Most should be familiar with Carvana at this point, the e-commerce-based auto retailer that will buy your car, sell, finance, and deliver a new one straight to your home. Here’s how they characterize the auto dealer landscape today:

They held an analyst day back in 2018 that outlined some long-term goals. Those included reaching 8-13% EBITDA margins in the long-run. The low-end of that range has been the high-end for publicly-traded auto dealer competitors.

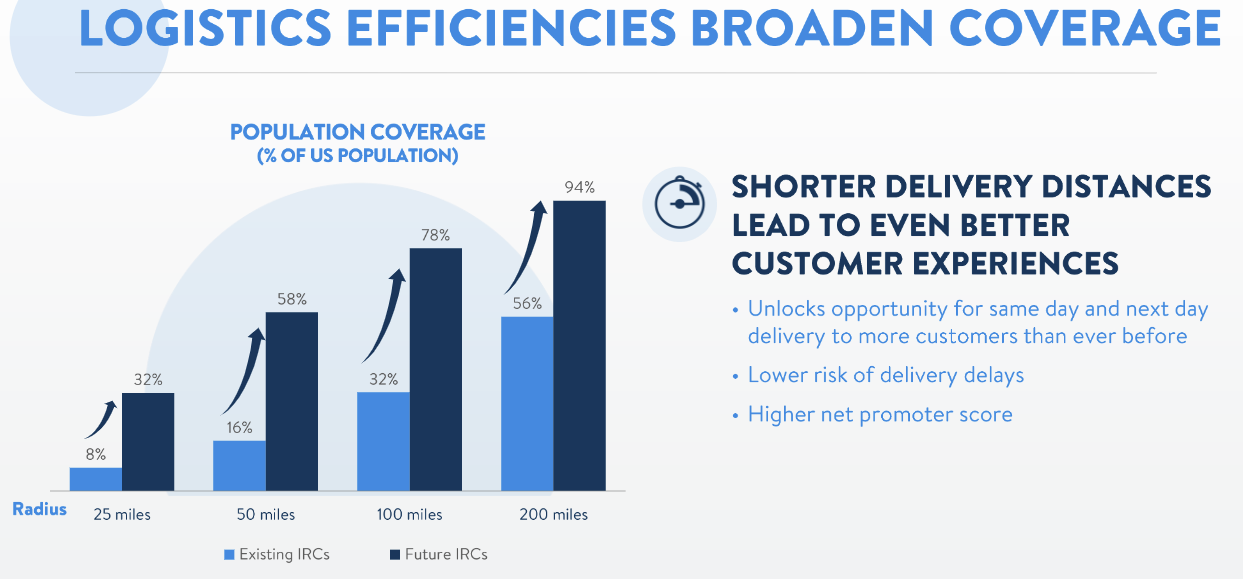

By adding the auction business, Carvana picks up 56 locations that can service and recondition vehicles, it also shortens the delivery distance and cost pretty substantially. Here are the main slides laying out the thesis for buying the auction business…

Added production capacity

Shorter distances to customers = faster delivery times

Savings on logistics (delivery) costs

An important note — management commented that the deal won’t add to the long-term margin goals but it will shorten the timeframe it takes to achieve them.

Like other e-commerce centric businesses, the pandemic provided a huge boost to Carvana. Sales were <$2bn in 2018 and hit $12.8bn in 2021. Analyst estimates project 25-30% annual sales growth over the next 5 years and an EBITDA target of $2.3bn in 2025. With the ADESA deal, management is confident the new target could be $5bn with production capacity.

With ~90m shares outstanding (and growing), Carvana is a ~$10bn market cap at $113/share with another $5bn or so in net debt. Analysts forecast $2.5-3bn in FCF outflows over the next 3 years until reaching critical mass for EBITDA and FCF… By the time those 2025 targets come around, it’s possible Carvana has a ~$23bn enterprise value.

This is a big market with minimal market share held by market leader(s) so Carvana could be expanding for a long time. In the shorter term, a $23bn EV by 2025 could be 10x EBITDA or 5x EBITDA depending on whether management forecasts or analyst forecasts prove to be accurate.