Quick Value 3.21.22 ($THRY)

Thryv Holdings - good biz/bad biz with declining publishing and growing SaaS

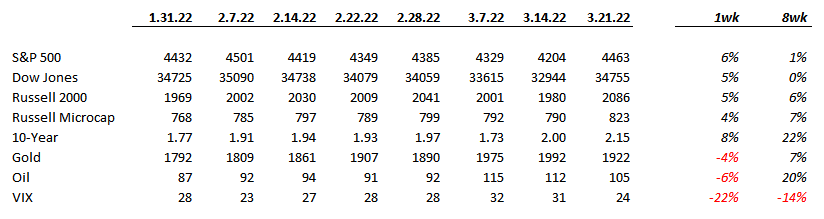

Market Performance

Market Stats

Mortgage rates are on the rise hitting 4%+ — while still a very low rate in a multi-decade context, it does have an impact on affordability with house prices rising

Retail sales just keep marching higher, growing 17% YoY in February. E-commerce sales (red bar) saw a big spike in 2Q20 through 1Q21 and while faded a bit, have started to level off

Quick Value

Thryv Holdings ($THRY)

This stock has been on my radar for most of 2021 as it’s been talked about on Twitter. What better way to finally dig in than through a weekly Quick Value post?

I should preface by saying that I’m covering this just a few weeks prior to their investor day on 4/5/22. So information could be a bit stale by the time that happens.

As a background, Thryv is a combination of post-bankruptcy Dex Media and publisher YP Holdings (merged in 2017); Thryv then came public in October 2020. They operate under 3 segments:

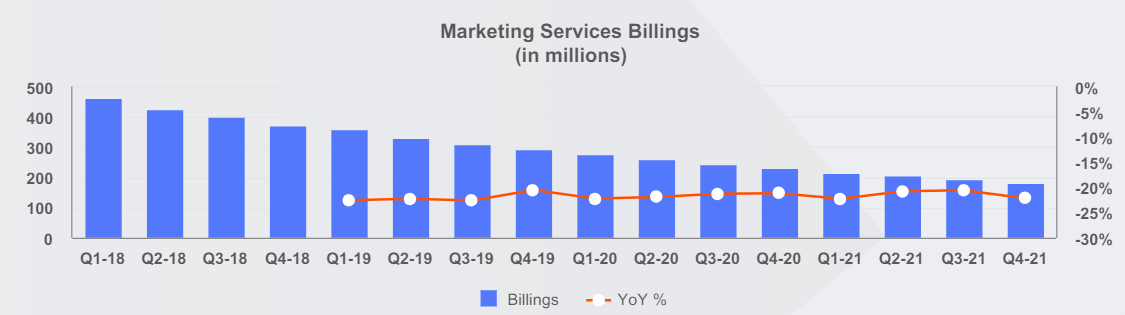

Marketing services — print & internet Yellow Pages (yes, that Yellow Pages)

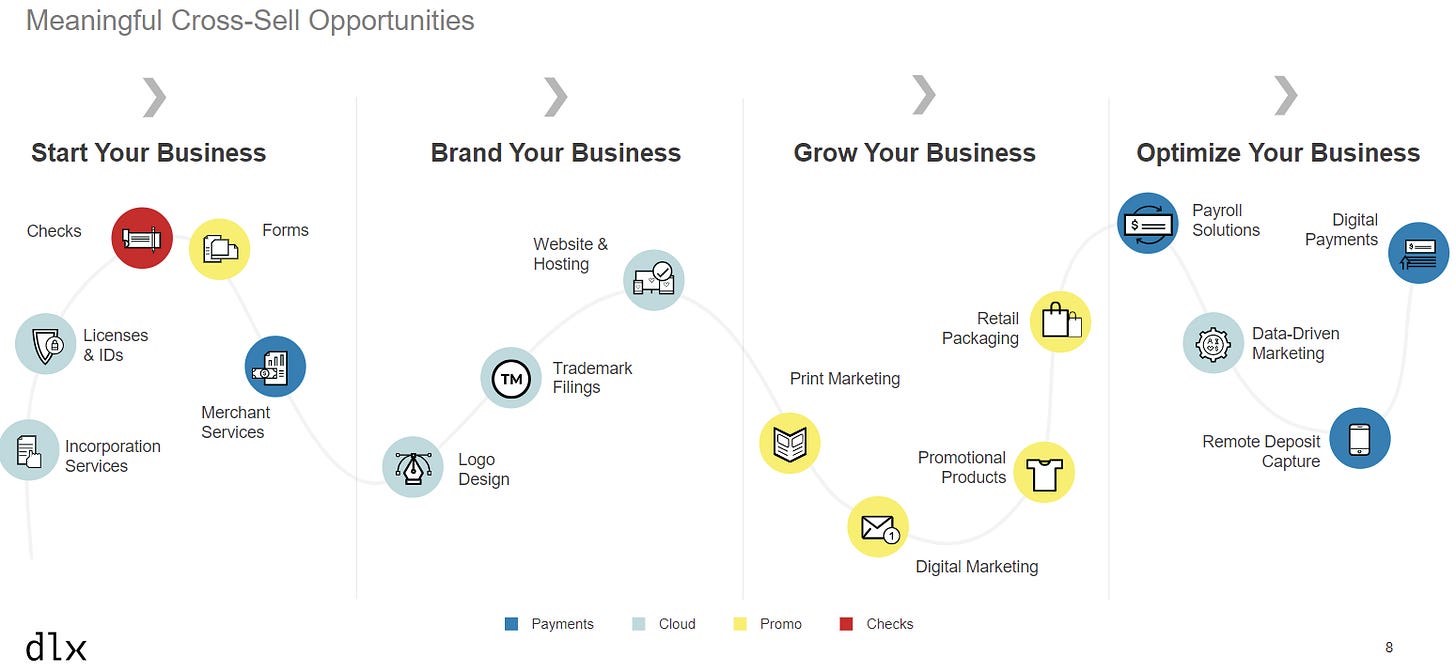

SaaS — SMB-oriented digital products like CRM, email/text marketing, scheduling software, invoicing, payments, social media, etc.

International — includes some international Yellow Pages and international SaaS offerings

It’s a “good business / bad business” situation. Marketing services is in rapid decline but generates cash flow which is getting funneled into the higher growth SaaS business.

The September 2020 investor day slides are a bit dated at this point but the long-term model looked like this:

How were FY21 results?

As expected, the marketing services sales fell 19% and SaaS revenue grew 31%. Overall EBITDA was down from $371m to $350m. They refinanced and repaid a small amount of debt and made a $175m acquisition.

And the outlook for FY22…

Again, marketing services continues to decline and the SaaS business is expected to grow another 20%. Management has opted to invest like a traditional growth company in taking the SaaS business to negative earnings in supporting the product.

There are some dilutive options and warrants outstanding so the share count looks more like 37m as of right now (I could be missing some securities here). At $31/share, that’s a $1.15bn market cap.

At yearend 2021, Thryv had ~$582m in outstanding debt and another $140m in pension obligations. The debt carries an expensive L+8.5% rate and is 38% owned by related parties. That’s an enterprise value of $1.73bn or so.

Simplistically using 2022 EBITDA guidance ($285m midpoint) = 6.1x EBITDA multiple and 2x leverage. A company like Intuit (QuickBooks, Mailchimp, TurboTax) trades at 10x sales… A more likely comparable company might be Deluxe ($DLX) — they are building a slightly different suite of products and targeting medium-to-large businesses but it’s essentially the same strategy — Deluxe trades at 7x EBITDA.

The big questions for Thryv (and these may get covered on the upcoming investor day):

Can the SaaS product compete with other digital behemoths like Intuit (the closest competitor in my opinion)?

How long will the marketing services / yellow pages business continue to generate meaningful cash?

Does management actually intend to repay debt or is the true goal to recycle marketing services cash flow into acquisitions? (this is how they are currently behaving.)

As an added tidbit, you can check out the Thryv product demo here.

If you like this content, check out my website www.valuedatalibrary.com and subscribe to my newsletter! It’s both self-serve (the VDL database) and regular programming (newsletter).