Quick Value 5.24.21 ($T and $DISCA)

AT&T spin + merge with Discovery

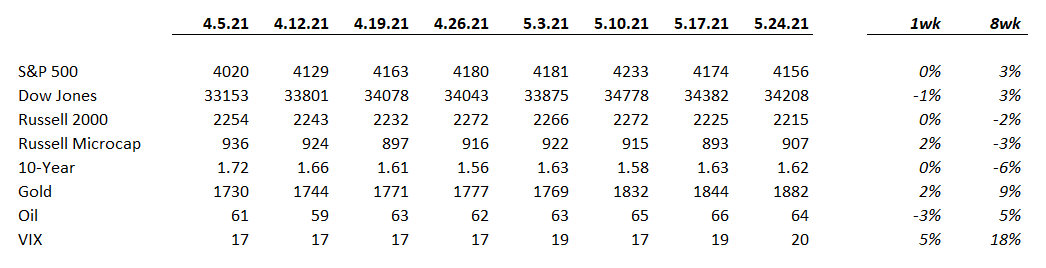

Market Performance

Market Stats

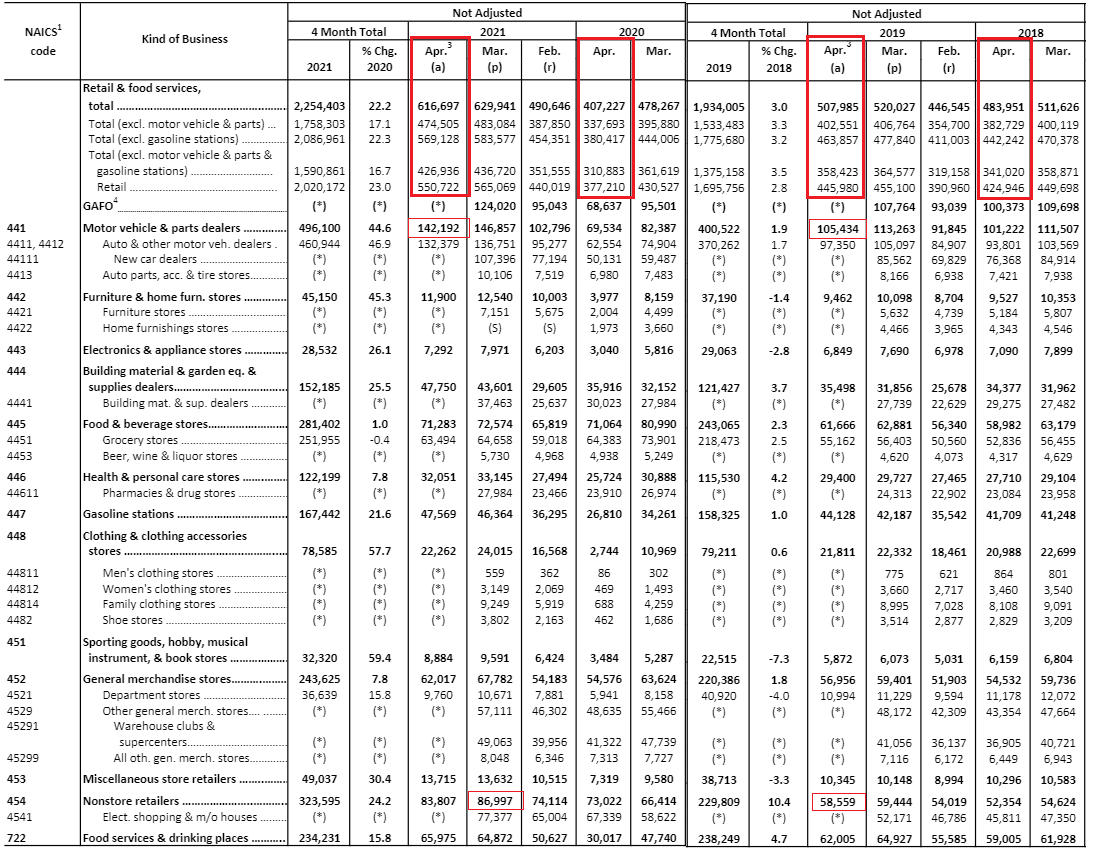

April 2021 advance retail sales came out recently. I wanted to take a look at retail sales stacked against 2020, 2019, and 2018 levels…

Quick recap… April 2021 retail & food services totaled $616.7bn — this compares to $407.2bn in 2020, $508bn in 2019, and $483.9bn in 2018 — that’s a 10% CAGR from 2019 and 8.4% CAGR from 2018. No surprise here, people are spending more money!

Here’s an interesting note — retail sales increased $108.7bn from April 2019 to April 2021 — of that increase, $36.8bn was attributed to buying cars and trucks and $28.4bn to “nonstore” purchases. So ~60% of the increase from 2019 to 2021 can be attributed to cars + e-commerce. Food & beverage (grocery + liquor stores) was the other notable increasing category at $9.6bn.

Sure, “nonstore” retail sales come from a lot of source but e-commerce is lumped into the 454 NAICS code…

It’s been a higher growth NAICS category for quite a while now…

Quick Value

AT&T ($T) + Discovery ($DISCA)

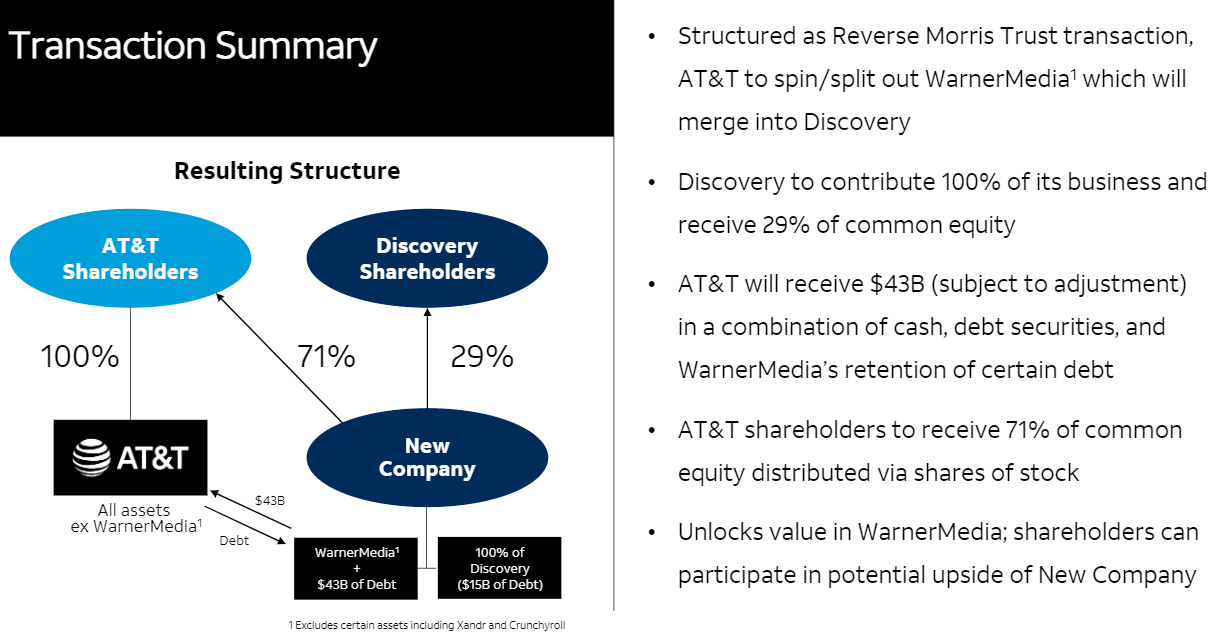

Yes, I’m caving and writing about the merge + spin announced a few days ago… In the proposed transaction, AT&T shareholders will receive shares in 2 new businesses:

A standalone wireless / wireline / broadband company (known today as AT&T Mobility); and

A new media company consisting of the old Time Warner assets + Discovery / Scripps.

I think a reasonable place to start is with some basic numbers…

There have been plenty of headlines flagging AT&T as sitting on way too much debt and leverage running high… But really, since the Time Warner acquisition, leverage has been in great shape relative to cash generation (which matters to me more so than EBITDA).

The highlighted periods indicate the DIRECTV acquisition in 2015 and the Time Warner acquisition in 2018. Both involved new debt and an increased share count. All-in , AT&T issued ~2bn shares for these acquisitions and added $56.5bn in debt.

As a reference point — competitor Verizon Wireless has $148bn in net debt at 1Q21 and had trailing FCF of ~$24bn for debt/FCF of 6.2x. Even after the spin of the media business, standalone Wireless Co will have a comparable leverage profile to Verizon.

Along with the announcement, AT&T is cutting the dividend to a 40-43% payout of the anticipated $20bn FCF which comes to ~$1.15 per share… Verizon has a ~4.4% dividend yield which would equate to $26 per share for the new wireless business. That price point would value Wireless Co at about 6.5x EV/EBITDA vs. Verizon at ~8x. Cutting the dividend also has the effect of making the Wireless Co more competitive with Verizon, T-Mobile, and others. Lastly, this segment has historically performed well for AT&T — EBITDA grew from $25bn in 2013 to $30.5bn in 2020 (just the wireless segment excluding fiber/broadband/wireline).

Onto the Media business. AT&T shareholders will own 71% of the new company and Discovery will own 29%. That should leave ~2.5bn shares outstanding for Discovery and a $75bn implied market cap with Discovery hanging around $30 per share.

Management indicated roughly $12bn run-rate EBITDA at time of close and a target of $14bn by 2023 with synergies… Media Co will send $43bn back to Wireless Co and Discovery brings ~$13bn in net debt = $56bn net debt at closing or 4.7x leverage.

With a ballpark 60% EBITDA-to-FCF conversion, this is trading at an implied ~10x FCF / 10-11x EBITDA currently. This is about in-line with standalone Discovery prior to the merger announcement.

Today’s Discovery price implies about $7.40 per share to AT&T shareholders ($75bn implied market cap x 71% divide by 7.2bn shares outstanding) and Verizon’s valuation would imply $26-33 per share for the Wireless Co. A bit more than the current $30 AT&T share price.

Plenty of open questions — whether the Wireless business deserves a Verizon multiple… whether the media business warrants a higher multiple… whether investors will forgive management for their past sins… heck, there are still risks in the deal closing in mid-2022…

There seems to be this general fear that management(s) will do something value destructive again based on past events. (Though I’m not sure I’d call the Time Warner deal a dud.) Despite the headlines there might be some value here…