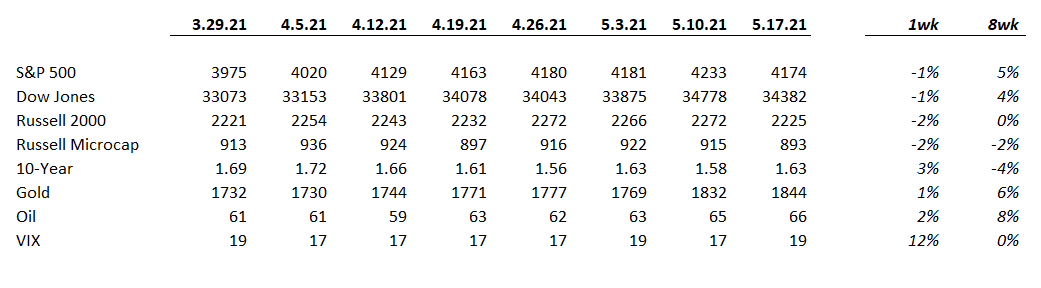

Market Performance

Market Stats

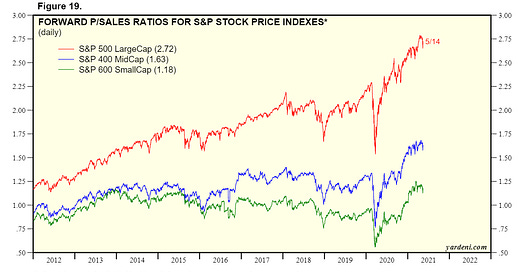

After seeing flat revenue multiples for a few consecutive years, small and mid-cap stocks are starting to follow suit with the S&P 500 in expanding multiples.

A widely covered topic, value has been outperforming growth stocks of late and closing an outperformance gap that has lasted for years.

Overall, valuations still look pretty high with most stocks and the index in general at >20x earnings.

Quick Value

Norton LifeLock ($NLOK)

This is a stock I’ve followed since they announced the sale of their enterprise security business to Broadcom a few years ago… That sale looked like a great one for shareholders as the enterprise business wasn’t producing much earnings, it resulted in a large special dividend, and focused the remaining business on the high-margin consumer segment.

Norton has had a nice little run over the past few days after solid earnings and a good outlook… Turns out the market for consumer cyber security and identity protection might be pretty good?

Sure, they are likely benefitting from some of the cyber crime headlines out there…

Norton provides digital cyber security products to consumers via subscription services. They have 80m users and boast 50% operating margins.

At $26/share, it’s a $15bn market cap with $2.5bn in net debt. FY22 (which just started in April 2021) guidance anticipates $1.65-1.75 in EPS for a 15.3x earnings multiple and 8-10% revenue growth. Management is targeting $3 in EPS within 3-5 years — more than double FY21 level of $1.44 per share.

This is a massively cash generative business with very little capital required. One potential risk that comes with big cash generation in larger companies is the complacency for reinvestment. Products get stale, customers ignored, and market share is lost to upstarts with a better sense for what customers really want. Still, it’s impressive to see a $15bn company spend only $6m on capex in an entire year…

A small dividend (2% yield at today’s price) is part of the capital allocation picture but buybacks and acquisitions are likely to be bigger contributors over the next few years — potentially chipping in an extra $0.60-0.70 per share in earnings.