Quick Value 3.6.23 ($DBRG)

DigitalBridge - Asset recycling and simplification story

This week is a free Quick Value post. Subscribe to the full newsletter if you haven’t already! Plenty of interesting value investments on my watchlist that are coming up this month, updates on existing holdings, and a handful of incredibly cheap microcaps in the portfolio…

Market Performance

Market Stats

GDP grew 7.4% YoY in Q4 (2.7% growth QoQ) as economic growth is quickly returning to pre-pandemic levels. The Fed is anticipating ~2.3% GDP growth in 2023 vs. 2022.

Quick Value

DigitalBridge Group ($DBRG)

This stock has been fairly popular on Twitter so I’m sure I’ll butcher what’s actually going on here relative to those comments. This is the former Colony Capital of Tom Barrack fame. Renamed DigitalBridge in 2021 to emphasize their transition from a diversified real estate lender to one focused on “digital infrastructure.”

What they do…

DBRG is an investment manager focused on digital infrastructure real estate like cell towers, data centers, and fiber lines. Here’s how they describe it in the 10-K:

On the surface it’s an easy business model to understand… raise capital via funds, the company invests alongside those funds, buy digital assets, collect management fees and hopefully some performance fees and generate returns. The financial statements are a bit more complicated.

Why it’s interesting…

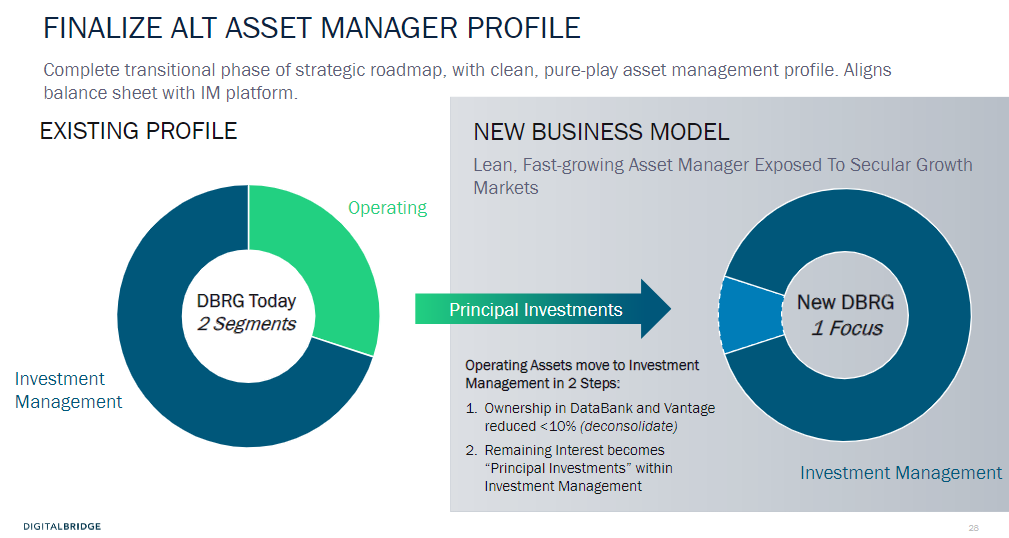

1) Business model transition — Before the rebrand, Colony Capital had a wide net with assets in healthcare, industrial, hospitality, etc. In the 2021 PR announcing the rebrand, management described the plan as:

Rotate $100 billion in AUM ‘from diversified to digital’

This is an asset recycling and simplification story. Instead of trying to be both an investor and an operator, the company is shedding assets and diversification to singularly focus on being an asset manager of digital properties.

Financials will be cleaner and easier to understand. Investors should be able to ascribe an actual multiple to this business. Plus, the economics in asset management are way better than traditional ownership.

2) Organic growth — DBRG plans to double fee-earning AUM (they call it “FEEUM”) from 2022-2025, partly through M&A but mostly by organic fundraising. They’ve accomplished a great deal already over the past few years but investors will be closely watching AUM growth from here.

3) Balance sheet cleanup — REITs and real estate focused businesses tend to carry pretty high leverage. They think in terms of LTV as opposed to debt/EBITDA. DBRG has been running with leverage >10x EBITDA thanks to the RE businesses on their balance sheet. In a transaction that will bring their equity stake below 10%, they’ll be able to shed that debt from the consolidated balance sheet and raise some cash.

DBRG has 160m shares outstanding x $12.34/share = ~$2bn market cap. This story is pretty complicated and there’s not a great way to value the business as it stands… Even the 2023 guidance slide is overly complex:

Fee related earnings (FRE) seems to be the key metric management is focusing on. They’re guiding to $185m at the mid-point in 2023. This is really an EBITDA equivalent as opposed to net earnings.

The operating businesses and their associated debt should fall off the balance sheet by the end of 2023 so net debt could be closer to $300m at that point (?). But they’ll still have a small equity stake in these businesses that they think will be worth as much as $1.1bn so we’ll still have a sum-of-the-parts thing going on here unless they intend to further monetize that stake.

If I take management’s word on $300m net debt plus a $2bn market cap = 12.4x FRE/EBITDA based on 2023 guidance. Maybe that’s a fair price for an asset manager? It certainly isn’t crazy cheap unless you net out the $1.1bn equity stake and argue it’s trading at 6.5x.

This one’s a bit complicated for me; but these business simplification stories tend to do well. I’ll be watching for the deconsolidation of these levered operating business stakes…