Quick Value 3.20.23 ($R)

Ryder - could be at compounder status?

We’re back with a free Quick Value this week! There are tons of really interesting value stocks out there at great prices right now; subscribe below to keep the actionable ideas coming :)

Market Performance

Market Stats

Energy and materials are ALL trading below their 50-day moving average per Bespoke… Banks are getting a lot of attention but energy/materials a little more beaten up at the moment.

Quick Value

Ryder System Inc ($R)

What they do…

Ryder System Inc helps businesses manage their transportation needs. They rent, lease and maintain vehicles such as trucks and vans, and provide logistics services to help businesses move goods efficiently. They own/operate ~260k vehicles, 300 distribution centers, ~1m square feet of warehouse space, and 750 maintenance locations.

There are 3 segments:

Fleet Management Solutions (FMS) — Truck leasing and rental business. Management refers to it as the “outsourcing of a truck.”

Supply Chain Solutions (SCS) — “SCS product offerings includes: distribution management, dedicated transportation, transportation management, brokerage, e-commerce, last mile, and professional services.” Described as outsourcing of trucks, drivers, warehouses, distribution centers, and transportation networks.

Dedicated Transportation Solutions (DTS) — Smallest segment. The “outsourcing of a truck and a driver.”

Why it’s interesting…

1) Fundamentals look really good

Fundamentals in general look pretty solid and it seems like the business has created sustained improvement while valuation is more-or-less flat.

Revenue grew 10% annually from 2016-2022

Operating cash flow has been inching higher annually (7.5% growth since 2011)

Earnings per share are up >2x over the past 7 years

Book value and BV/share are up while P/B is flat

Overall capital intensity is down as % of revenue

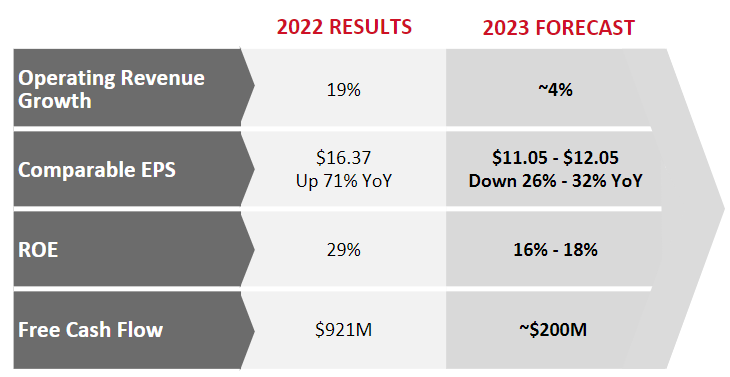

Ryder has very clearly benefitted from pandemic-related supply chain issues and 2023 looks like it’s normalizing a bit from higher returns in 2022… so it’s possible the cycle could be turning on them.

2) Asset light transition

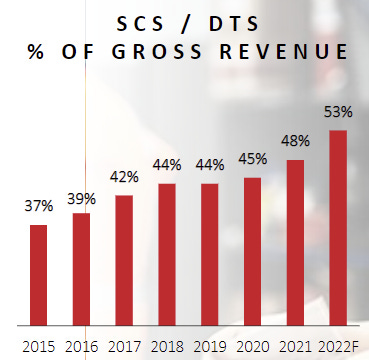

2022 was the first year where the asset light segments SCS/DTS were more than 50% of total revenue. These segments require a lot less capital than the leasing/rental segment (though they benefit from services provided by that segment). SCS/DTS aren’t necessarily higher margin businesses; they just don’t need as much owned equipment.

Management has made a concerted effort to grow this piece of the business and the results are showing. Revenue mix is up and net capex as a percentage of revenue is way down. It looks like net capex was averaging ~$1.7bn from 2011-2016 when revenue was ~$6.5bn per year (>25%)… today, net capex is up ~30% from those levels while revenue is >2x higher.

One caveat — post-COVID, management is clearly ramping capex to keep pace with demand. Guidance calls for >50% net capex growth in 2023.

3) Activist investor situation

Activist investor HG Vora owns ~10% of the company and made an offer mid-2022 to buy the company for $86/share. The board rejected the offer but HG Vora hasn’t sold down their stake. Later in 2022, it was rumored that Apollo was interested in buying Ryder.

There haven’t been any updates on either of these situations but clearly others are seeing the business improvement.

Summing it up…

Guidance calls for $11-12/share in EPS and FCF/share looks to be down to ~$4.35 (although 2022 FCF included a $400m exit of their UK business). Revenue is expected to grow 4% in 2023.

Pre-pandemic this stock had a long-run average of 12.5x earnings but shares at $83 are trading at 7.2x. This could be a bargain price. Although, could this be related to results starting to normalize for a few years?