Quick Value 5.8.23 ($NGVT)

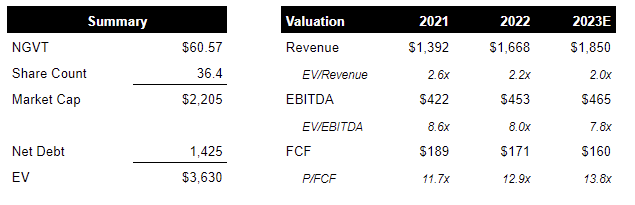

Ingevity Corp - specialty chemicals at 7.8x EBITDA, 13.8x FCF

This is a free edition of the weekly Quick Value report. Today’s issue covers a specialty chemical producer at an inexpensive valuation (<8x EBITDA, <14x FCF). I’ve generally viewed these companies as pretty good businesses with solid margins and cash flow. Plus, many of them get acquired by strategics/PE on a regular basis.

Sign up for the full newsletter to receive all Quick Value posts, deep dives, and portfolio updates. Check out the full assortment of content here.

Market Performance

Market Stats

Job market continues to look very strong with labor force climbing back to pre-pandemic levels (not yet there) and unemployment staying at lows… jobs are soaking up folks returning the workforce pretty rapidly…

Quick Value

Ingevity Corp ($NGVT)

Ingevity Corp, formerly known as MeadWestVaco, is a 2016 spin off from box manufacturer WestRock.

What they do…

NGVT is a specialty chemical manufacturer with 2 segments:

Performance Materials ($550m sales / $252m EBITDA in 2022) — Activated Carbon is the main product line sold to automotive manufacturers to reduce vehicle emissions in gas engines.

Performance Chemicals ($1.1bn sales / $200m EBITDA) — This segment has various product lines ranging from chemicals for road paving and preservation to adhesives, coatings, lubricants, etc. used in all sorts of industries like manufacturing, metalworking, agriculture, medical, plastics, oil and gas, etc.

Why it’s interesting…

1) Fundamentals

On the surface, this is a good looking company — consistent revenue growth (absent the pandemic), earnings growth, cash flow and FCF generation, reasonable debt levels (leverage consistently below 3x), ROIC in the mid-teens, and a capital allocation plan that includes periodic buybacks and medium-sized acquisitions.

2) Peer valuations

Specialty chemical valuations range from 6-10x EBITDA with NGVT in the middle of the range (these are forward 12 month figures, FYI).

NGVT fundamentals look close to group averages with better than 20% EBITDA margins and leverage a tad higher than the 2x average.

3) Cash sources & uses

I like to see the consistent cash generation and capital intensity (capex as a percentage of sales hasn’t been expanding much). Acquisitions haven’t been the “transformational” sort with an average $400m per deal in 2018-2019 and 2022. That’s basically a years’ worth of operating cash flow. Buybacks were modest when the valuation was higher (2016-2019) and are ramping now that shares are cheap relative to earnings. Share count is down 14% since 2016. This seems like a well balanced approach to capital allocation.

I don’t like that FCF hasn’t grown much despite spending ~$1.2bn on acquisitions since 2018. It looks like the jury is still out on whether these deals have added value.

Management’s priority for the rest of 2023 is to repay debt and get leverage down from ~3x to 2.5x… If 2023 ends at $465m in EBITDA, that would mean most or all of 2023 FCF will go toward debt repayment. They still seem committed to buybacks however.

Summing it up…

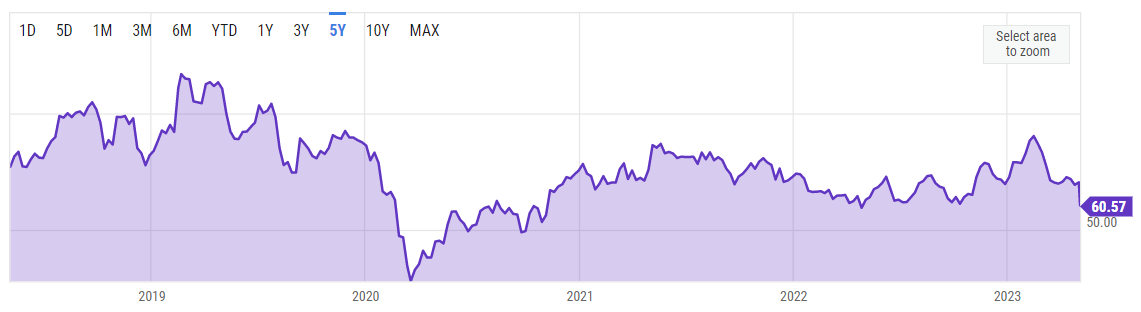

Why are shares flat over the past 5-6 years?

NGVT has significant exposure to internal combustion engines (ICE) through the activated carbon products (performance materials segment). This is viewed as a secularly declining business and perhaps today’s multiple is reflecting that?

Some other reasons might include higher interest expense on their debt, lack of FCF growth from 2018-2023 ($160m), and higher input costs… these things led to a mixed 1Q23 report with sales up 2.6%, EBITDA down 12.7% and EPS down 32.7%…

If many of these hurdles are temporary, then shares might be cheap… Using NGVT’s own historic EBITDA multiple of 10x would value shares around $87 vs. $60 today. That’s a good amount of upside from today’s price…