Quick Value 6.14.21 ($NRG)

NRG Energy - Value coming out of winter storm Uri?

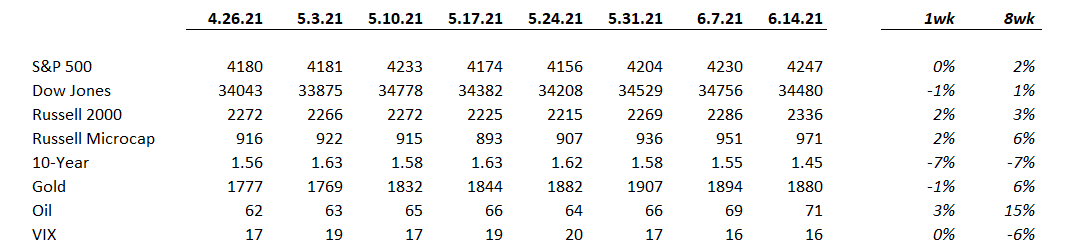

Market Performance

It’s generally time to pause when you see headlines like “S&P 500 Sets New High, Rises for Third Straight Week”

Market Stats

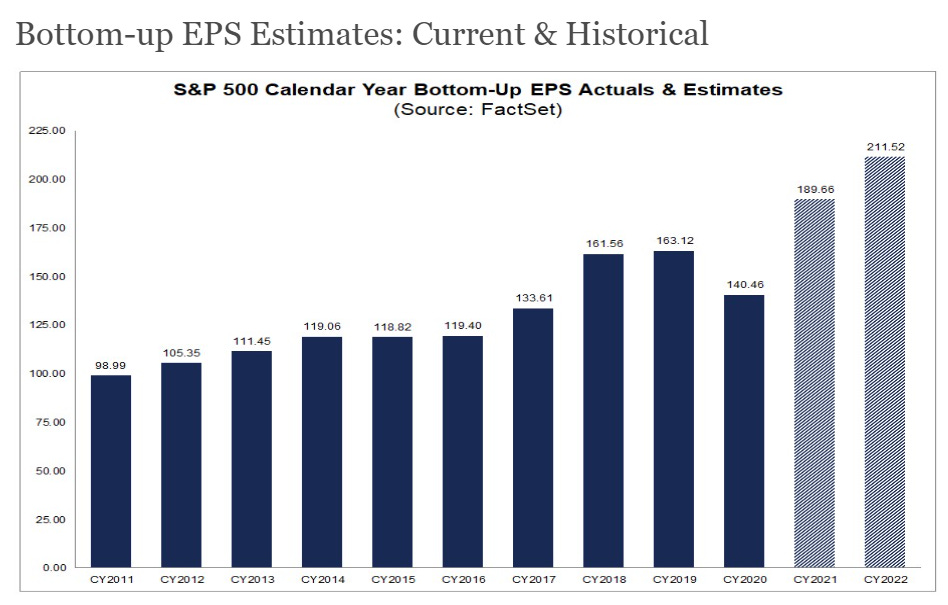

If 2022 estimates for S&P 500 earnings become accurate (or low), then earnings growth would be 9% per year or better from 2019 — absent any knowledge of COVID, most investors would be quite happy with this result!

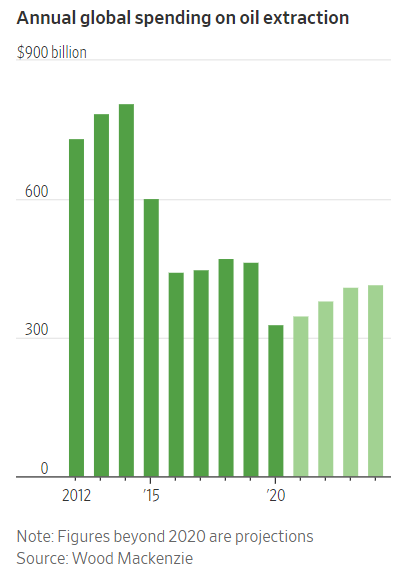

In case you forgot… oil prices have been on the rise… surpassing 2019 levels…

…as capital spending for drilling new wells has continued to decline.

Quick Value

NRG Energy Inc ($NRG)

NRG is an integrated power producer (IPP). They generate electricity via a 23 Gigawatt power plant fleet and service some 6m retail customers (residential and commercial). NRG operates in all 50 states but they’re primarily in Texas and the East Coast. At today’s price of $37, NRG is a $9bn market cap with roughly $9bn in net debt for a $18bn enterprise value.

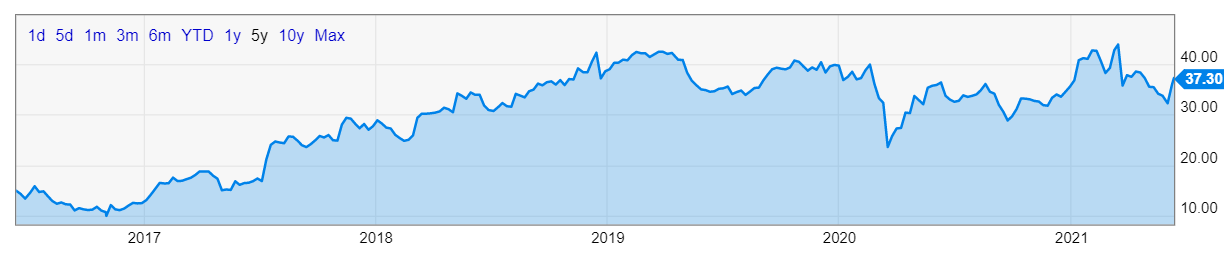

Winter storm Uri hit Texas fairly hard in February 2021 which led to blackouts and major losses to power producers and providers. NRG saw a less dramatic hit to its share price than peer Vistra ($VST) experienced but shares of NRG have traded sideways for several years nonetheless…

This isn’t quite a regulated utility. I won’t go into that in detail here but it’s worth noting that you’ll need to dig deeper into that. Yes, they produce and sell electricity, but these are competitive markets as opposed to regulated markets.

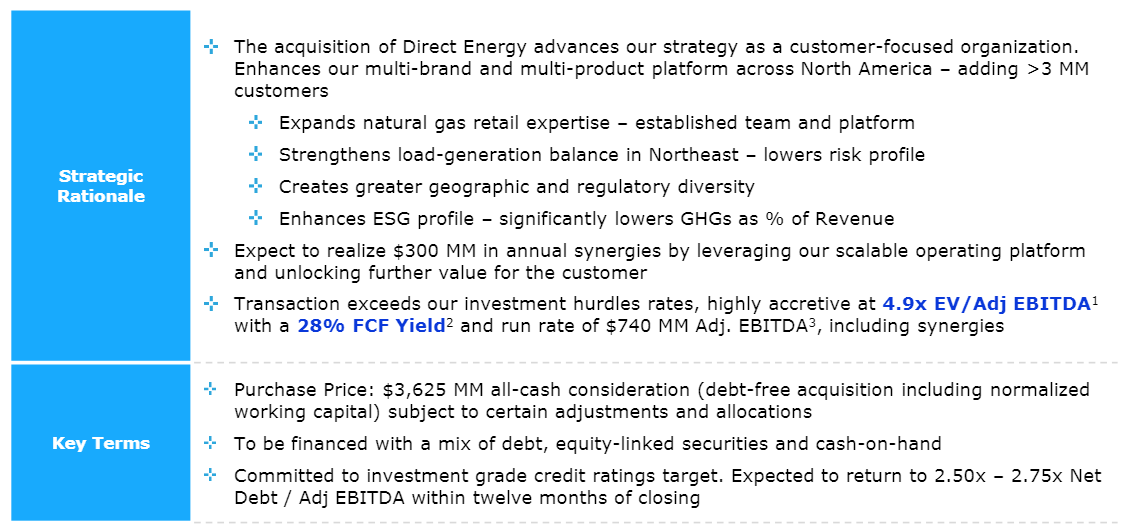

In January 2021, leading up to winter storm Uri, NRG closed on a $3.6bn acquisition of Direct Energy to add some exposure to markets outside Texas and increase revenue from retail customers. NRG had sold some assets in 2018-2019 and announced the DE deal in the midst of COVID. On the surface it looks like they struck a deal at a favorable price — 5x EBITDA.

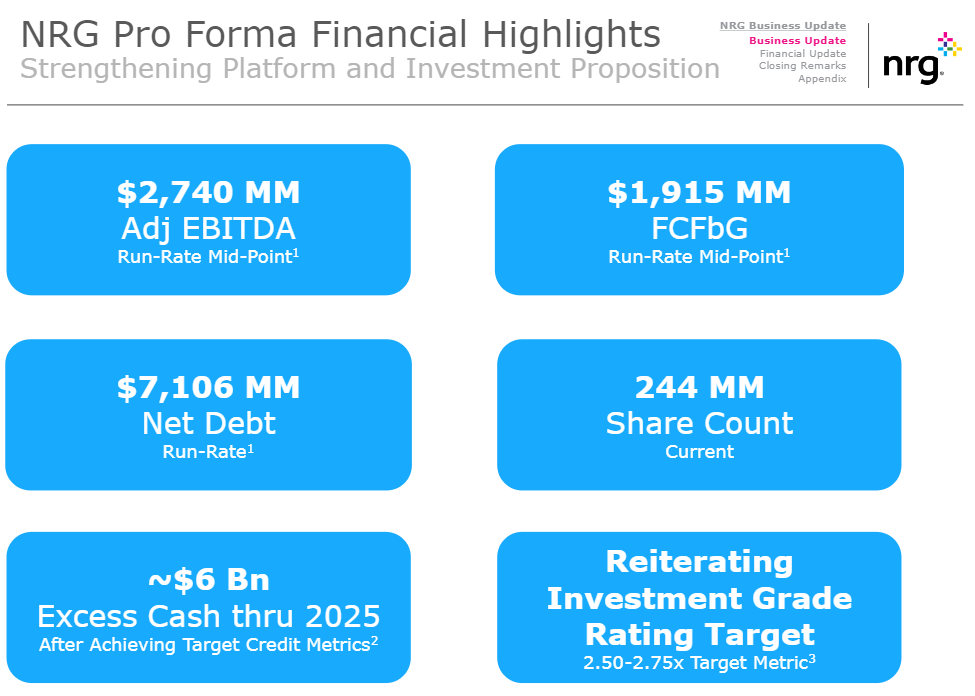

In mid-July 2020, at the time of the Direct Energy announcement, NRG was highlighting the following metrics after realizing synergies from the deal. (Note: FCFbG indicates free cash flow before growth investments.)

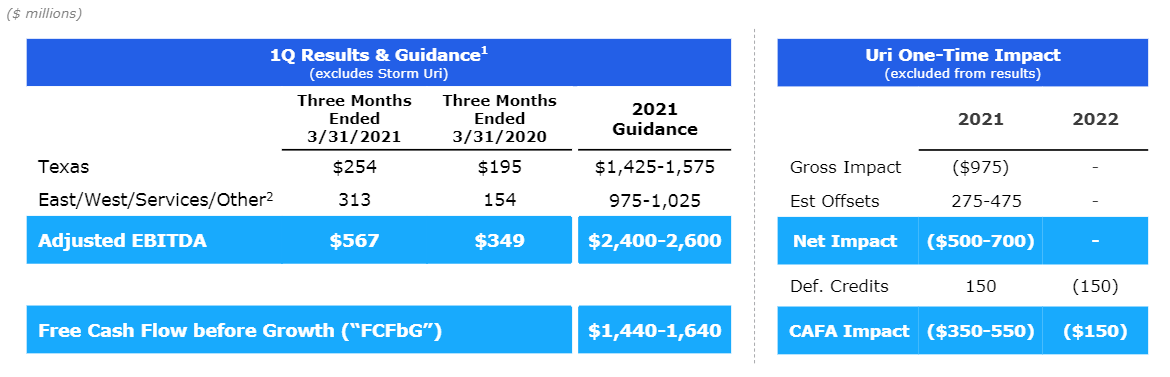

Back to winter storm Uri and where things sit as of 2021…

This was a terrible storm that caused many fatalities and exposed problems with the Texas electrical grid. Rival IPP Vista Energy saw $1.6bn in cash losses from the storm, some smaller players went out of business. NRG experienced a $975m hit from Uri and with actions taken, should be able to stem those losses to $500-700m.

Both NRG and Vistra management teams have been insistent that these are rare / one-time events and both companies are taking action within their fleets to prevent this from occurring again. One factor that can’t be ignored — these companies are essentially losing an entire / partial years’ worth of cash generation from this storm.

If you believe the statement above, then these Uri costs should be treated as legitimate add-backs when looking out to 2022. With that being the case, NRG would be trading at 7.2x EBITDA and ~6x FCF.

NRG is hosting an investor day on June 17th — this would be a good chance to clear up any remaining questions on the story…