Quick Value 3.8.21 ($DOX)

Amdocs Ltd $DOX - Billing software with stable earnings at a 16x multiple...

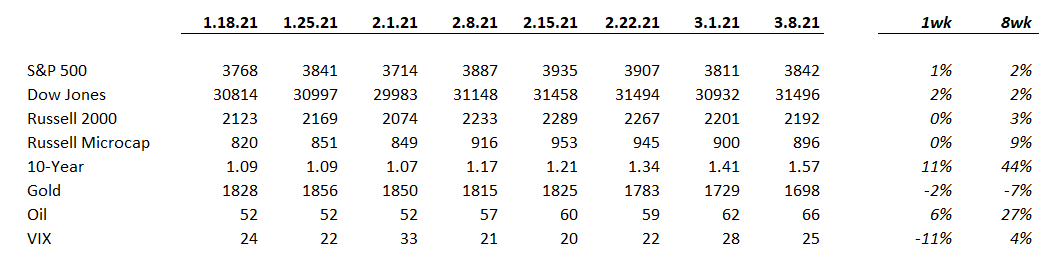

Market Performance

Market Stats

Unemployment data was released last week… Payrolls rose by 379,000 workers in February and the unemployment rate ended the month at 6.2%. The U-6 unemployment rate (which includes discouraged workers and PT workers looking for FT work) is still quite high at ~11% but well below 2009 peak levels.

Continuing unemployment claims are lower than they were during the 2009 peak… Weekly new unemployment claims are flattening out and still running well above normal.

Net result — labor trends continue to rebound following the initial “shock” from COVID… But the recovery is slow and a bit misleading… Long-term downward trends in the labor force have picked up steam. Wage levels are strong and hiring is on the rise however.

Quick Value

Amdocs Ltd ($DOX)

This is a sleepy little technology company without the tech multiple… They provide services to some blue-chip media and communications companies like AT&T, T-Mobile, Comcast, and Charter. Amdocs provides software and services for things like customer billing and network management.

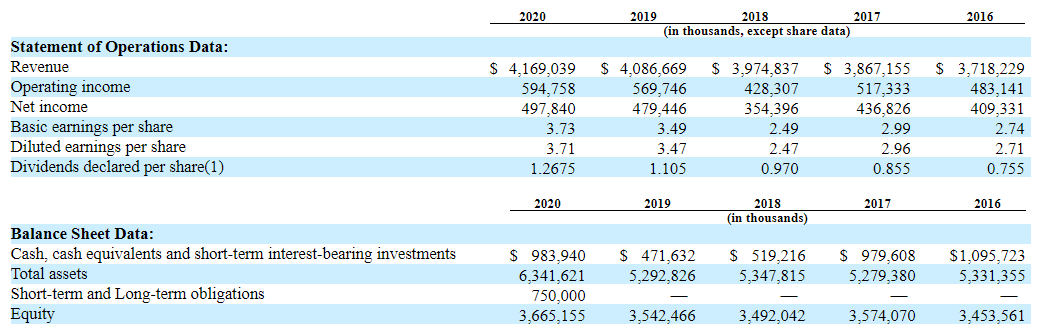

This has been a relatively stable business over time.

There are 131m shares outstanding

x $77 stock price

= $10bn market cap

After they released 1Q21 earnings, the company indicated 5.5-9.5% EPS growth in FY2021 — ~$4.75 per share for a 16x multiple at the current share price. Not dirt cheap but not expensive for a relatively stable business. FY2020 earnings grew modestly from $4.30 to $4.44 despite COVID.

Cash flow…

Capital allocation has been split between small acquisitions, a small dividend, and mostly buybacks. Buybacks have averaged ~$400m or so per year which would be 4% of the current market cap.

Amdocs doesn’t has a net cash position and probably an opportunity to add some debt to expand via acquisition or faster buybacks.

This isn’t the most exciting business but some investors prefer consistent earnings at a reasonable price! Maybe the biggest negative is the limited revenue / earnings growth and it might take an activist investor to get management to consider a more aggressive capital allocation policy.