Quick Value 3.22.21 ($REGN)

Regeneron -- 15.4x PE and a big pile of cash... what next?

Market Performance

Market Stats

Retail and food service sales fell 3% from January but grew 6% from February last year. If you haven’t been out and about over the past few days, most consumers seem anxious to get out and spend money (at least it seems that way here in the Midwest).

As another reminder of the pharma / biotech sector — here’s the chart that was posted last week:

Quick Value

Regeneron Pharmaceuticals ($REGN)

Regeneron is a biotechnology company making complex products used in cancer treatment, eye diseases, oncology, and other complex diseases. This stock is mostly flat over the past 5 years.

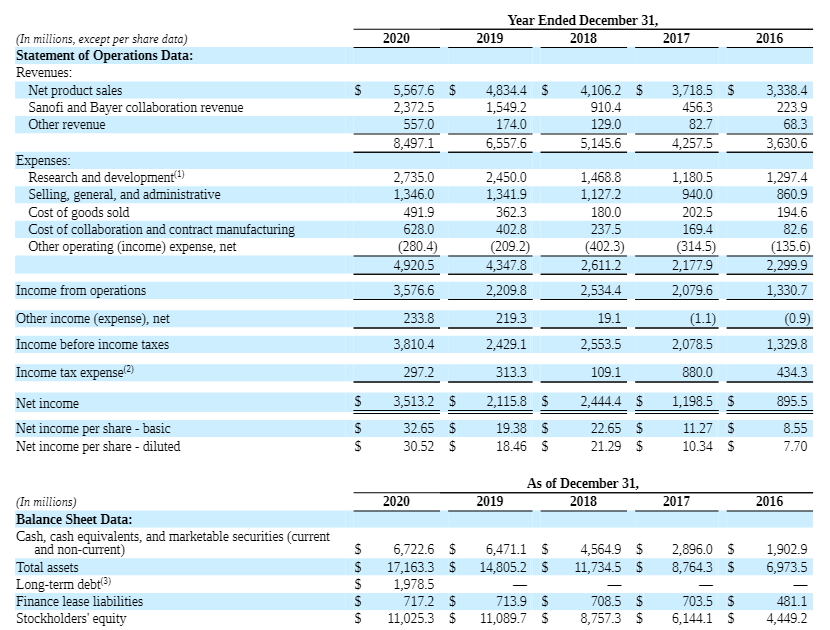

For starters, the stock was somewhat expensive 5 years ago and is considerably less so today. So you could say it has grown into the valuation. Net income (GAAP) in 2020 was $30.50 per share for a 15.4x PE multiple. The balance sheet is also in great shape with $4.7bn in net cash.

For pharmaceutical companies, it always comes down to — what’s the patent cliff exposure? and how full is the pipeline?

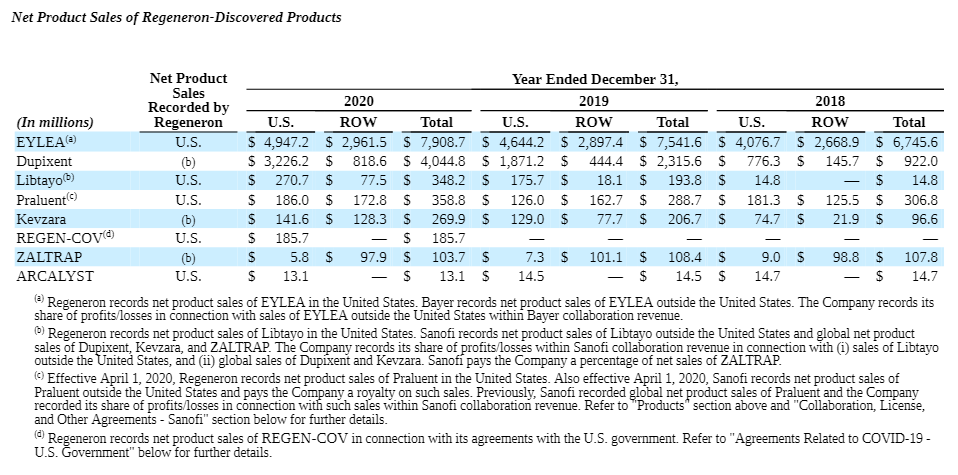

Regeneron has 2 main products on the market today with a few newbies starting to add to the mix. This is a pretty concentrated business as it stands.

EYLEA — 60% of sales

Dupixent — 31% of sales

Fortunately, these are difficult to replicate products so generic risks are a little less than your traditional pharmaceutical company. EYLEA comes off patent in 2023, Dupixent in 2031, and Libtayo in 2035. Clearly some risk with the top selling product. Though Dupixent grew 75% in 2020. Libtayo is a relatively new product with recent FDA approvals for expanded use as well.

How are they spending cash?

Regeneron has 107m shares outstanding and a $473 share price = $50.6bn market cap. Net cash is $4.7bn for a $45.9bn enterprise value.

We’ve already established the 15.4x earnings multiple on 2020 results. Estimates call for ~$44 per share in 2021 earnings thanks to some short-term benefits from COVID related treatments. They’re clearly seeing some growth ahead.

Cash has piled up on the balance sheet and will continue to do so. It’s possible they accelerate the buyback plans or look to add via acquisition.