Quick Value 5.31.21 ($DSEY)

Diversey Holdings ($DSEY) - Busted IPO and plenty of changing hands in this chemical company...

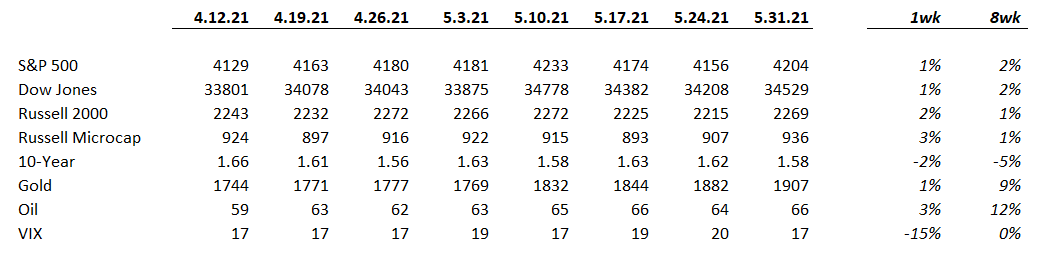

Market Performance

Market Stats

Personal income and spending data for April are out. Wages are still on the rise as is well known thanks to average hourly earnings data and inflation commentary around the world.

I’ve highlighted the contribution from Unemployment and Other (which includes stimulus checks).

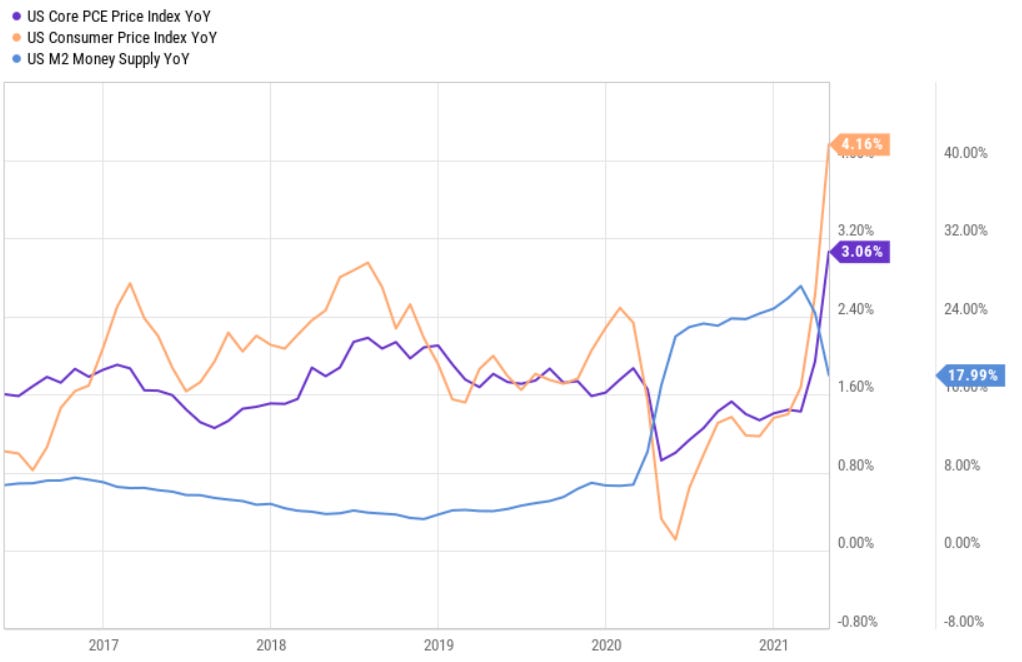

On Friday, YoY Core PCE data was released — this is the Fed’s preferred measure of inflation — no surprise that it looks similar to CPI data with a big acceleration in April (and likely again in May).

I’ve charted Core PCE vs. CPI YoY movements along with Money Supply growth which is starting to rollover from 20-25% growth to 18% at last measure. The timing of when the Fed will reduce, eliminate, or reverse the free-flowing money supply is hotly debated in financial circles. It likely coincides heavily with inflation data. Money supply growth is a weekly metric worth monitoring.

Quick Value

Diversey Holdings ($DSEY)

Diversey has had a long history of ownership… It was owned by Unilver in the 1990’s, then sold to an SC Johnson subsidiary, then spun off the public in 1999, then taken private in 2009…

More recently, it was acquired by Sealed Air in 2011 for $4.3bn and then sold to Bain Capital in 2017 for $3.2bn. Fast forward to today, Bain Capital has taken the company public again under the ticker DSEY at a current market cap of $5.1bn.

This was a “busted” IPO in the sense that bankers had initially priced shares near $20 but demand fell short of expectations leading to an ultimate capital raise at $15 per share.

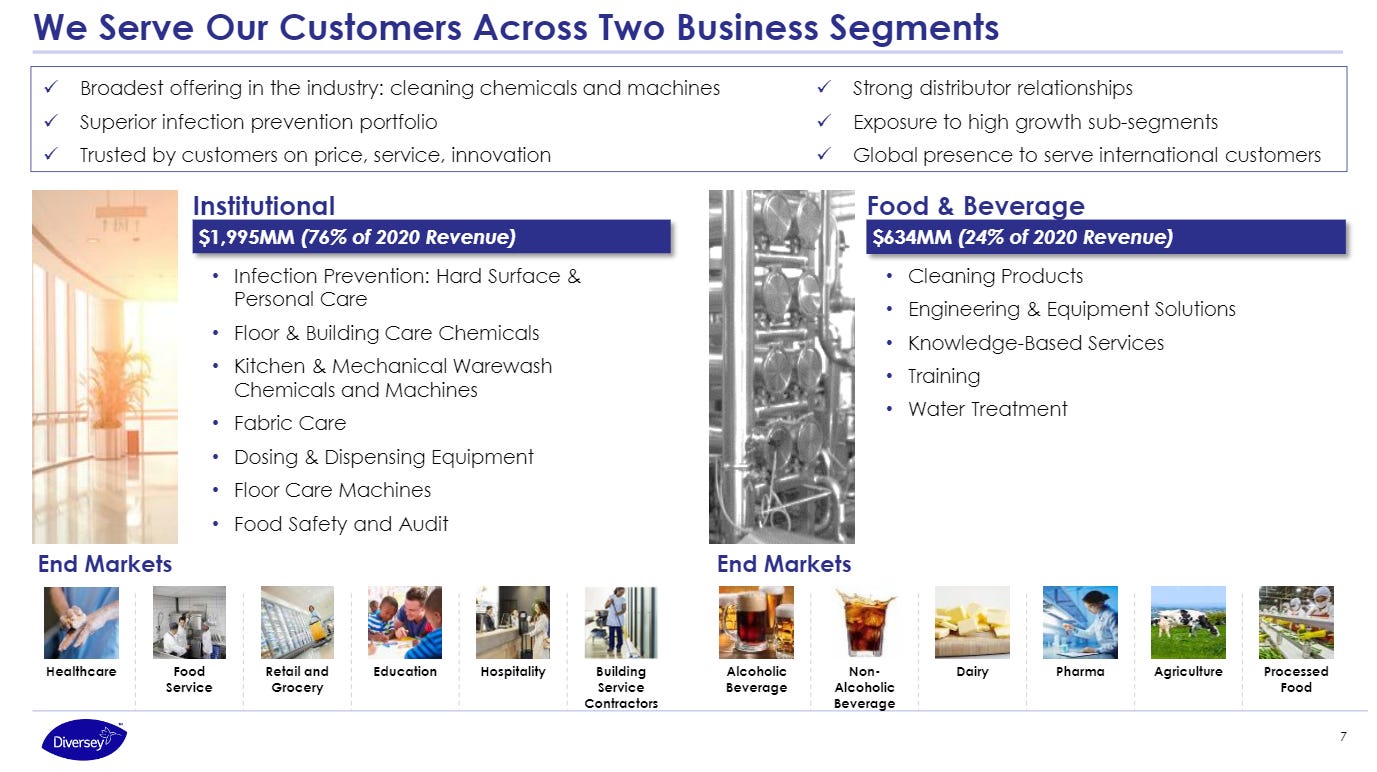

Diversey provides chemicals and equipment for the “cleaning and hygiene” industry. Here’s how they describe their business:

Here are the 2 segments and product examples:

Ecolab ($ECL) is the larger competitor in the space at a $60bn+ market cap and $11bn in revenue. Ecolab trades at a hefty premium of 20x EBITDA and nearly 6x revenue.

Diversey has 301m shares outstanding and a ~$17 share price = $5.1bn market cap. Net debt is ~$1.9bn for a $7bn enterprise value. Adjusted EBITDA in 2020 was $401m for a 17.5x multiple.

From a revenue standpoint, this is a remarkably stable business. And Bain has done a decent job of taking out costs on the SG&A line… (From the Diversey S-1 filing)

Diversey outlined the investment summary in the Q1 slide deck:

Delever from 4.5x debt to EBITDA down to ~3x target

Increase EBITDA margins from ~14% to 20% — closer to peer Ecolab

Trade at a similar multiple to Ecolab

Acquire smaller regional players as the market is fragmented between Ecolab/Diversey

If they can get some revenue growth to ~$3bn or so and get EBITDA margins up to 20% (both huge “ifs”) = $600m in EBITDA which would make the stock 11x EV/EBITDA vs. Ecolab at 20x. Despite the high EBITDA multiples, these businesses turn EBITDA into FCF at a high rate.

Plenty of reasons to be skeptical as this is very much driven by future performance. On the flip side, there are some “stability” factors at play which investors prefer and the element of a busted IPO means expectations might be fairly low out of the gate…