Quick Value 3.15.21 ($RHHBY)

Roche - cheap large cap pharma and diagnostic business

Market Performance

What a week for stocks across the board and especially small stocks!

YTD performance:

Microcap +33%

R2K +19%

S&P +5%

Market Stats

I’ve been wanting to take a closer look at the pharmaceutical sector and what

Here is an overview of the Pharma sector as I see it today:

I’ve got 16 companies here with a total market cap of $2.5tn generating $173bn in cash flow (14.4x multiple) and trading at 13.5x earnings with 1x leverage.

Naturally, as I’ve been mulling this over, Barron’s released a piece on some of these companies recently. Their idea that pharma is a closet COVID reopening play seems a bit silly to me but the sector looks cheap nonetheless.

Quick Value

Roche Holding AG ($RHHBY)

I’m not going to spend 16 weeks covering this list of stocks and I’ve already highlighted a few in past posts. So I’ll wind up cherry-picking a few to highlight over the next few weeks. Strap in. Barron’s covered Merck, AbbVie, Bristol, J&J, Amgen, Pfizer and Lilly in their latest piece so I’ll set those aside…

Roche is a bit more like J&J than the rest of the group as they have a large pharmaceutical division but also make diagnostics.

The diagnostics business competes against businesses like Siemens and Abbot making tests for things like diabetes.

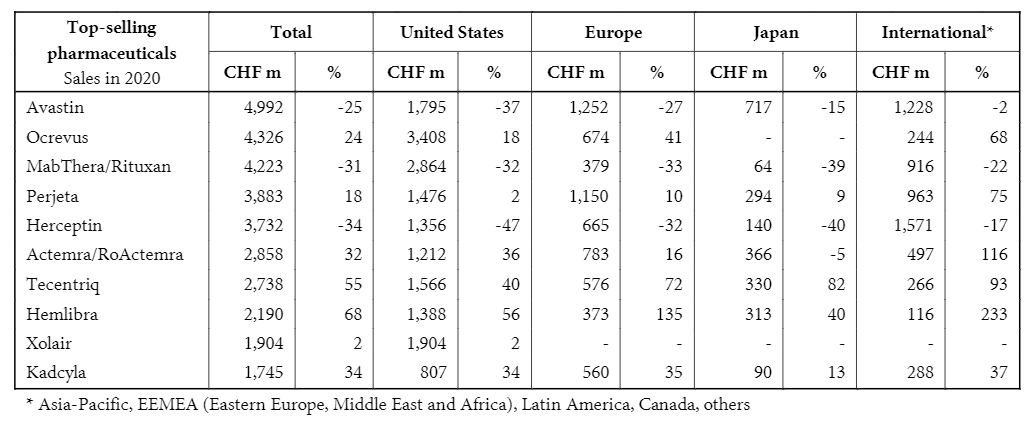

What I like about this pharma business is the low concentration in individual products. The largest selling drug accounts for ~10% of pharma sales. Though some of these are declining from generic competition.

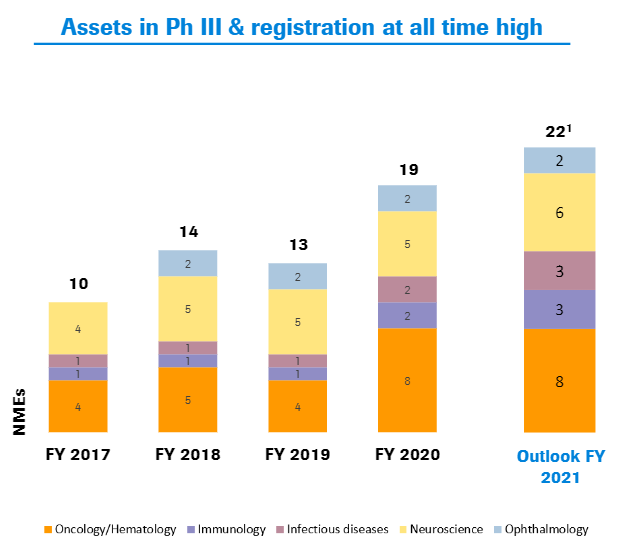

Also, the pipeline looks full with a large number of products in Phase 3 or in registration.

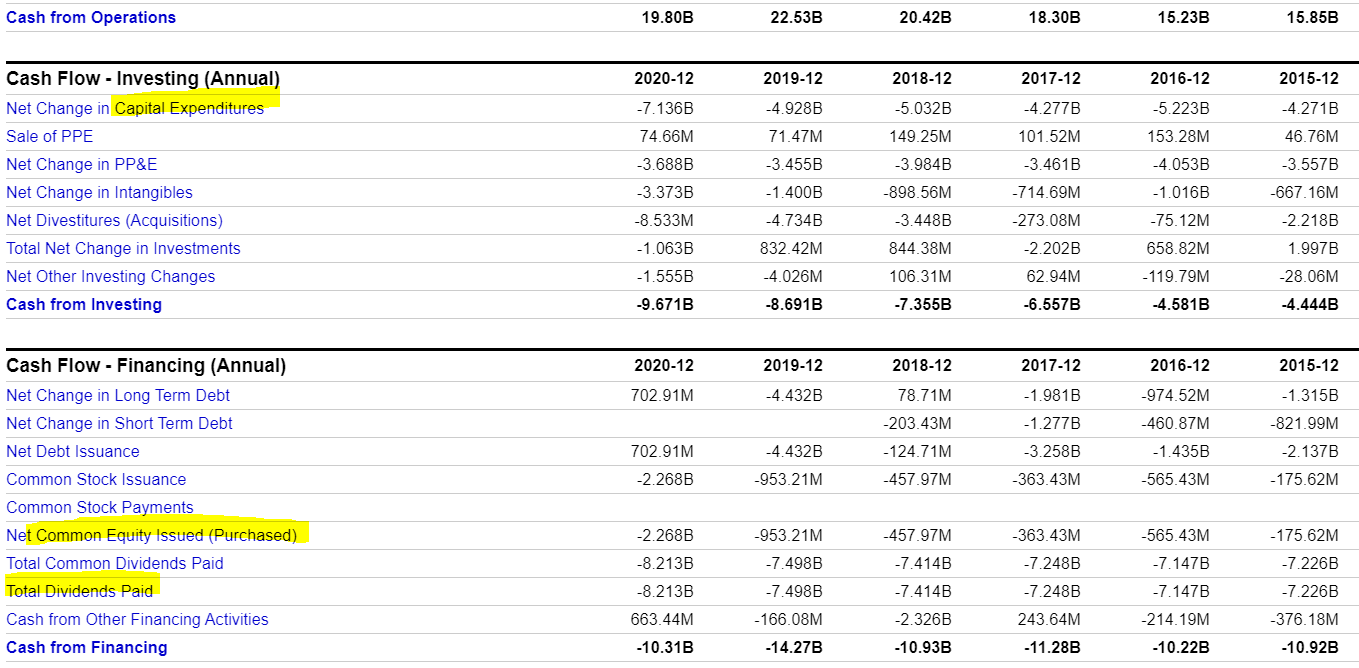

Though there are certainly some positive attributes to Roche — the big drawbacks are the heavier than peer capex levels (8-10% of sales vs 4-5% for J&J) and the underwhelming capital deployment…

Over half of free cash flow goes toward the modest ~3% dividend and a much smaller amount has gone to buying back shares. They’ve spent a lot of time repaying debt despite an already pristine balance sheet.

There’s room for a more aggressive stance but some foreign companies are slow to take the same approach as US competitors with leverage and buybacks…