Quick Value 4.24.23 ($BIG)

Beaten up retailer with multi-bagger potential

This stock has multi-bagger potential if they can turn around the post-pandemic hangover. It isn’t a secular decliner and has been a very stable business with share cannibal tendencies. Read on and leave some comments if you’ve worked on this one…

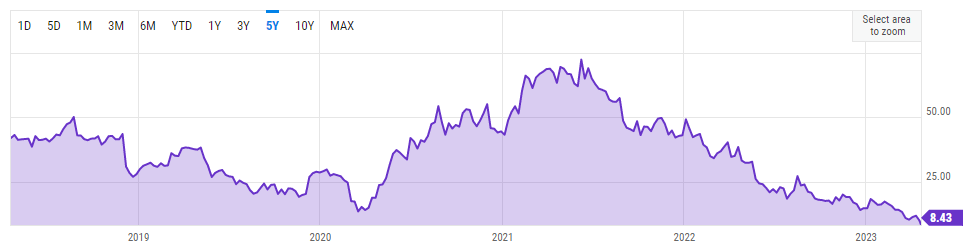

Market Performance

Market Stats

Quarterly estimates are on the downtrend with EPS growth being heavily weighted to the 2nd half of 2023 (thanks to @UpslopeCapital on Twitter).

Quick Value

Big Lots Inc ($BIG)

That’s one hell of a 5 year chart… from $40 to $14 to $70 to $8 per share, all since April 2018. There are big returns (and losses) along many points in that chart!

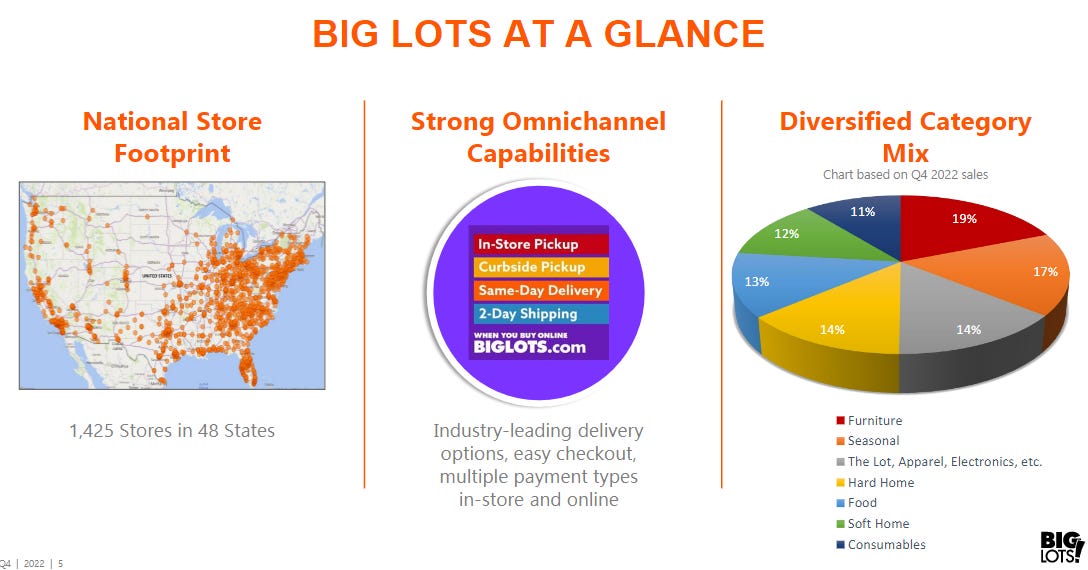

What they do…

Big Lots is a discount/closeout retailer with 1425 stores in 48 states and a wide mix of product categories (furnishings, food, apparel, etc.). Think of this is a combination of a mini-Target and less polished version of TJ Maxx.

The average store is ~23k square feet which is smaller than an Ollie’s, TJ Maxx, or Ross Stores. Ollie’s Bargain Outlet ($OLLI) is probably the best comparison with the focus on lower income customers and the bargain/deal hunter mentality.

Why it’s interesting…

1) Turnaround story

I’m going to lay out most of the negatives first and come around to why it could be an interesting stock to watch…

Like many (most?) other inventory-centric businesses. BIG got caught up in the pandemic boost and working capital overbuild. Now, sales are falling and the company outspent cash flow last year. Throw in a hefty pile of debt and leases accumulated over the past few years and you have a beaten up stock price.

Sales have been declining for 7 straight quarters and guided to a low/mid-teens decline next quarter.

Debt and leases are >$2bn today.

Cash flow and net income went negative in FY23 for the first time since 2005-2006.

On the bright side…

This business has a staples-like quality to it and margins should be bottoming in 2023 from higher cost inventory purchased during the pandemic.

Capex and inventory are coming down in 2023 which should generate meaningful cash flow.

In addition to the anticipated gross margin improvement, the company is taking out another $70m in opex.

2) Share cannibal

Big Lots has been a share cannibal for a long period of time. Shares outstanding are down ~75% since FY2007, or 8% annually.

They have ~$160m remaining on the current buyback authorization which is >60% of their market cap. There were no buybacks in Q4 and it’s unlikely they’ll dip into this authorization until they get some clarity on the turnaround and cash generation.

3) Capital allocation

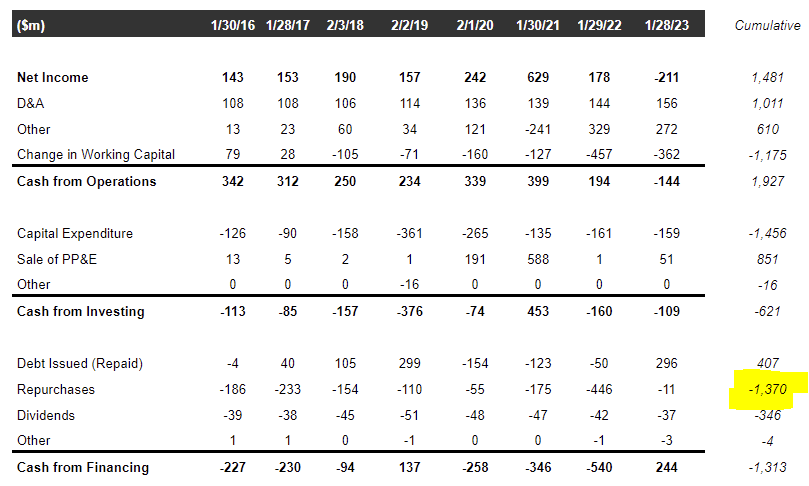

Historically, this is a very cash generative business. From pre-pandemic they were averaging ~$300m per year in operating cash flow which then spiked and has since gone negative.

Capex is a bit of a roller coaster with some distribution center buildout and sale-leasebacks. Guidance calls for $100m in 2023 which is way below ~$160m spent in FY22-23.

Buybacks have been the preferred capital allocation use. They were funding buybacks with debt from FY17-19 and then used sale-leaseback proceeds for buybacks in FY21-22. Buybacks have come to a halt with cash flow going negative in FY23.

Dividends cost the company ~$40m per year. The $0.30 quarterly dividend works out to a ~14% yield.

Summing it up…

BIG has 29m shares outstanding x $8.60 = $250m market cap. Debt is $301m and cash of $44m for an enterprise value of $507m. Clearly the stock is really cheap if cash flow gets back to $300m, which wouldn’t be heroic as they’ve produced that level of cash flow at similar revenue levels.

We’ve outlined most of the risks — sales declines, negative cash flow, working capital, leases, etc. This isn’t a high growth company but sales and earnings are stable, with the pandemic being an exception to the upside.

Unfortunately, I think much of the stock’s success from here will come down to whether they can stabilize revenue which is hard to predict. They won’t be able to cost cut their way out of this hole, eventually they’ll need to lock down some revenue growth. Fortunately, they should produce some cash in 2023 to tide them over and management thinks there are more asset sales to monetize. If successful, this stock has multi-bagger potential.

It looks a bit like a call option at this price unless there’s a better way to pin down the probability of returning to revenue growth… I’m open to feedback on the outlook!