Quick Value 5.18.20

Blucora ($BCOR)

This week’s Quick Value idea is a re-post of a very recent premium article on Blucora. My hope is to occasionally share some of these ideas in the weekly free newsletter. Six months into this initiative felt like a good time do so!

As a reminder, I have a very affordable premium newsletter. At least 2x detailed investment ideas each month plus a live look at my portfolio and weekly activity / commentary. Give it a try:

Market Performance

[Index | % change WoW ]

S&P 500 | 2864 -2.3%

Dow Jones | 23685 -2.7%

Russell 2000 | 1257 -5.5%

Russell Microcap | 470 -4.5%

10-Year | 0.65% -4bps

Gold | 1754 +2.8%

Oil | 30 +20%

VIX | 32 +14%

Market Stats

Last week’s economic releases had some big messages:

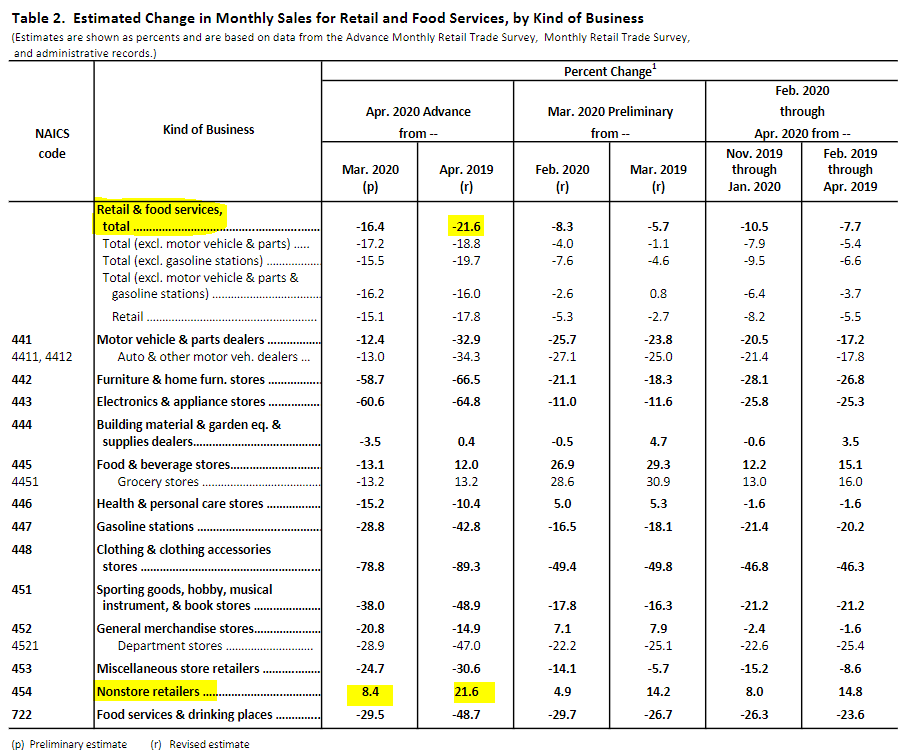

Retail sales — Total retail sales in April were down 21% from last year… Clothing, furniture, and electronics appear to be the weakest categories. Looks like the crazed rush at the grocery store is subsiding with sales down 13% from March.

One of the biggest takeaways here is the rise in e-commerce sales. Up ~22% from last year and another 8% from March. Of the ~$400bn in retail sales in April, e-commerce was some $75bn of that amount or roughly 19% market share. This is a huge jump from the ~12% market share in April 2019.

Inflation (CPI) — I should call it deflation… food was the only major category that saw rising prices in April relative to March… no surprise that fuel costs declined significantly, as well as transportation related items like airfare, car insurance, and auto repair…

Jobless claims — Another 3m initial claims last week… jobless claims still piling up despite being well over a month into the PPP initiation… estimates were calling for 2.5m claims

Next week will give us a good glimpse at the overall state of the housing market with building permits and existing home sales data.

(Not So) Quick Value

Blucora (BCOR)

Price: $11

Market Cap: $540m

Valuation: 11x 2020 earnings?

Category: GENERAL

Background

This was formerly known as InfoSpace and consisted of a crummy internet search and content services business. InfoSpace acquired tax prep software TaxACT in 2012 and electronics e-commerce business Monoprice in 2013 while changing its name to Blucora (BCOR). A series of bizarre pivots later ensued…

Monoprice and the internet search businesses were later sold and a few additional acquisitions were made in the tax-focused wealth management industry.

Today, there are 2 businesses in Blucora:

TaxACT

Avantax

TaxACT

This is the crown jewel of the business. The #2-3 DIY tax prep software behind TurboTax and H&R Block — TaxACT views itself as the “value” offering in the market.

For starters, the digital-do-it-yourself segment of the tax prep market continues to take share from other segments. Manual (pen and paper) and retail stores have been in decline while the professional (CPA) market has been relatively stable.

E-filed returns make up the vast majority of total tax returns and have grown in spite of total filings (only notable drop-off in filings was 2009 and 2012):

Blucora acquired TA for $287.5m in 2012 at a 7.6x EBITDA multiple ($37.6m in 2011).

2020 is likely going to be a tough year with the delay in tax filing deadline. Not so much because consumers and businesses won’t file their returns… because TA will need to keep pumping money into customer service and marketing costs for an extended period of time — but historically, this has been a good business:

Avantax

Through a series of acquisitions over the past few years, Blucora has built what they call a “tax focused” wealth management business with a few different revenue streams:

Through its registered broker-dealer, registered investment advisor, and insurance agency subsidiaries, Avantax Wealth Management operates the largest U.S. tax-focused independent broker-dealer, providing tax-smart wealth management solutions to financial advisors and their clients nationwide.

Acquisitions making up Avantax:

2015 — HD Vest for $614m

2019 — 1st Global for $180m

2020 — HKFS for $100m (not completed yet)

At the time of acquisition in 2015, HDV was doing $305m in revenue, had $10bn in AUM, and $43m in segment income — in 2018, HDV did $373m in revenue and $53m in operating income — a +5% CAGR for each.

Then came 1st Global in 2019… Management liked this deal given the high mix of recurring revenue (mainly advisory fees on AUM) and larger revenue per advisor (i.e. more productive employees).

1st Global came with another $9bn in AUM, $175m in revenue, and $10m in EBITDA — with a targeted $11m in synerges.

Risks

Segment income in both businesses could look ugly in 2020…

Wealth management will hurt from lower interest rates impacting their cash sweep product as well as lower AUM levels and transaction commissions. Here’s a tidbit from a previous earnings call regarding the cash sweep income:

If Fed Funds are down 1.25-1.5% this year does that mean segment income could decline $20-30m? Maybe. This is what I have in my 2020 estimate for Avantax.

Bad acquisitions are a real risk — and arguably one of the top reasons the stock is cheap. Consider, management invested nearly $800m in wealth management (HDV and 1st Global) with annual segment income of $60-70m. On the other hand, TaxACT cost $287.5m and is closing in on $100m+ in segment income. Think if they had just held TA and returned all that cash instead!

Sources & Uses of Cash

As always, let’s take a look at how cash has been generated and deployed over the years…

From the time of the HD Vest acquisition in 2015, operating cash flow has steadily grown while Blucora repaid debt and the stock moved higher…

After 3 years of intense delevering from 2016-2018, they’ve gone back to acquisitions with 1st Global and potentially HKFS later in 2020.

Following that, management intends to repay debt as their top priority for cash flow.

So what makes it interesting?

We have a business getting pummeled from the challenging tax environment (delayed filings and increased costs) AND challenging wealth management environment (lower AUM and fewer commissions) — stock is down from $30+ to $11.50 today.

We know that under “normal” conditions, this business generates a ton of cash — they levered up to 6x EBITDA to buy HD Vest and quickly got down to less than 2x within 3 years

And we know (think?) these segments (tax prep and wealth management) will be around for quite some time — certainly in 2021 and beyond

Beyond that, BCOR effectively has an option on buying HKFS at $100m after they recently negotiated a price reduction (from $160m to $100m) and an extension to “late 2020” with no commitment to complete the deal — HKFS would add ~$31m in revenue and $9m in EBITDA

Valuation

First, to highlight just how valuable TaxACT could be —

H&R Block (HRB) has historically traded at ~7.5x EBITDA but TaxACT likely deserves a better multiple given they have no exposure to the challenged retail locations which make up some 2/3 of HRB revenue.

The last 3 years had TA segment income of:

2017 — $73m

2018 — $87m

2019 — $96m

Let’s call 2020 a wash at this point… If 2021 looks more like 2017-2019, then perhaps the TA business is worth 8.5x or $620m to $815m… This is $12-16 per share.

2020 Earnings

Starting with TaxACT — 1Q20 saw $37.8m in segment income as our starting point. Historically Q2-Q4 has generated $20-30m in segment income so let’s call it the low end of $20m given the filing deadline extension = $58m in 2020 segment income for TaxACT.

Next is Avantax — My “best guess” is near $30m in segment income for 2020 based on lower AUM and brokerage asset levels and $30m in cash sweep revenue wiped out (hopefully this is a pretty conservative approach). You can see my estimates for this segment below.

Add in $28m in annual corporate costs and $22m for interest expense.

This gets to $46m in pre-tax earnings or about $1 per share. Blucora still has significant net operating losses to offset most taxable income. This would put the stock at 11x depressed earnings.

2021 and beyond

My biggest assumptions here are that TaxACT returns to its normal $96m segment income run-rate from 2019. Otherwise, I anticipate Avantax hangs around the $30m per year mark and interest expense continues to move down as debt gets repaid.

This gets to $78m in 2021 pre-tax earnings or $1.60 per share. Now we’re at 6.9x earnings… getting more compelling

I am intentionally being overly conservative in 2020 and with the Avantax segment specifically as I don’t want to rely entirely on a rebound in the wealth management business. Though I’m not opposed to their roll-up strategy in this industry.

Here are my full estimates:

Beyond these results are:

the option to acquire HKFS (which Blucora has the cash on hand to complete),

repay debt which could replicate 2016-2018 where interest expenses decline by half (saving $10m per year or $0.20 per share),

and a general rebound in the wealth management business to normal levels…

Under these super optimistic conditions you could get to $130m+ in pre-tax earnings or $2.65 per share… $96m from TA + $70m from Avantax less $28m corp costs less $11m interest = $127m pre-tax earnings.

I wouldn’t bet on this outcome but it sure would be nice!

(Disclosure: long Blucora)