Quick Value 4.5.21 ($BDX)

Becton Dickinson - potential quality healthcare conglomerate at 18.5x earnings

Market Performance

Market Stats

Worth noting the level of volatility is finally starting to fade (as measured by the VIX index)…

When I was learning the value investing ways from my mentor, I was taught to consider the VIX over 20 as above-average volatility, near 10 as extremely low, and anything over 30-40 as a “pretty good buying opportunity.”

You can see the 2009 peak and the 2020 COVID peak fairly clearly. It’s been somewhat of a surprise to see how long it took the VIX fall below long-run averages despite the strong upward movement in markets.

Takeaway from this? Watch for complacency and/or that slow, relentless grind higher in the markets…

In other stats, there were a handful of good releases over the past week…

Manufacturing PMI posted a big number and remains above long-term averages…

Consumer confidence index saw a big jump (likely thanks to stimulus checks going out).

Quick Value

Becton Dickinson and Co ($BDX)

Healthcare conglomerate with 3 divisions:

Medical — injection-related products like syringes and needles, catheters, and IV systems

Life Sciences — products for collecting and transporting blood and other specimens

Interventional — surgical products and instruments

The stock has been stagnant for a few years but it looks to have the makings of a quality business at a pretty reasonable price.

2021 estimates calling for ~$13 in per share earnings and ~$5.7bn EBITDA. At a $242 stock price it’s a $70bn market cap and $85bn enterprise. Good for a 18.6x PE and 15x EV/EBITDA multiple.

The business was built on the back of 2 major acquisitions — CareFusion in 2014 for $12bn and CR Bard in 2017 for $24bn.

Financial performance has been spotty but COVID certainly had an impact with elective procedures plummeting in 2020 — revenue was down 1% in 2020 and EPS fell 13% from $11.68 to $10.20. And with no earnings growth from 2018-2020, investors might be questioning the overall approach.

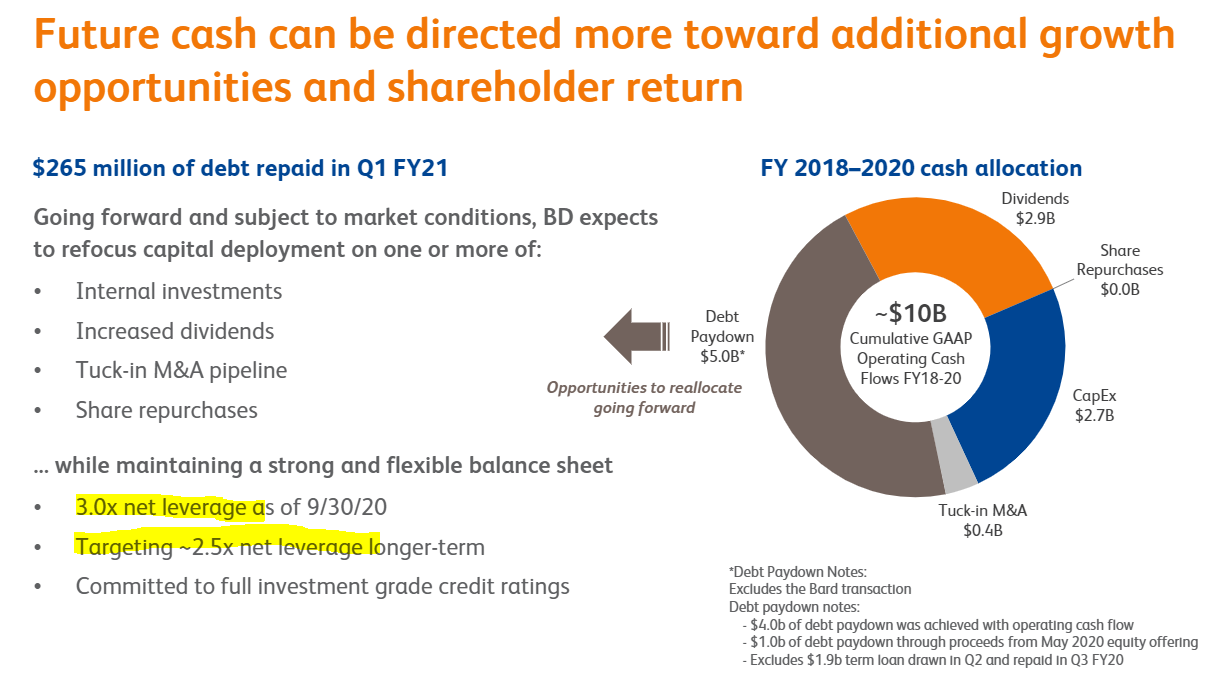

With the acquisitions, BDX has been boxed into a corner in allocating cash exclusively to repay debt and fund the dividend

They did a large equity offering in 2020 to help clean up the balance sheet…

On the upshot…

The 2021 outlook calls for good revenue growth and earnings of $12.75-12.85 per share

Revenue grew ~25% in Q1 FY2021 so the rebound is starting to take shape

Cash flow can now be directed toward other uses… Buybacks haven’t happened since 2014! After capex and the dividend, BDX should have $2-2.5bn left over for buybacks or M&A

Management is targeting double-digit returns through earnings growth + dividend (~1.4% yield)

Most of these business lines are #1 in their respective markets (terms of market share)

Competitors like Abbot, Stryker, and Boston Scientific trade at ~25x forward earnings

All told, this has been a stagnant business but has the makings of a quality healthcare player at a reasonable valuation.