Market Performance

Market Stats

Average home prices have been rising consistently

Global inflation rates hitting varying levels of “very high”

Quick Value

The Timken Co ($TKR)

Timken is an industrial company making bearings and power transmission products. Mostly small and mission critical parts to keep machines running. Timken estimates the bearings market is ~$30bn annually and 3 major competitors — Timken, SKF, and RBC Bearings — make up ~$13bn of that amount.

They serve a huge assortment of industries — just about every industry utilizes some sort of capital equipment needing Timken or competitor parts.

Where is Timken trying to take the business?

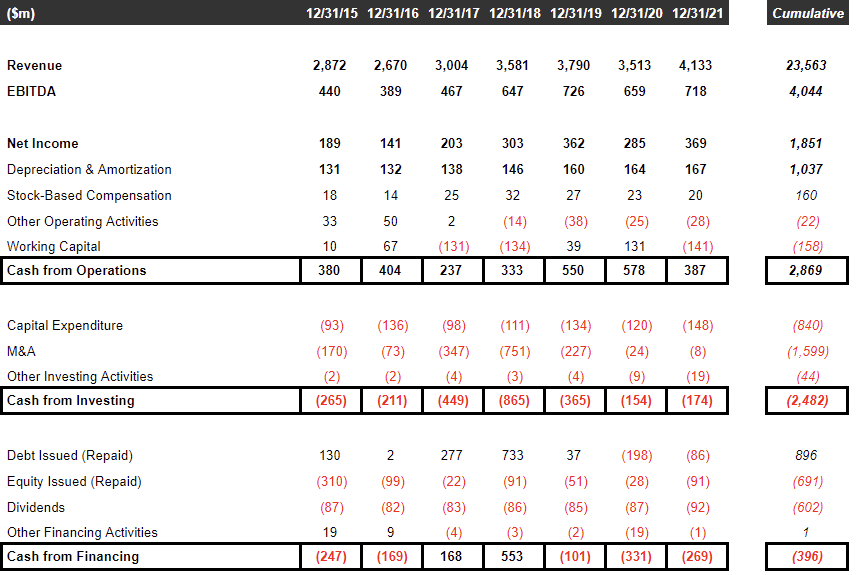

As always, I rely on actual cash flow sources & uses to determine what the true capital allocation plans are for any business.

Since the 2014 spin-off of their steel business, Timken has spent most of their cash on acquisitions and a small amount of share repurchases (share count has fallen around 6%). Then COVID hit, leading to a year of hefty debt repayment (~$200m) followed by a sharp drop in cash flow from the 2021 rebound as working capital rebuilt.

With the leverage target achieved, management is eyeing smaller M&A and share repurchases — likely more of the latter.

In 2022, Timken is facing continued supply chain and inflation pressure which they are working to pass onto customers. Revenue is expected to grow 10% to ~$4.5bn in 2022, which would be 5.8% annual growth from pre-pandemic 2019. Earnings are expected to add another 10% growth to $5.20/share.

At $61/share, Timken is a $4.6bn market cap with $1.2bn in net debt for a $5.8bn enterprise value. That leaves the stock at 7.3x EBITDA and 11.7x earnings vs. longer run averages of 8.25x and 13x.

The automotive-heavy Mobile Industries segment looks like it has been weighing on overall results for several years with 10% +/- EBITDA margins vs. the industrial-oriented Process Industries segment generating 20%+ margins. Maybe these subtle portfolio differences lead to the valuation differences between competitors like SKF trading below 10x earnings and RBC Bearings north of 30x earnings?