Quick Value 6.15.20 (TEVA)

Teva Pharmaceuticals ($TEVA)

Market Performance

[Index | % change WoW ]

S&P 500 | 3041 -5%

Dow Jones | 25606 -6%

Russell 2000 | 1388 -8%

Russell Microcap | 520 -7%

10-Year | 0.7% -20bps

Gold | 1740 +3%

Oil | 36 -8%

VIX | 36 +44%

Market Stats

Another roller coaster of a week… I’ve been highlighting macro arguments both for and against economic optimism. Here is a rundown of my current beliefs:

Some industries, businesses, products, and services are benefiting from this environment and others are losing

Consumers are likely in better shape financially than headlines indicate — this still doesn’t mean they have been or are willing to spend money wildly (and consumer spending is some 2/3+ of economic activity)

Online will permanently take a decent chunk of market share from physical

Corporate (and perhaps personal) tax rates are likely to go up — the 2018 tax cuts will almost certainly need to be reversed at some point in the future to pay for the stimulus efforts of 2020 — a real “shoot first, ask questions later” situation we’re in… and those “questions later” may have painful answers

Deflation is still more likely than inflation

Overall market levels will be less meaningful for “some time” given the gap between winners / losers within various industries

And a chart for good measure…

Business formation has been low (and not just in 2020) for a few years now. Leading up to the financial crisis and after it ended, business formation was flat from 2006 to 2013 or so.

Entrepreneurial activity has implications for jobs, consumer and business spending, productivity, and a host of other important metrics…

Quick Value

Teva Pharmaceuticals ($TEVA)

I’ve highlighted a number of healthcare and pharmaceutical businesses in the past. Many of those situations are interesting in part due to business transforming M&A that is taking place — spin-offs, mergers, divestments, etc.

Teva is a bit different in that they made a big bold M&A bet a few years when they acquired the generic portfolio from Allergan in a $40bn deal. This wound up being a huge bust for Teva as earnings collapsed while the company was left with a huge pile of debt…

Teva is a generic drug manufacturer with some specialty/branded drugs in their portfolio. North America is their largest market and the business faced a double whammy from falling generic drug prices and loss of exclusivity on a branded product, Copaxone — these led to big drops in revenue and earnings following the Allergan deal.

But cash flows have remained positive and allowed Teva to chip away at it’s debt… Slowly and steadily…

There are ~1.1bn shares at $11 = $12bn market cap. Net debt is now around $24bn for a $36bn enterprise value. 2019 EBITDA came in at $4.7bn and guidance calls for a similar number in 2020… roughly 7x EV/EBITDA at today’s prices…

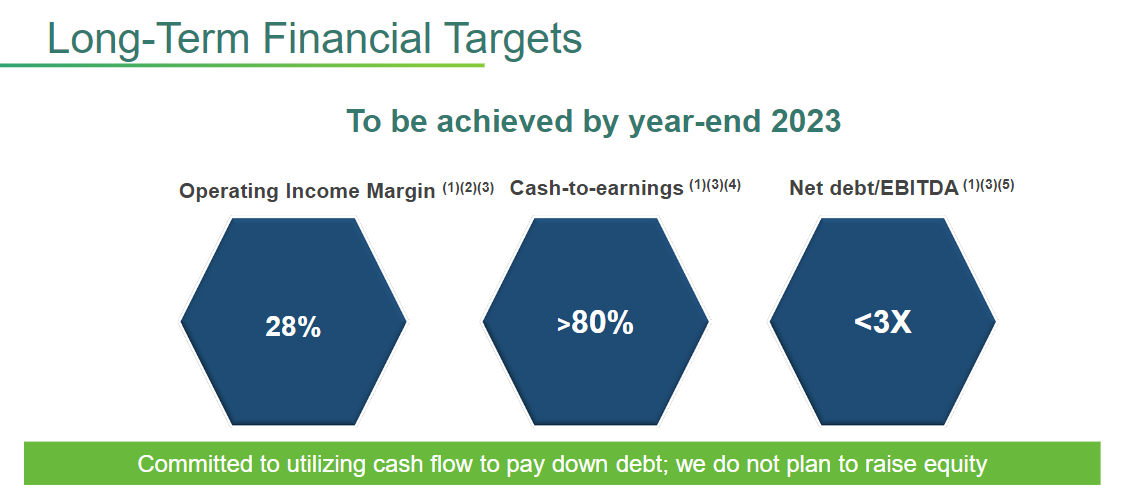

Another $2bn in free cash flow should help chip away at debt for yet another year. Debt to EBITDA is right around 5x and management thinks they can hit 3x by 2023 — through a combination of debt payments, organic growth, and margin improvement.

The “growth” aspect may not be too far fetched either as revenue is starting to stabilize in generics…

A bit early to tell but could make for an interesting deleveraging story in a highly cash generative industry…